Reblog: The When-In-Doubt-Follow-Others syndrome

Choose the correct line?

Let me start by asking you a simple question?

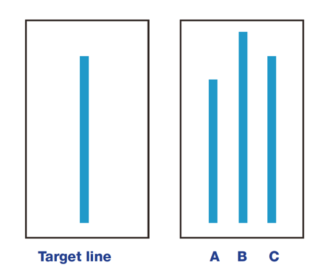

In the above diagram, which of the three lines numbered A,B and C is closest in length to the target line ?

If you answered C, congrats that is the right answer!

Of course, it was outrageously obvious right.

Now before you swear at me for insulting your intelligence, here is the shocker – in a famous experiment conducted in the 1950’s, for the same question majority of the people chose the wrong line.

But how could this be?

Were they actually that dumb..

Enter behavioural economics. Unknown to the participants, there was a secret behavioural trick played on these people which caused them to choose the wrong answer despite the correct answer being very obvious to them.