- USFB is the second-largest SFB in India.

- It has shown growth in its business for the last three fiscals.

- Issue pricing appears reasonable against listed peers.

- Pre-IPO placement worth Rs. 299.19 cr. done at Rs. 35 per share in Nov. 19.

- UFSL shareholder quota offered at a discount of Rs. 2 per share against IPO pricing of Rs. 37 (upper band).

ABOUT COMPANY:

Ujjivan Small Finance Bank (USFB) is a mass-market focused SFB in India, catering to unserved and underserved segments and committed to building financial inclusion in the country. Its Promoter, UFSL (Ujjivan Financial Services Ltd.) commenced operations as an NBFC in 2005 with the mission to provide a full range of financial services to the ‘economically active poor’ who were not adequately served by financial institutions. UFSL’s erstwhile business was primarily based on the joint liability group-lending model for providing collateral-free, small ticket-size loans to economically active poor women. UFSL also offered individual loans to Micro and Small Enterprises (“MSEs”) and adopted an integrated approach to lending, which combined a customer touchpoint similar to microfinance, with the technology infrastructure and related back-end support functions similar to that of a retail bank. On October 7, 2015, UFSL received RBI In-Principle Approval to establish an SFB (Small Finance Bank), following which it incorporated Ujjivan Small Finance Bank Limited as a wholly-owned subsidiary. UFSL, after obtaining RBI Final Approval on November 11, 2016, to establish and carry on business as an SFB, transferred its business undertaking comprising of its lending and financing business to USFB, which commenced its operations from February 1, 2017. The bank is included in the second schedule to the Reserve Bank of India Act, 1934 as a scheduled bank on July 3, 2017. In the short period that it has been operational as an SFB, it is among the leading SFBs in India in terms of deposits, advances, branch count and geographical spread, as of March 31, 2019.

Continue Reading →

Markets on Friday ended lower, amid weak global cues, as investors booked profits after sharp gains in the previous session which lifted the benchmarks to 18-month highs. Further, testing of a nuclear weapon by North Korea also dampened sentiment for riskier assets.

The S&P BSE Sensex ended down by 248 points at 28,797 and the Nifty50 slipped 86 points to settle at 8,867. In the broader markets, BSE Midcap and the Smallcap indices eased between 0.5%-1% each. Market breadth ended weak with 1604 losers and 1146 gainers on the BSE.

Continue Reading →

The Sensex continued to struggle around the 28,000 mark to finish lower on Friday even as benchmark indices gained on the week. The weakness in Indian equities was in line with the subdued mood in Asian markets.

The Sensex closed at 28,051.86, down 156.76 points over its previous close, and the Nifty shed 27.80 points to close at 8,638.50.

For the week, the Sensex rose 0.9 percent, and the Nifty by 1.1 percent.

About 1221 shares have advanced, 1462 shares declined, and 209 shares are unchanged.

- Nifty 50 closed at 8638.5 with 0.3% loss today. 24 stocks advanced whereas 26 stocks declined and 1 stocks unchanged

- With 6.6% increase EICHERMOT was the top gainer in Nifty. ADANIPORTS, ZEEL increased 3.3% and 2.9% respectively

- ICICIBANK with a loss of 3.6% was the biggest loser in the Nifty. BHARTIARTL , BHEL lost 2.8% and 2.4% respectively

- FIIs bought net 84.6 crores worth of index futures and bought net 1392.9 crores worth of index options

- FIIs sold net 865.8 crores worth of stock futures and bought net 7.2 crores worth of stock options

- Daily volume in ICICIBANK surged 116%, highest growth among NSE stocks

Continue Reading →

After a lot of struggle, the market has ended lower on Friday. The Sensex is down 105.61 points or 0.4 percent at 27836.50, and the Nifty fell 23.60 points or 0.3 percent at 8541.40. About 1000 shares advanced, 1681 shares declined and 197 shares remained unchanged.

Bharti Airtel, Tata Steel, HDFC twins and Adani Ports were top gainers while Infosys, TCS, Wipro, NTPC and Coal India were top losers in the Sensex.

Continue Reading →

The original post is by Mastermind, Sana Securities, authored by Rajat Sharma and appears here.

I wasn’t really sure of the title to this post but the idea stemmed out of a question that I received from a subscriber.

Instead of repeating the exact question, I will break it up into 2:

- Can you earn fixed interest income on the spare cash lying in your trading account?

- Should you transfer spare cash into your bank account where you can earn up to 4% – 6% interest (savings account rate for Yes Bank and Kotak Mahindra Bank) or can you earn higher?

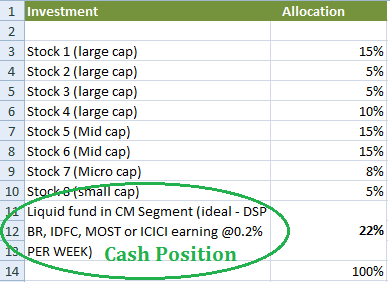

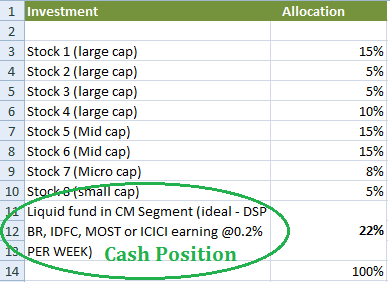

Cash Position: The best cash position is naturally the one that earns the highest possible ‘fixed income rate’ in the market. Fixed interest income can be earned on – money lying in savings/ current account, money market and liquid funds, ultra-short and short term funds and medium and long term funds.

As a trader or as a short term investor, you will require the money that you keep in your trading account at a short notice. For this reason, many short term investors believe that the best thing to do is to transfer funds from trading account to your savings bank account, perhaps at the end of the trading day (i.e. at 3.30 pm) and allocate them back to your trading account terminal when needed. It’s all in real time with internet banking these days. This is not the best thing to do.

How much are you going to earn by doing this?

Savings bank interest: In the most aggressive (bank) scenario you will earn ~ 0.06% on a weekly basis (i.e. ~ half of 6% divided by 52 weeks; considering that you transfer it exactly at 3.30 pm each day for until when the market opens on the next day).

Now consider a Liquid fund on the Mutual Fund Segment within your trading terminal.

Liquid and money market fund interest: Typically, these funds earn between 7.8% – 7.9% annual interest but that’s not all. You can actually stay invested in these funds unless you need to settle a trade (see example below). Here you will earn ~ 0.15% on a weekly basis (i.e. 5.8% divided by 52 weeks; see example below).

Example: You have Rs. 2,00,000 lying unutilised in your trading account and do not want to buy anything or make any position. You can either transfer this money to your bank account or buy a money market or liquid fund which typically earns 7.8 % return with very little volatility.

If you have stocks lying in your demat account, you will typically get 4 times their market price as margin to trade / invest (i.e. if you have stocks with current market value of Rs. 2,50,000 in your demat account, you will be allowed to buy/sell for up to Rs. 10,00,000/-). No interest will be charged on such buying and selling for up to 3 days**. Even on the 3 rd day, all you have to do is sell your liquid fund and your account is settled immediately. So practically, you may never have to sell your cash position. All you have to do is to define how much of your capital would you want to keep in cash at any point, based on market factors.

** These margins and limits may vary. The above is based on the limits we provide to all our clients.

Now consider this:

If you choose an ultra-short to short term fund where interest rates are 8.9% – 9.6%, and can stay invested for up to 15 days, then you earn ~0.18 % on a weekly basis (provided that instead of 2-3 days, as above, you can plan your buying and selling for up to 15 days).

Depending on market factors you do get opportunities to invest in even higher interest bearing instruments. For now, if you are still worried about losing out on basic interest income in trading account and are constantly transferring money back and forth between your accounts, STOP. There are easier solutions in life and better things to do after 3.30 pm.

The market ended with super gains boosted by index heavyweights. The Sensex closed up 286.92 points or 1 percent at 26653.60, and the Nifty was up 79.90 points or 0.9 percent at 8149.55. About 1401 shares have advanced, 1173 shares declined, and 189 shares are unchanged.

SBI gained 9 percent while Sun Pharma was up 6 percent. Adani Ports, Reliance and Bajaj Auto were other gainers in the Sensex. Among losers were ONGC, Axis Bank, ITC, GAIL and NTPC.Here are some picks from the week gone by.

Here are some picks from the week gone by.

Continue Reading →

The market ended with heavy losses. The Nifty ended below 7850, down 33.70 points or 0.4 percent. The Sensex is down 97.82 points or 0.4 percent at 25301.90. About 871 shares advanced, 1679 shares declined, and 197 shares are unchanged.

ITC gained 1 percent after posting better-than-expected Q4 results. Adani Ports, ONGC, NTPC and Bajaj Autowere top gainers in the Sensex. Losers were Lupin (down 9 percent), ICICI Bank, Reliance, M&M and Tata Motors.

After the political results of 5 states yesterday, there was a glimmer of hope of seeing the GST bill through but we can only hope things fall in place soon.

Here are some picks from the week gone by:

Continue Reading →

The Reserve Bank of India has recently announced how banks can be opened. This informative article has been authored by Mastermind, Deepak Shenoy. The original post appears here.

RBI will allow banks to be created “on tap” in the private sector. Meaning if you qualify, you can go apply for a licence – much like a driving licence – and get one. The previous model was: you waited till the RBI told you it wanted people to bid for a licence. This wait could be for 10 years. Then you applied and you waited, usually for two or three years. Then you were told that your fingernails were dirty and please clean them and reapply. And then you died and no one remembered you for it.

Here’s what RBI said in 2013 about How to start a bank in India?

The new process will be less brutal, apparently. These are draft guidelines, released by the RBI today.

Continue Reading →

An ounce of performance is worth pounds of promises – Mae West

The week that just ended, saw many companies declare their results. It was a nail-biting experience for quite a few as there could be hits and misses. But we do hope as always that our users got away unscathed. Here are some of the picks from the week just gone by. Happy Investing.

Continue Reading →

The week was marked by the announcement of results of IT bellwethers Infosys, TCS and Wipro. And of course, the torch bearer of the market, Reliance.

An action packed week came to an end and we do hope our followers would have made money.

Here are some of the picks from the week that just went by.

Continue Reading →