It was a range-bound trade on the bourses on Friday as investors awaited US Fed chief Jerome Powell’s address at the Jackson Hole Symposium later tonight. The S&P BSE Sensex traded between 58,723 and 59,321, and ended at 58,834, up 59 points or 0.1 per cent.

The NSE Nfty50, meanwhile, shut shop at 17,559, up 36 points or 0.21 per cent. It touched a high of 17,686 and a low of 17,519 on the NSE. In the broader markets, the Nifty MidCap 100 and the Nifty SmallCap 100 settled up to 0.7 per cent higher.

Among sectors, the Nifty Metal index rose 1.7 per cent, followed by the Nifty PSU Bank index, up 1 per cent. On the flipside, the Nifty Private bank index fell 0.3 per cent.

Shares of Syrma SGS Technologies (Syrma) soared 42.2 per cent to Rs 313 against its issue price of Rs 220 per share on debut on Friday. The stock of the industrial electronics company listed at Rs 262, a 19 per cent premium when compared to its issue price on the BSE. On NSE, the stock started trading at Rs 260.

The Rs 562-crore IPO of DreamFolks received a bumper response from investors on the last day of the issue. The offer was subscribed nearly 53 times till 3:30 PM with retail investors’ quota at 42x subscription, NII at 37.5 times, and QIB at 64 times.

Continue Reading →

Over the past few months I have received many requests for portfolio rebalancing. Since August, I have been of the view that this is not the best time to deploy fresh capital in the market.

Those already invested should try to rebalance their portfolios and so I have done in many client folios.

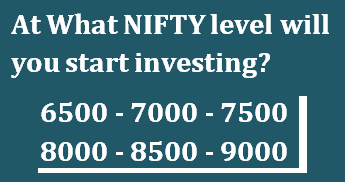

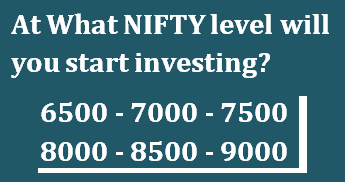

Common question: with NIFTY having fallen ~ 10% from its highs made earlier this year, is it time to start buying stocks? Here’s how valuations will look at different levels on the Nifty with current EPS base.

At what NIFTY level will you start investing?

To calculate current EPS, I will be taking current Nifty P/E (15 November, 2016) which is 21.00.

P/E = Price (Nifty level)

Earnings per Share (EPS)

Current EPS = 379

[1] Nifty at 7,000 levels

P/E = 7,000/379

=18.47

[2] Nifty at 7,500 levels

P/E = 7,500/379

=19.79

[3] Nifty at 8,000 levels

P/E = 8,000/379

=21.11

[4] Nifty at 8,500 levels

P/E = 8,500/379

=22.45

[5] Nifty at 9,000 levels

P/E = 9,000/379

=23.75

CURRENT NIFTY PE AS OF 15 NOVEMBER 2016 = 21.37

VIEW

Typically, in a bull market (which I believe we certainly are in right now); valuations tend to run ahead of the earnings. It would be difficult to buy these markets at valuations of sub 19 level anytime soon. Further, some of the buying and selling that happened over the past 2-3 days has no explanation.

There sure is some amount of panic and herd selling. This could go on for some time as investors sell their liquid investments to arrange cash in the short term. Certainly with this new reality (of demonetization) one thing every investor should do is to pay some attention to his portfolio and rebalance it in light of the new realities.

As for buying stocks, sure . . . . . the tide could turn anytime from these levels.

The original post is written by Rajat Sharma of Mastermind, Sana Securities and is available here.

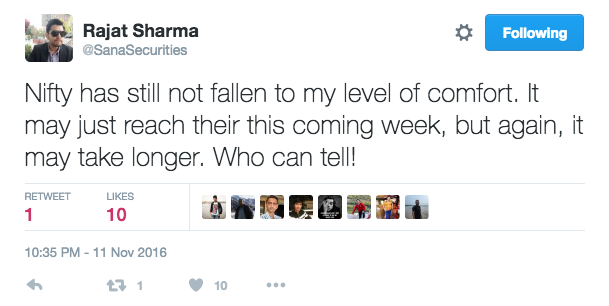

For a week now demonetization of high value notes has been polarizing the country between those who totally support the idea and those who are against it. The move has had a big impact on the stocks markets. A lot of investors are withdrawing capital from stocks. Some because they are out of funds (since the currency they had at home no longer works) and others because they expect a crash, perhaps an opportunity to buy at lower levels.

Continue Reading →

The original post is written by Mastermind, Sanasecurities and is available here.

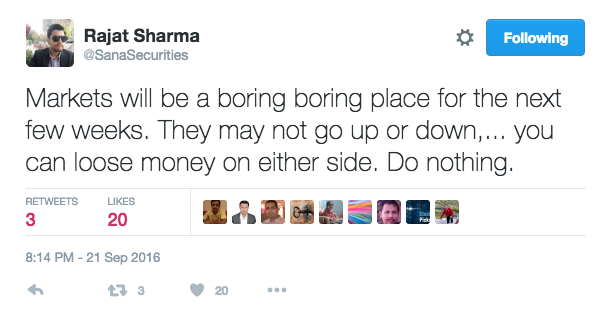

Over the last few weeks, markets have beaten all resistance barriers and have defied the very notion of value. Those waiting for a correction sometime back have now jumped in hoping for newer all time highs.

Anybody who believes in value may not find much for the taking. Certain I am however that many old school value buyers are neck deep in stocks right now. Perhaps for the right reason given the enormous liquidity coupled with strong news flow both domestically and from international markets.

Markets are risky – more so at the kind of valuations they are trading at right now. Nevertheless, from positive earnings, passage of GST, U.S. Jobs data and FEDs almost certain stance of maintaining interest rates, everything looks positive.

If you are already invested, in all likelihood you would have made money over the past 2-3 months. The key question: If you are not invested, should you jump in now?

Continue Reading →

This is a post written by Mastermind, SanaSecurities. The original post appears here.

Let me assure you – No matter how positive (or negative) you are about something, there will always be much which will not be in your control.

There are things you cannot change and things that are totally in your control. The hard task is to understand the difference between the two.

When I started writing this post, the idea was to list in order of importance, habits which set apart successful investors from those who achieve substandard returns. Naturally, such a list would require me to first state who would qualify as a ‘successful investor’ and what’s ‘substandard’.

Continue Reading →

The original post is written by Rajat Sharma from our Mastermind, Sanasecurities and can be found here.

Goods and Service Tax (“GST”) is a comprehensive tax on manufacture, sale and consumption of goods and services, that will absorb most of the indirect taxes levied by Central and State Government. Currently the GST is adopted in over 150 countries. If passed, GST Bill would be THE biggest tax reform by the Indian government since inception of the Indian constitution.

How Will GST Work?

- In India, GST would work on dual model which will include – C-GST collected by Central Government + S-GST collected by State Government on intra-state sales. GST reform would also feature an Integrated GST (IGST) collected by Central government on inter-state sales, which is to-be divided between Central and States Government in a manner decided by the Parliament on recommendations by GST Council.

- By doing away with several Central and State Taxes, GST would diminish the cascading effect of tax (or double taxation, whereby the same product is taxed at the stage of manufacturing as excise, then as VAT/ sales tax on sale and so on.), which is prevalent in the current tax framework. Being a consumption-destination-based tax, GST would be levied and collected at each stage of sale or purchase of goods or services based on the existing input tax credit method. Current tax structure works on production-origin-based system i.e. goods and services are taxed differently on each stage of production.

Continue Reading →

This post is written by Mastermind, Sana Securities. The original post appears here.

I have written about educated speculation in the stock markets (here) and about how to create an ideal streamlined portfolio of stocks for the long-term (here). A topic I have never touched is short-term trading in stocks. The irony is that this is what keeps me busy on a regular basis. If you follow the markets as much as I do, it is hard to resist buying and selling in the short-term. So here it is.

Continue Reading →

The market on Friday ended on a firm note with the Sensex up 100.45 points or 0.4 percent at 26625.91 and the Nifty was up 29.45 points or 0.4 percent at 8170.20. About 1240 shares advanced, 1333 shares declined, and 184 shares were unchanged. Bharti Airtel, TCS, Tata Motors, HDFC and Coal India were top gainers while Sun Pharma, Dr Reddy’s, Tata Steel, SBI and L&T are losers in the Sensex.

Here are some picks from the week gone by.

Continue Reading →

The original post is by Mastermind, Sana Securities, authored by Rajat Sharma and appears here.

I wasn’t really sure of the title to this post but the idea stemmed out of a question that I received from a subscriber.

Instead of repeating the exact question, I will break it up into 2:

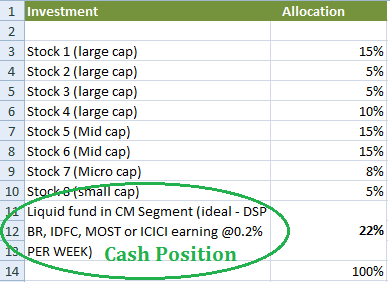

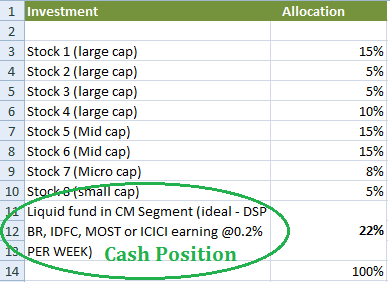

- Can you earn fixed interest income on the spare cash lying in your trading account?

- Should you transfer spare cash into your bank account where you can earn up to 4% – 6% interest (savings account rate for Yes Bank and Kotak Mahindra Bank) or can you earn higher?

Cash Position: The best cash position is naturally the one that earns the highest possible ‘fixed income rate’ in the market. Fixed interest income can be earned on – money lying in savings/ current account, money market and liquid funds, ultra-short and short term funds and medium and long term funds.

As a trader or as a short term investor, you will require the money that you keep in your trading account at a short notice. For this reason, many short term investors believe that the best thing to do is to transfer funds from trading account to your savings bank account, perhaps at the end of the trading day (i.e. at 3.30 pm) and allocate them back to your trading account terminal when needed. It’s all in real time with internet banking these days. This is not the best thing to do.

How much are you going to earn by doing this?

Savings bank interest: In the most aggressive (bank) scenario you will earn ~ 0.06% on a weekly basis (i.e. ~ half of 6% divided by 52 weeks; considering that you transfer it exactly at 3.30 pm each day for until when the market opens on the next day).

Now consider a Liquid fund on the Mutual Fund Segment within your trading terminal.

Liquid and money market fund interest: Typically, these funds earn between 7.8% – 7.9% annual interest but that’s not all. You can actually stay invested in these funds unless you need to settle a trade (see example below). Here you will earn ~ 0.15% on a weekly basis (i.e. 5.8% divided by 52 weeks; see example below).

Example: You have Rs. 2,00,000 lying unutilised in your trading account and do not want to buy anything or make any position. You can either transfer this money to your bank account or buy a money market or liquid fund which typically earns 7.8 % return with very little volatility.

If you have stocks lying in your demat account, you will typically get 4 times their market price as margin to trade / invest (i.e. if you have stocks with current market value of Rs. 2,50,000 in your demat account, you will be allowed to buy/sell for up to Rs. 10,00,000/-). No interest will be charged on such buying and selling for up to 3 days**. Even on the 3 rd day, all you have to do is sell your liquid fund and your account is settled immediately. So practically, you may never have to sell your cash position. All you have to do is to define how much of your capital would you want to keep in cash at any point, based on market factors.

** These margins and limits may vary. The above is based on the limits we provide to all our clients.

Now consider this:

If you choose an ultra-short to short term fund where interest rates are 8.9% – 9.6%, and can stay invested for up to 15 days, then you earn ~0.18 % on a weekly basis (provided that instead of 2-3 days, as above, you can plan your buying and selling for up to 15 days).

Depending on market factors you do get opportunities to invest in even higher interest bearing instruments. For now, if you are still worried about losing out on basic interest income in trading account and are constantly transferring money back and forth between your accounts, STOP. There are easier solutions in life and better things to do after 3.30 pm.

This post originally appeared here and is by Mastermind, Sana Securities.

Meeting with individual investors over the years has taught me much about investing mistakes. No matter how you classify investors (i.e. fundamental, technical or confused), the mistakes they make are almost invariably identical.

While some mistakes are the result of simply not knowing what to do, many are the results of either (i) losing interest; or (ii) getting overly greedy or fearful, particularly when the tide turns. In either case, much money is lost when people assume things will simply take care of themselves.

Continue Reading →