New Delhi: Finance Minister Arun Jaitley delivered the current government’s fifth and last full financial budget (Budget 2018 for the fiscal year 2018-19) amid subdued economic growth, challenging fiscal situation and farm distress.

While a budget covers a plethora of items and heads, the mix can leave a lot of people confused. This budget is rendered all the more important as there are elections coming up in eight states this year and the Lok Sabha election next year, all of which put tough demands on the Finance Minister.

India is the world’s fastest-growing economy, said the Finance Minister as he announced the Budget. He lauded the govt’s moves to contain black money and encourage tax formalisation. Batting for GST, he said it ensured tax simplicity, demonetisation paved the way for a digital economy.

“When the Narendra Modi government took over, India was considered to be one of the fragile five economies of the world. Our government reversed the trend,” Jaitley said.

Continue Reading →

The original post is by Mastermind, Sana Securities, authored by Rajat Sharma and appears here.

I wasn’t really sure of the title to this post but the idea stemmed out of a question that I received from a subscriber.

Instead of repeating the exact question, I will break it up into 2:

- Can you earn fixed interest income on the spare cash lying in your trading account?

- Should you transfer spare cash into your bank account where you can earn up to 4% – 6% interest (savings account rate for Yes Bank and Kotak Mahindra Bank) or can you earn higher?

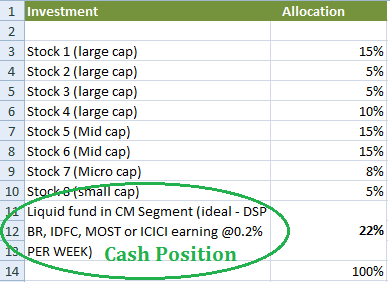

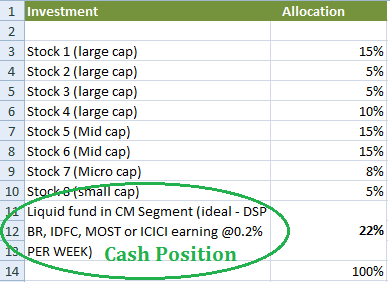

Cash Position: The best cash position is naturally the one that earns the highest possible ‘fixed income rate’ in the market. Fixed interest income can be earned on – money lying in savings/ current account, money market and liquid funds, ultra-short and short term funds and medium and long term funds.

As a trader or as a short term investor, you will require the money that you keep in your trading account at a short notice. For this reason, many short term investors believe that the best thing to do is to transfer funds from trading account to your savings bank account, perhaps at the end of the trading day (i.e. at 3.30 pm) and allocate them back to your trading account terminal when needed. It’s all in real time with internet banking these days. This is not the best thing to do.

How much are you going to earn by doing this?

Savings bank interest: In the most aggressive (bank) scenario you will earn ~ 0.06% on a weekly basis (i.e. ~ half of 6% divided by 52 weeks; considering that you transfer it exactly at 3.30 pm each day for until when the market opens on the next day).

Now consider a Liquid fund on the Mutual Fund Segment within your trading terminal.

Liquid and money market fund interest: Typically, these funds earn between 7.8% – 7.9% annual interest but that’s not all. You can actually stay invested in these funds unless you need to settle a trade (see example below). Here you will earn ~ 0.15% on a weekly basis (i.e. 5.8% divided by 52 weeks; see example below).

Example: You have Rs. 2,00,000 lying unutilised in your trading account and do not want to buy anything or make any position. You can either transfer this money to your bank account or buy a money market or liquid fund which typically earns 7.8 % return with very little volatility.

If you have stocks lying in your demat account, you will typically get 4 times their market price as margin to trade / invest (i.e. if you have stocks with current market value of Rs. 2,50,000 in your demat account, you will be allowed to buy/sell for up to Rs. 10,00,000/-). No interest will be charged on such buying and selling for up to 3 days**. Even on the 3 rd day, all you have to do is sell your liquid fund and your account is settled immediately. So practically, you may never have to sell your cash position. All you have to do is to define how much of your capital would you want to keep in cash at any point, based on market factors.

** These margins and limits may vary. The above is based on the limits we provide to all our clients.

Now consider this:

If you choose an ultra-short to short term fund where interest rates are 8.9% – 9.6%, and can stay invested for up to 15 days, then you earn ~0.18 % on a weekly basis (provided that instead of 2-3 days, as above, you can plan your buying and selling for up to 15 days).

Depending on market factors you do get opportunities to invest in even higher interest bearing instruments. For now, if you are still worried about losing out on basic interest income in trading account and are constantly transferring money back and forth between your accounts, STOP. There are easier solutions in life and better things to do after 3.30 pm.

This article originally appeared on http://value-picks.blogspot.in/. The link to the original article is given at the end of the post.

Stock investors constantly hear the wisdom of diversification. The concept is to simply not put all of your eggs in one basket, which in turn helps mitigate risk, and generally leads to better performance or return on investment. Diversifying your hard-earned dollars does make sense, but there are different ways of diversifying, and there are different portfolio types. We look at the following portfolio types and suggest how to get started building them: aggressive, defensive, income, speculative and hybrid. It is important to understand that building a portfolio will require research and some effort. Having said that, let’s have a peek across our five portfolios to gain a better understanding of each and get you started.

Continue Reading →