Choose the correct line?

Let me start by asking you a simple question?

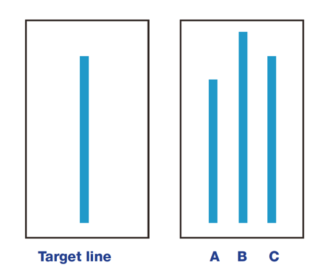

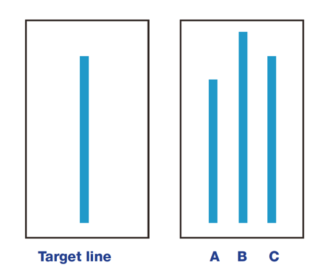

In the above diagram, which of the three lines numbered A,B and C is closest in length to the target line ?

If you answered C, congrats that is the right answer!

Of course, it was outrageously obvious right.

Now before you swear at me for insulting your intelligence, here is the shocker – in a famous experiment conducted in the 1950’s, for the same question majority of the people chose the wrong line.

But how could this be?

Were they actually that dumb..

Enter behavioural economics. Unknown to the participants, there was a secret behavioural trick played on these people which caused them to choose the wrong answer despite the correct answer being very obvious to them.

Continue Reading →

Because financial matters are rarely covered during high school, many people don’t understand the stock market or how to invest their money properly.

This means that they are more vulnerable to investment scams. With the growth of the internet, and the current frothy state of global markets, these investment scams are unfortunately all too common.

So here are a list of 20 common traps that all traders and investors need to be aware of:

1) Ponzi Schemes

Ponzi schemes involve a cycle of using new investors money to fund the returns of existing investors.

Continue Reading →

Back during my schooling years, I studied the same problem again and again so as not to make the same mistake come exam time.

Problem was, I was horrible at application.

If the exact question came out in the exam, I killed it.

But that rarely happened. The question was always worded differently and confused the heck out of me.

I screwed up similar questions time after time simply because I couldn’t adapt what I had studied to the current version of the question.

Isn’t the market like this?

You make investment mistakes and in order to make sure you get it right next time, you focus and tell yourself you won’t make the same mistake again.

But how often does the market offer the exact same situation?

Rarely.

Continue Reading →

Investors have many different strategies that they can follow to build wealth in the stock market. Income investors tend to prize dividends above all else. Value investors seek to buy stocks that trade below their intrinsic value. Growth investors, on the other hand, aim to buy businesses that hold the greatest upside potential and tend to de-emphasize traditional valuation metrics that generally show a growth stock to be expensive compared with the company’s current earnings.

Growth investing is highly attractive to many investors because buying the right companies early can lead to life-changing returns. However, companies that promise huge upside potential usually trade at lofty valuations. That amps up the risk that they will fail in spectacular fashion if they don’t meet expectations.

So how can investors increase their odds of buying the next Amazon.com (NASDAQ:AMZN) instead of a Fitbit (NASDAQ: FITB)? While there’s no bullet-proof solution to this conundrum, I’ve found that buying companies with the following traits can greatly increase the odds of success:

- A large and expanding market opportunity

- A durable competitive advantage

- Financial resilience

- Repeat purchase business model

- Strong past price appreciation

- Great corporate culture

- Talented leadership with skin in the game

Let’s dig into each of these principles in detail to see why they work.

Continue Reading →

One of our favourite value investors here at The Acquirer’s Multiple is Jim O’Shaughnessy.

One of our favourite value investors here at The Acquirer’s Multiple is Jim O’Shaughnessy.

O’Shaughnessy recently wrote an awesome series of tweets detailing twenty five investment lessons that he’s learned over thirty years of value investing. They’re a must read for all investors.

With Jim’s permission here are his twenty five timeless investing lessons:

- I have been a professional investor for over 30 years. What follows is some things I think I know and some things I know I don’t know. Let’s start with some things I know I don’t know.

- I don’t know how the market will perform this year. I don’t know how the market will perform next year. I don’t know if stocks will be higher or lower in five years. Indeed, even though the probabilities favor a positive outcome, I don’t know if stocks will be higher in 10 yrs.

- I DO know that, according to Forbes, “since 1945…there have been 77 market drops between 5% and 10%…and 27 corrections between 10% and 20%”. I know that market corrections are a feature, not a bug, required to get good long-term performance.

- I do know that during these corrections, there will be a host of “experts” on business TV, blogs, magazines, podcasts and radio warning investors that THIS is the big one. That stocks are heading dramatically lower, and that they should get out now, while they still can. Continue Reading →

Most textbooks portray humans as self-interested people making rational economic decisions, but people often are far from rational in making investment decisions.

Behavioral economics provides insight into why humans make sub-optimal decisions, studying the impact of psychological, cognitive and emotional factors on economic and investment decisions. Two winners of the Nobel Prize in economics, Richard Thaler and Daniel Kahneman, have been recognized for their pioneering work in behavioral economics.

In awarding the Nobel to Thaler in 2017, the Royal Swedish Academy of Sciences stated, “His contributions have built a bridge between the economic and psychological analyses of individual decision-making.” Thaler’s work was instrumental in pension reform, illustrating how subtle changes in framing can lead to dramatically different consumer choices. Thaler’s research contributed to policy changes including automatic enrollment of employees in 401(k) plans and the use of target date funds as the default option for new 401(k) enrollees instead of money market funds.

Continue Reading →

One of our readers shared the transcript of a roundtable talk among Seth Klarman, David Abrams, and Howard Marks almost 10 years ago. It is a very long read (22 pages) but if you’d like to learn about these great value investors and their investment approaches, it is a great read. I will share some excerpts from each of these investors and share the link at the bottom of this article. Here is how Seth Klarman summarized what Baupost does:

“In terms of investing I would say that there is no exact formula for what we do. We try to use all the value investing principles we know. The world is imperfect. The world doesn’t just dish up net, nets all the time. The world doesn’t dish up stocks trading below cash all the time, doesn’t deliver fine businesses at eight times earnings all the time. So we look very hard for mis-pricings, for information asymmetries. for supply/demand imbalances, and we find ourselves at various times heavily in distress debt or no position in distress debt, significantly involved in equities and uninvolved in equities, very focused on private markets or uninvolved because you can create the same assets cheaper in the public market. So in a nutshell that’s our approach. Very opportunistic. We try to be not siloed the way many people are. We don’t have industry analysts we have generalists who can move quickly from working one day on a drug stock to another day on the distress debt of a bank, and another day even potentially on a mortgage security or real estate investment. That’s not easy but it does provide constant stimulation, a lot of cross-training, which people enjoy, and it also means that our resources will always be deployed in the most interesting areas all the time. So that’s Baupost in a nutshell.”

Continue Reading →

If you question how ‘boring’ can be beautiful, you have been following the wrong investment strategy.

Too many people have the misconception that investing is glamorous. The reality is that glamour is the last thing you will find in the stock market, most especially if you plan on being successful.

Hedge fund guru, George Soros sums it up brilliantly: “If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.”

Sure, we have all heard of a stock market success story or two. You probably have an acquaintance who made a decent return from investing in a tech stock that tripled in price before selling. Maybe even someone who inadvertently timed the 2008-09 crash correctly. In most cases, these successes are short-lived and can be attributed to pure luck. Although these ‘successful investing’ stories make for good dinner-party conversation, they are by far the exception among prosperous independent investors.

The fact is investors who produce the flashiest returns, time and time again, usually do so in the most unglamorous manner. A great example is Warren Buffett, who built an empire investing in so-called ‘boring’ stocks.

Continue Reading →

Every day I jot down on yellow legal paper a list of ideas and subjects that I think will be interesting to our subscribers and that I can add value to — topics for future opening missives in my Diary.

Each morning, at around 4:45, I think about what I will write as the subject of my opener for the day.

I typically contemplate the prior day’s market action and the overnight price changes in the major asset classes and regional markets around the world and I try to come up with something relevant, topical and actionable.

Something on my list, for many moons, is the subject of the lessons I have learned from Jim “El Capitan” Cramer.

Over the years I have written about the contributions that Jim has made and I have defended Jim as well against the wrong-footed criticism that he often faces in his role as a high-profile and visible public figure.

My defence of Jim is not done because I essentially have worked for him over the last two decades. Rather, it is heartfelt and done in the recognition of the contributions that Jim has made since he invented and founded TheStreet. I do this in large part because Jim has been my professor, an important contributor to my investment experience.

Continue Reading →

Value investing starts with low PE stocks, but it shouldn’t be an investor’s only financial metric.

What do Warren Buffett, Ben Graham, Seth Klarman, and Peter Lynch all have in common? Besides being wildly successful investors, they’re all are adherents to value investing, a method where one attempts to buy securities that have a higher intrinsic value than their current price.

One of the most basic forms of value investing is to find stocks with low price-to-earnings (PE) ratios. The PE ratio is a simple ratio that divides the current price per share of a company by the earnings per share over the trailing-12-month period. The logic behind buying low PE stocks is simple: As an investor, you are ultimately entitled to a pro-rata portion of company earnings, so paying the lowest cost, or multiple, for those earnings is preferable than paying a higher multiple. Essentially, your dollar is buying a larger portion of company earnings than it would with a high-multiple stock.

One of our favourite value investors here at The Acquirer’s Multiple is Jim O’Shaughnessy.

One of our favourite value investors here at The Acquirer’s Multiple is Jim O’Shaughnessy.