The 3rd article in this series explains about the key performance indicators (KPI) to track any pharmaceutical company and measure their performance. Few of those metrics are R&D spends, ANDA filings, Operating Segments, to know particularly in which market the company deals, what is the status of the products in the companies pipeline, the number of patents that have been filed by any company etc. It’s not necessary for every pharma company to have the same standards of operating and therefore financial metrics and KPI can differ from company to company.

how-indian-pharma-industry-works-part-3

The original post is written by Shuchi Nahar, appears on alphainvesco.com and is available here.

The second part of this series explains the various business segments in which a pharmaceutical company works. This post will help us to understand the significance of different segments in detail and will give a brief idea about how pharma companies make money through R&D , sales and marketing. The need of having a strong distribution channel, dispensing the right goods at the right place and at right time is equally important.

how-indian-pharma-industry-works-part-2

The original post is written by Shuchi Nahar, appears on alphainvesco.com and is available here.

Following article is first in the series of articles on the Indian Pharmaceutical Industry, the first article is written to familiarize ourselves with the terminology or the jargons of the pharmaceutical industry. We will briefly touch upon terms like API, Intermediates, Formulations, Innovator drug, Generic drugs, life cycle development etc.

The Indian Pharmaceutical industry is about $ 17 bn industry (2016) with as many as 20,000 registered companies (includes MNC’s and small-scale units) directly or indirectly involved in the business of selling medicines. India has the distinction of being the lowest cost producer of medicine in the world. India also has the feather of being the largest exporter of generic drugs in the world, we have some great franchises like Lupin, Sun Pharma etc.

how-indian-pharma-industry-works-part-1

The original post is written by Shuchi Nahar, appears on alphainvesco.com and is available here.

Seek, and ye shall find your queries on a year-end list.

Such is the case for Asia’s Googlers, whose most popular financial searches of 2016 have been compiled and released by the company. The data is evidence of the roller coaster year it’s been for some of the world’s biggest economies, where local political scandals roiled the markets at the same time that curveballs from outside the region heightened volatility and triggered capital outflows.

After watching $5 trillion evaporate from China’s stock market last year, investors may have thought they deserved a calmer 2016. Yet, the flurry of bad news, from South Korea’s trio of political, economic and corporate scandals to India’s shock decision to junk 86 percent of its currency bills, ensured the year has been anything but. Add to that the U.K.’s June vote to leave the European Union and Donald Trump’s shock election in the U.S., and you start to understand why China’s dwindling foreign-currency reserves lay behind the country’s most popular financial search term.

Using Google’s data, here are four charts that gauge the pulse of Asian economies in 2016.

Continue Reading →

The original article is written by Pranav Mehta, Senior Analyst and is available here.

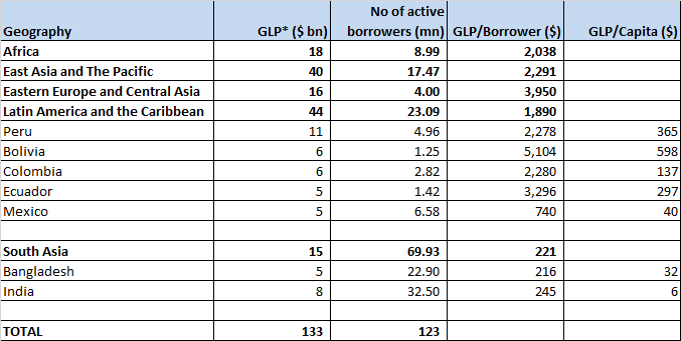

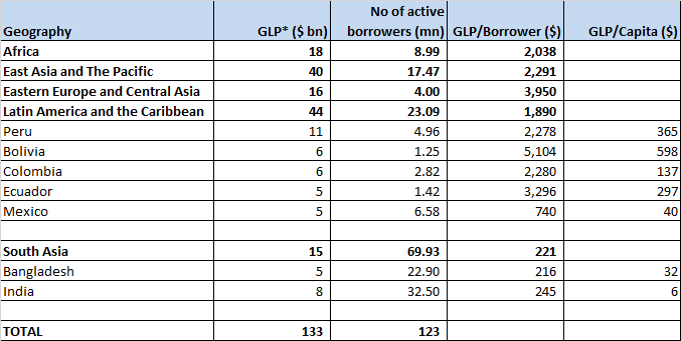

Part I: Global Microfinance Industry

Size of the industry

*GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio

Continue Reading →

This is an interview with Saurabh Mukherjea, author of the book ‘The Unusual Billionaires’. The original post appears here on moneycontrol.com.

Saurabh feels the buy-and-hold approach to investing holds true even as volatile financial markets and disruptive changes across sectors are questioning its validity.

Consistent revenue growth combined with a consistent return on capital employed: if a company has been delivering on these two parameters for over ten years, then look no further. That, in effect, is the theme of Saurabh Mukherjea’s second book ‘The Unusual Billionaires’. The book says that a portfolio of companies which satisfies both these criteria will invariably beat the market over the next decade and more.

Mukherjea, whose day job is CEO, Institutional Equities at Ambit Capital, feels the buy-and-hold strategy for stock investing holds true even as volatile financial markets and disruptive changes across sectors are questioning its validity.

Continue Reading →

Markets consolidated with midcaps at record high. The Bank Nifty closed at its highest level in the last 17-months high. The Sensex was down 46.44 points or 0.2 percent at 28077 and the Nifty was down 6.35 points at 8666.90. About 1480 shares have advanced, 1237 shares declined, and 182 shares are unchanged.

In stock specific action SBI remained on buyers’ radar gained 4 percent as investors gave a thumbs up to its merger ratio. All SBI associates including State Bank of Mysore, State Bank of Travancore and State Bank of Bikaner and Jaipur jumped.

BHEL, Tata Steel, HUL and Cipla were other top gainers while Coal India, TCS, Lupin, Sun Pharma and M&M were losers in the Sensex.

Continue Reading →

The original post is written by Rajat Sharma from our Mastermind, Sanasecurities and can be found here.

Goods and Service Tax (“GST”) is a comprehensive tax on manufacture, sale and consumption of goods and services, that will absorb most of the indirect taxes levied by Central and State Government. Currently the GST is adopted in over 150 countries. If passed, GST Bill would be THE biggest tax reform by the Indian government since inception of the Indian constitution.

How Will GST Work?

- In India, GST would work on dual model which will include – C-GST collected by Central Government + S-GST collected by State Government on intra-state sales. GST reform would also feature an Integrated GST (IGST) collected by Central government on inter-state sales, which is to-be divided between Central and States Government in a manner decided by the Parliament on recommendations by GST Council.

- By doing away with several Central and State Taxes, GST would diminish the cascading effect of tax (or double taxation, whereby the same product is taxed at the stage of manufacturing as excise, then as VAT/ sales tax on sale and so on.), which is prevalent in the current tax framework. Being a consumption-destination-based tax, GST would be levied and collected at each stage of sale or purchase of goods or services based on the existing input tax credit method. Current tax structure works on production-origin-based system i.e. goods and services are taxed differently on each stage of production.

Continue Reading →

After a lot of struggle, the market has ended lower on Friday. The Sensex is down 105.61 points or 0.4 percent at 27836.50, and the Nifty fell 23.60 points or 0.3 percent at 8541.40. About 1000 shares advanced, 1681 shares declined and 197 shares remained unchanged.

Bharti Airtel, Tata Steel, HDFC twins and Adani Ports were top gainers while Infosys, TCS, Wipro, NTPC and Coal India were top losers in the Sensex.

Continue Reading →

*GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio