Sensex sinks 398 points, Nifty below 16,950 as STT hike, global cues weigh

Equity markets turned sharply lower at the fag-end of the session as investors digested amendments to Finance Bill, 2023. Besides, selling in US index futures and European markets also weighed on the sentiment.

Back home, under the Bill approved by the Parliament, the debt mutual fund (Debt MF) investors will no longer receive the long-term capital gain tax benefit. They will be taxed like bank deposits. It will be applicable from April 1.

The Centre also hiked the securities transaction tax (STT) on the sale of future and option contracts by up to 25 per cent.

The S&P BSE Sensex closed 398 points, or 0.69 per cent, lower at 57,527 levels, while the Nifty50 shut shop at 16,945, down 132 points or 0.77 per cent.

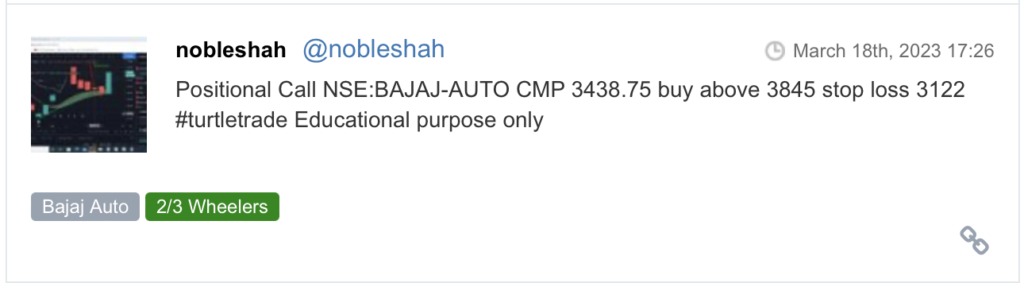

The broad-based selling was led by metal, PSU banks, and realty indices, which were down over 2 per cent each. Individually, Bajaj Finserv (down 4 per cent), Adani Enterprises, Adani Ports, Hindalco, Bajaj Finance, ONGC, Hero MotoCorp, Tata Steel, Coal India. Titan, HDFC Life, Reliance Industries, M&M, JSW Steel, Maruti Suzuki, and L&T.

In the broader markets, the BSE MidCap and SmallCap indices declined around 1.4 per cent each.

Investment made by GQG Partners in Adani Green Energy has fetched the Australia-based asset management company over 100 per cent returns in just 15 trading sessions. GQG Partners have earned over Rs 2,900 crore or 104 per cent during the period.

Campus Activewear slipped 7% after over 9% equity changes hand on NSE. Till 09:33 AM; around 27.93 million shares representing 9.17 per cent of total equity of Campus Activewear changed hands on the NSE, the exchange data shows. A combined 29.2 million shares or 9.6 per cent of total equity of footwear company changed hands on the NSE and BSE. The names of the buyers and sellers were not ascertained immediately.

AMC stocks tumbled as govt likely proposed LTCG changes to debt MF schemes. In a move to remove the tax advantage enjoyed by debt mutual funds over bank fixed deposits, the government has proposed to tax gains arising from debt MFs at the investor’s slab rate, irrespective of the investment period. Shares of asset management companies (AMCs) witnessed sell-off pressure in early trade. HDFC AMC was trading almost 4 per cent lower at 9.15 am.UTI AMC and Aditya Birla Sun Life AMC were down almost 2 per cent. Nippon AMC was trading 1 per cent lower.

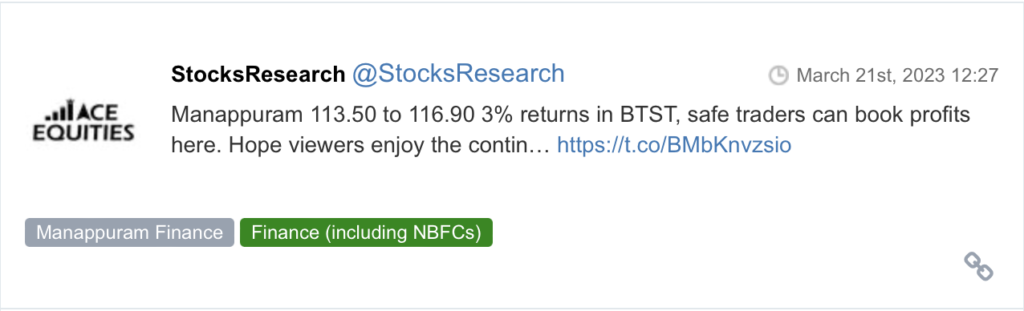

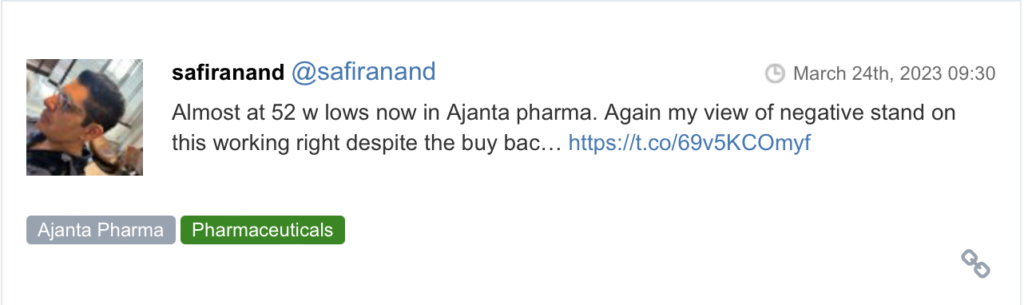

Here are some picks from the week gone by.