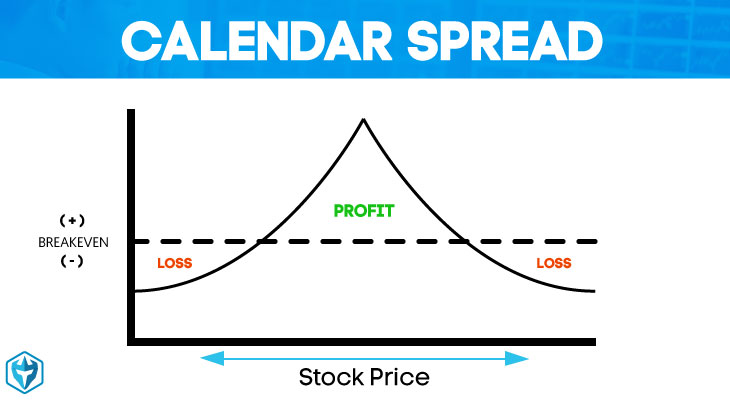

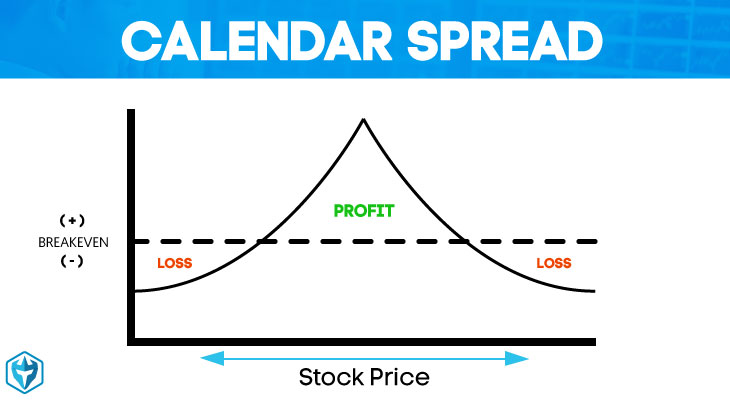

Calendar spread is an options strategy that allows traders and investors to enter long and short positions simultaneously for the same underlying and strike price but different expiration dates.

Option traders can utilize calendar spreads as a way to get into a long position at a cheaper price by selling the other leg and bringing in a credit. As a result, the option trader has the choice of owning longer-term calls or puts for less money. Keep in mind that this strategy can be used with both calls or puts.

How To Trade A Calendar Spread

As said earlier, the calendar spread is an option trading strategy where a trader opens two legs with different expiring dates for the same security. In the picture above, you can see that we are selling the earlier expiration (aka the front month) in January and buying the longer expiration set for February. Your max loss on this trade is your net debit you paid to open the position while your max gain is theoretically unlimited.

Continue Reading →

Looking back, I now realize that what allowed me to finally establish consistency into my trading was not a better trading strategy or a different method, but something I never expected when I started out as a trader.

In today’s society where the average attention span has dropped to 8 seconds, where 140 character tweets seem too long (#TLDR) and people skip YouTube videos after just a few seconds, we easily lose the connection to ourselves…

The concept of “self-awareness” has a woo woo ring to it and most traders will not listen to you if you start a trading conversation by referring to self-awareness. However, if you really want to make this work and if you want to finally realize your goal of becoming a pro trader, you have to listen and I am 100% certain that you will be able to relate to my story as well.

What is self-awareness? Forget the spiritual mumbo-jumbo

Unfortunately, most people, and especially traders who are often numbers driven and very rational, associate the term self-awareness with something spiritual and connect the wrong assumptions with it. This is very unfortunate because I have never met a successful trader who is not also very self-aware. You’ll see soon that self-awareness is something very different from what you believe it is.

Continue Reading →

The markets ended higher on Friday ahead of the Karnataka Assembly elections. The southern state will vote on Saturday and the poll outcome will be known on May 15.

The S&P BSE Sensex ended at 35,536, up 289 points while the broader Nifty50 index settled at 10,807, up 90 points.

Among individual stocks, Asian Paints hit a record high on strong March-quarter results and was among the top contributors to index gains. Stock was the top gainer of the broader Nifty50 index.

Shares of Fortis Healthcare ended 3% lower at Rs 148 on the BSE, after the company said the board chooses the Hero Enterprises-Burman Family Office offer as the best for the hospital and diagnostic chain.

Shares of select pharmaceutical companies were under pressure, falling by up to 6% ahead of US President Donald Trump speech today about controlling prescription drug prices. Sun Pharmaceutical Industries slipped 6% to Rs 468 on the BSE in noon deal on back of heavy volumes. Novartis India, Marksans Pharma, Ajanta Pharma, Morepen Laboratories, Alkem Laboratories, Sun Pharma Advanced Research Company (SPARC) and Aarti Drugs were down in the range 3% to 4% on the BSE.

PC Jeweller on Thursday announced its board has approved buy-back of shares worth Rs 4.24 billion amid a sharp plunge in stock price in recent weeks. The shares will be bought back at Rs 350 per unit, which is 67 per cent higher than the closing price of Rs 209 apiece on the BSE on Thursday. Promoters will not participate in the buy-back process. In a regulatory filing, the jeweller said the board at its meeting held on Thursday considered and approved the buy-back of up to 1,21,14,286 fully paid-up equity shares of Rs 10 each.

Continue Reading →

Last time, I wrote an article discussing a valuable piece of advice from Seth Klarman (Trades, Portfolio) on how to act in falling markets.

The key message of the article was that in a bear market, the best strategy to follow is to continue as you always have. As Klarman notes, “Controlling your process is absolutely crucial to long-term investment success in any market environment.” The last thing you should do is try to time the market:

“While it is always tempting to try to time the market and wait for the bottom to be reached (as if it would be obvious when it arrived), such a strategy has proven over the years to be deeply flawed…the price recovery from a bottom can be very swift. Therefore, an investor should put money to work amidst the throes of a bear market, appreciating that things will likely get worse before they get better.”

Continue Reading →

After a lull in the month of April 2018, long wait for main board IPO for financial year 18-19 is over with a non-banking finance company breaking the ice with its float of around Rs. 1850 crore. Details of the first main board IPO of this fiscal is given hereunder:

Indostar Capital Finance Ltd. (ICFL) is a leading non-banking finance company (“NBFC”) registered with the Reserve Bank of India as a systemically important non-deposit taking company. It is a professionally managed and institutionally owned organization which is primarily engaged in providing bespoke Indian Rupee denominated structured term financing solutions to corporate and loans to small and medium enterprise (“SME”) borrowers in India. ICFL recently expanded its portfolio to offer vehicle finance and housing finance products. Although, the company operated in a challenging credit environment in the initial years of our business operations business has experienced growth since the commencement of operations in 2011. Between fiscal 2013 and 2017, its total credit exposure, total revenue and net profits grew at a CAGR of 30.0%, 31.4% and 23.7% respectively. Its corporate lending business which was at 99.8% in FY 2015 declined to 76.8% for the period ended 31.12.17 and for the said periods, its SME lending business grew from 0.2% to 22.7%. Vehicle financing operations started from November 2017 and housing finance operations started from March 2018.

Continue Reading →

In today’s market, after nearly a decade of low volatility and steadily rising stock prices, it is easy to forget the turmoil that gripped the stock market, and the world, in 2008-09.

Even though a crash might seem a million miles away currently, you never know when the next decline might arrive, so it is always best to prepare for the worst. The best way to prepare is to read accounts of investors given at the time.

This will not give you answers as to when the next crash will arrive (all but impossible to predict), but it will provide a sort of template as to what goes on.

Learning from Klarman

One of the most fascinating accounts of investing during the crisis comes from Seth Klarman (Trades, Portfolio). In February 2009, Klarman wrote an article in Value Investor Insight titled, “The Value of Not Being Sure.” Within the article, he detailed how he was investing in the crisis and why he thinks fear is such a great motivator.

Continue Reading →

Benchmark indices dropped on Friday tracking global markets, while metal and pharma stocks pulled down the indices ahead of elections in the key state of Karnataka.

The S&P BSE Sensex ended at 34,915, down 188 points while the broader Nifty50 index settled at 10,618, down 61 points.

Among sectoral indices, the Nifty Metal index was trading over 1% lower led by a fall in shares of Hindustan Zinc and Hindalco. The Nifty IT index, too, was down led by a fall in shares of Mindtree and Wipro. Among the FMCG counters, ITC, Emami, GSK Consumer slipped over 2% on the NSE.

Pharma stocks pushed both indices lower, with the Nifty Pharma index falling over 1.5%.

Bajaj Auto, Mahindra & Mahindra (M&M), ITC, Reliance Industries (RIL), Mahindra & Mahindra Financial Services (MMFS) and JSW Steel are the six stocks that Morgan Stanley is betting on in India to play its ‘growth at reasonable price’ (GARP) investment strategy.

An Indian jeweller that saw its market worth reach $3.6 billion at the start of the year is now floundering at about a quarter of that value after one of its founders gifted some shares to family members, raising concern about the company’s governance. PC Jeweller Ltd. slumped by about half after the company said last week that one of its founders P.C. Gupta made the gifts through off-market transactions. The stock has plunged 75 per cent from a record on January 19, taking its market capitalization to Rs 58.3 billion ($873 million). It climbed 21 per cent to Rs 146.85 as of 12.31 p.m. in Mumbai on Friday.

Realty firm Godrej Properties on Friday reported over two-fold jump in its consolidated net profit at Rs 1.41 billion for the January-March quarter of last financial year on higher sales. Its net profit stood at Rs 625.9 million in the year-ago period, the company said in a filing to the BSE.

Continue Reading →

There are seven things that I believe are pretty common in the successful traders I have known, read about, and seen in action. Whether it is stock trader Nicolas Darvas in the sixties, commodity trader Ed Seykota in the twentieth century, or Jesse Livermore at the turn of the last century, many of their principles hold true to this day. The closer I get to these principles, the better I trade. The farther I stray from them, the worse I do. In trading, discipline pays. Adopt these seven habits of highly successful traders.

- Traders must have the perseverance to stick to trading until they are successful. Many of the best traders are the ones that had the strength to push through the pain, learn from their mistakes, and keep at it until they made it.

- Great traders cut losing trades short. The ability to accept that you are wrong and put your ego aside is the key to personal and professional success.

Continue Reading →

A few weeks back, I heard someone asking this question:

“How do you find new trading strategies and setups?”

Now the truth is… setups and strategies are useless if it doesn’t have an edge in the markets. You can have the best risk management, correct trading psychology but, without an edge, you’re still going to lose money in the long run.

Instead, a better question would be… “How do I find an edge in the markets?”

Now, if you are interested to know, then today’s video is for you.

Because you will learn…

- The SECRET to finding an edge in the markets

- How to profit from losing traders (by thinking one step ahead of them)

- Practical trading techniques which give you an edge

Continue Reading →

Benchmark indices ended sharply up on Friday, triggered by corporate earnings and taking cues from global peers.

The S&P BSE Sensex hit an intra-day high of 35,065, but pared gains to end at 34,970 levels, up 256 points. The broader Nifty50 index settled at 10,692, up 75 points.

Reliance Industries (RIL) hit a record high of Rs 1,000 per share, up 2.5% on the BSE in intraday trade on the BSE, ahead of its Q4FY18 results today. The stock surpassed its previous high of Rs 990 recorded on January 23, 2018 in intra-day deal. The textiles-to-telecom conglomerate, RIL is expected to post its best-ever quarterly consolidated net profit, with the figure expected to be close to Rs 100-billion mark.

Country’s largest car maker, Maruti Suzuki, reported a record annual profit of Rs 77.21 billion for the year ended March 31, 2018, helped by a double-digit growth in volumes of cars sold. The Suzuki-promoted firm clocked a near 17 percent jump in sales revenue for the year to Rs 781 billion. Profit, however, grew by just five percent. An increase in effective tax rates and lower non-operating income due to mark-to-market impact on the invested surplus, compared to last year impacted net profit, the company said.

Shares of public sector undertaking (PSU) banks were in focus with Nifty PSU Bank index gaining 5%, its sharpest intra-day gain during past one month on the National Stock Exchange (NSE).

Continue Reading →