A new feature on StockArchitect – F&O Activity

The original post is by Mastermind, Sana Securities, authored by Rajat Sharma and appears here.

I wasn’t really sure of the title to this post but the idea stemmed out of a question that I received from a subscriber.

Instead of repeating the exact question, I will break it up into 2:

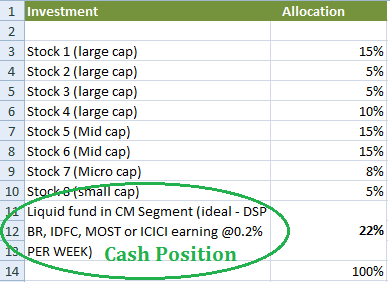

Cash Position: The best cash position is naturally the one that earns the highest possible ‘fixed income rate’ in the market. Fixed interest income can be earned on – money lying in savings/ current account, money market and liquid funds, ultra-short and short term funds and medium and long term funds.

As a trader or as a short term investor, you will require the money that you keep in your trading account at a short notice. For this reason, many short term investors believe that the best thing to do is to transfer funds from trading account to your savings bank account, perhaps at the end of the trading day (i.e. at 3.30 pm) and allocate them back to your trading account terminal when needed. It’s all in real time with internet banking these days. This is not the best thing to do.

How much are you going to earn by doing this?

Savings bank interest: In the most aggressive (bank) scenario you will earn ~ 0.06% on a weekly basis (i.e. ~ half of 6% divided by 52 weeks; considering that you transfer it exactly at 3.30 pm each day for until when the market opens on the next day).

Now consider a Liquid fund on the Mutual Fund Segment within your trading terminal.

Liquid and money market fund interest: Typically, these funds earn between 7.8% – 7.9% annual interest but that’s not all. You can actually stay invested in these funds unless you need to settle a trade (see example below). Here you will earn ~ 0.15% on a weekly basis (i.e. 5.8% divided by 52 weeks; see example below).

Example: You have Rs. 2,00,000 lying unutilised in your trading account and do not want to buy anything or make any position. You can either transfer this money to your bank account or buy a money market or liquid fund which typically earns 7.8 % return with very little volatility.

If you have stocks lying in your demat account, you will typically get 4 times their market price as margin to trade / invest (i.e. if you have stocks with current market value of Rs. 2,50,000 in your demat account, you will be allowed to buy/sell for up to Rs. 10,00,000/-). No interest will be charged on such buying and selling for up to 3 days**. Even on the 3 rd day, all you have to do is sell your liquid fund and your account is settled immediately. So practically, you may never have to sell your cash position. All you have to do is to define how much of your capital would you want to keep in cash at any point, based on market factors.

** These margins and limits may vary. The above is based on the limits we provide to all our clients.

Now consider this:

If you choose an ultra-short to short term fund where interest rates are 8.9% – 9.6%, and can stay invested for up to 15 days, then you earn ~0.18 % on a weekly basis (provided that instead of 2-3 days, as above, you can plan your buying and selling for up to 15 days).

Depending on market factors you do get opportunities to invest in even higher interest bearing instruments. For now, if you are still worried about losing out on basic interest income in trading account and are constantly transferring money back and forth between your accounts, STOP. There are easier solutions in life and better things to do after 3.30 pm.