Mark to market refers to an investment measure or accounting tool used to record an asset’s value to reflect the market value of the security rather than its book value.

The tool is commonly used on futures accounts and helps to ensure that all margin requirements have been completed. When it comes to mutual funds, mark to market refers to how a fund’s net asset value is calculated every day based on the underlying investment closing prices.

Why It’s Important

In security trading, when a portfolio or investment is marked to market, then its value is usually changed in order to reflect the current market price. Investors usually take advantage of this when they are holding a position through the end of the year. Instead of being forced to close it out to realize a loss or gain, you can simply to choose to mark to market the position which will establish the position at the market price for when you file your taxes.

Continue Reading →

A thin market refers to a market characterized by a minimal number of buyers and sellers plus high price volatility. Also referred to as a narrow market, it is also characterized by high bid-ask spreads and low trading volume.

This type of market does experience lots of drastic swings thus making it difficult for traders and investors to trade systematically. As a result, it is quite common in a thin market for price fluctuations to be larger between transactions and slippage can be a common occurrence.

As said earlier, a thin market is characterized by a small number of traders – buyers and sellers- which results in a low volume of transactions and illiquidity. Due to this, price movement becomes more volatile.

Continue Reading →

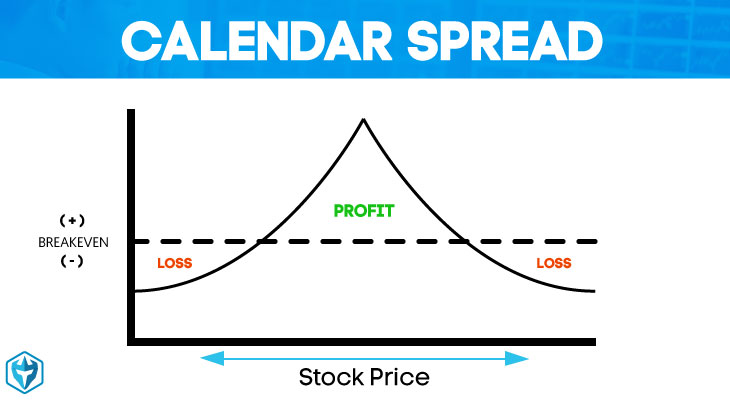

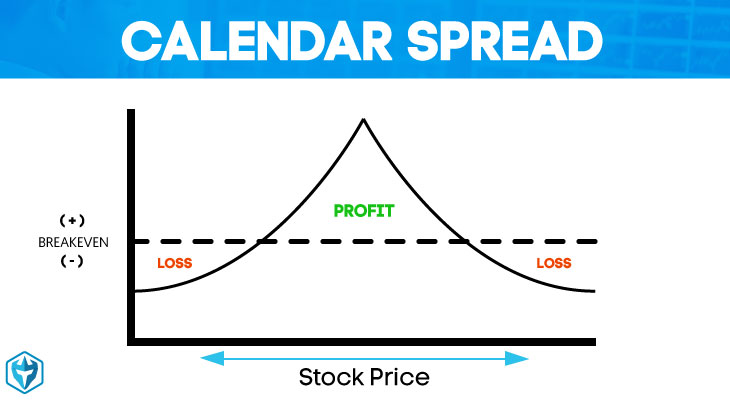

Calendar spread is an options strategy that allows traders and investors to enter long and short positions simultaneously for the same underlying and strike price but different expiration dates.

Option traders can utilize calendar spreads as a way to get into a long position at a cheaper price by selling the other leg and bringing in a credit. As a result, the option trader has the choice of owning longer-term calls or puts for less money. Keep in mind that this strategy can be used with both calls or puts.

How To Trade A Calendar Spread

As said earlier, the calendar spread is an option trading strategy where a trader opens two legs with different expiring dates for the same security. In the picture above, you can see that we are selling the earlier expiration (aka the front month) in January and buying the longer expiration set for February. Your max loss on this trade is your net debit you paid to open the position while your max gain is theoretically unlimited.

Continue Reading →

Momentum stocks can grow your trading account exponentially if you know how to manage risk, find good entries, and stick to your trading plan. New and inexperienced traders have to be especially careful because they can destroy there account as quickly as it can grow. Here are some of the best strategies and tips you can use to maximize your profits on these stocks.

Daily Chart Breakouts

Daily chart breakouts are a great daily context to play for momentum plays. The bias is obvious, it is easy to define your risk, and there is usually great risk versus reward. For newer traders, it is easier for most to play setups that are joining an existing trend. You want to look for long periods of consolidation before playing a breakout, like we see with SHOP above. The longer a stock is trading within a range, the more powerful the move will be when it breaks major resistance or support.

Continue Reading →

I think we can all agree that habits are what determine our success or failure in any endeavor, trading included. So, how do we go about developing the type of habits that will lead us to profitable trading?

I think we can all agree that habits are what determine our success or failure in any endeavor, trading included. So, how do we go about developing the type of habits that will lead us to profitable trading?

The answer: Routine.

Proper trading habits do not just magically appear out of thin air (unfortunately). They can sometimes take years to form. However, luckily for you, you have the power to put into motion a plan that will bring forth the proper trading habits sooner than otherwise possible. The development of positive habits, the ones that lead to success in any field, is something you can make a conscious effort to achieve simply by implementing consistent daily routines.

Continue Reading →

Bar Chart Definition: Day Trading Terminology

A bar chart is a graph characterized by a vertical bar and it’s used by technical analysts to learn more about trends. In trading, a single bar is used to represent a single day of trading. As one of the most popular chart type aside from candlesticks, it represents price activity within a given period of time.

As a result, traders and investors use this chart type to spot trends and patterns. What you need to know is that a bar chart is similar to the candlestick. The only difference is that the body of a bar chart is not filled like that of a candlestick.

As the western version of the Japanese candlestick, they help investors and traders to observe the contraction and expansion of different price ranges.

Continue Reading →

Today I want to talk about a topic that could turn a lot of losing traders into profitable and professional traders. In our pro forum, I keep coming back to this topic quite often because I know about the importance and in the pro area, we have now seen many times that traders who follow this way of thinking, have a better chance of becoming profitable.

Learning vs. making money

I completely understand that this will be a tough pill to swallow but I always think that being honest and having realistic expectations is a key to trading success.

In trading, there is a time to make money and there is a time to study and work on yourself. When you are just starting out, you should not focus on making money and you have to completely detach yourself from the belief that you’ll earn a great living anytime soon.

Continue Reading →

Good traders are known to be masters of risk management. Risk management includes following a detailed trading plan, setting stop and limit orders and managing traders without succumbing to emotions.

Good traders also tend to follow a robust trading plan that focuses more on ensuring that the traders do not lose their capital, while the profits are seen as only secondary. As part of this pursuit in achieving trading excellence, professional and seasoned traders follow the concept of setting limits on their losses, on a daily, weekly and even monthly basis.

Trading with limits ensures that the traders do not end up sabotaging themselves in the heat of the moment as emotions can often override logic when a trade turns into a loss.

Continue Reading →

This is a post by Mastermind, Bramesh Bhandari. The original post appears here.

If you are a LOSS making trader, answer the below question to yourself honestly.

What is the main Reason for Your Trading Loss? We are running a poll on Twitter Please participate

- Unable to Understand Market Trend as it moves from Sideways to Trending or

- Is it your system or strategy? You are not having the Right Strategy and Losing

- You — By repeating the same mistakes again and again

As per my experience with trading over 12+ years and also talking with 1000’s of traders over a period of time, my understating is

Traders are often their own worst enemies. The simple reason being most of the traders after doing a big loss will turn to charts and try to find their mistake. What I missed in catching this move, should I apply more indicators or should I learn something new to catch big moves etc. Readers can go back to thought process they went once they took a big loss or missed a major rally.

It’s easier to look at charts and imagine what the market might do or find an excuse , compared to turning inward and engaging in self-examination to determine if any changes in your approach to trading are required.

A very simple exercise will make you understand this

Go back to your past traders, highlight the trades where you made maximum losses, analyse all the loss making trades. You will observe over a period of time you have repeated the same mistake again and again. Be It taking an impulsive trade, trying to find top or bottom, not putting SL , taking over-sized position etc.

What would happen if you identified a recurring mistake? Would you do anything differently while trading, as a result? Would you need or use some type of structure or process to assist you in not repeating the same mistake?

The only thing we actually have any control over is our behaviour. The market will do what it will do. If one is truly interested in maximising / improving P&L, then focus on not to repeat your mistakes again. We may not be able to control our emotions, but we can learn to manage them.

Trading Journal is one of the tools which can help you in understanding your mistakes and over a period of time not repeating them.

This is a blog post by Mastermind, Nooresh. The original post appears here.

One can understand the obsession for Day Trading by just doing a Search on Google for the Words like – Day Trading, Intraday Trading Tips, Day Trading Tips and the number of sites that pop up catering to it.

BSE, an exchange in India, mentions itself to be the fastest exchange in the world.

Nifty 50 index is world’s most actively traded derivatives contract: Survey – Link

Majority of brokers have 90 – 96% of their business coming from Derivatives

There are a bunch of Discount Brokers with Rs. 0-20 as broking change.

Continue Reading →

I think we can all agree that habits are what determine our success or failure in any endeavor, trading included. So, how do we go about developing the type of habits that will lead us to profitable trading?

I think we can all agree that habits are what determine our success or failure in any endeavor, trading included. So, how do we go about developing the type of habits that will lead us to profitable trading?