The original post appeared on the website of Economic Times and can be found here.

The Nifty50 rallied over 4 per cent in July and the trend may continue in August too. Technical charts and options data show a bullish picture as off now, which means if the market managed to sustain the momentum, Nifty may very well touch the 9,000 mark in August.

But here is the spoiler. Data for the past 10 years shows August has not been great for the bulls. On an average, the Nifty50 has given a negative return of nearly 1 percent in last 10 years. The index saw deep cuts of over 5 percent in August in three out of last 10 years.

In 2011, the Nifty50 saw a vicious cut of 8.8 percent in August, followed by a deep cut of 6.6 per cent in 2015. In 2015, the Nifty50 plunged 5.8 per cent.

Continue Reading →

The original blog post is written by Hemant Parikh and can be found here.

RBI’s policy outcome, corporate earnings and macroeconomic data to dictate trend.

Next batch of Q1 June 2016 corporate results, progress of monsoon rains, macroeconomic data, trends in global markets, investment by foreign portfolio investors (FPIs) and domestic institutional investors (DIIs), the movement of rupee against the dollar and crude oil price movement will dictate market trend in the near term.

The major domestic event in the upcoming week is the Reserve Bank of India’s (RBI) third bi-monthly monetary policy meeting scheduled on Tuesday, 9 August 2016. The central bank had left its benchmark repo rate unchanged at 6.5% at its last meeting.

Continue Reading →

The original post is written by Rajat Sharma from our Mastermind, Sanasecurities and can be found here.

Goods and Service Tax (“GST”) is a comprehensive tax on manufacture, sale and consumption of goods and services, that will absorb most of the indirect taxes levied by Central and State Government. Currently the GST is adopted in over 150 countries. If passed, GST Bill would be THE biggest tax reform by the Indian government since inception of the Indian constitution.

How Will GST Work?

- In India, GST would work on dual model which will include – C-GST collected by Central Government + S-GST collected by State Government on intra-state sales. GST reform would also feature an Integrated GST (IGST) collected by Central government on inter-state sales, which is to-be divided between Central and States Government in a manner decided by the Parliament on recommendations by GST Council.

- By doing away with several Central and State Taxes, GST would diminish the cascading effect of tax (or double taxation, whereby the same product is taxed at the stage of manufacturing as excise, then as VAT/ sales tax on sale and so on.), which is prevalent in the current tax framework. Being a consumption-destination-based tax, GST would be levied and collected at each stage of sale or purchase of goods or services based on the existing input tax credit method. Current tax structure works on production-origin-based system i.e. goods and services are taxed differently on each stage of production.

Continue Reading →

The original article appeared on the blog of Stocktwits and can be found here.

People say it all the time.

Controlling risk is one of the most important things anyone can do when investing or trading. How much money are you comfortable losing on a single investment? How much of your portfolio is concentrated in one or two equities? These questions are only a few examples of what some risk managers might ask. There are many more.

Continue Reading →

The original post appeared in Economic Times and can be read here.

If you had invested in a bank fixed deposit (FD) or Kisan Vikas Patra (KVP) three years ago, you would not have been even halfway through towards your goal of doubling that investment over eight to nine years. But had you invested the same money in the top 100 stocks, it would have already doubled by now. Here’s how:

But had you invested the same money in the top 100 stocks, it would have already doubled by now.

Here’s how:

On June 10, 2013, it would have cost you Rs 80,541 to buy one unit each of the Nifty100 stocks. Today, that amount would have become Rs 1.63 lakh, growing at a compounded annual growth rate of 26.43 per cent.

“We are all familiar with the phrase, ‘Do not put all your eggs in one basket’. That way, a diversified portfolio could have resulted in higher returns. One can’t eliminate risks completely, but manage the risk level,” said Dhruv Desai, Director and COO, Tradebulls.

Diversification reduces stock-specific risks and gives better risk-adjusted return, said Rahul Jain, Head of Retail Advisory at Edelweiss Edelweiss Broking

The return offered by the 100 stocks is higher than most fund managers managed to generate with their multicap funds during the same period.

While sectors from banking, IT to consumer goods carry more than half of Nifty100’s weightage, strong performance by some stocks priced in four digits did the trick for the Nifty100 portfolio.

For example, Eicher Motors, which quoted at Rs 3,600 on June 10, 2013, has surged 5.2 times to Rs 18,800 by now. Bajaj Finance has surged 5.1 times over the past three years. The stock now trades at about Rs 7,700 against Rs 1,500 three years ago.Britannia Industries, Shree Cement and Bajaj Finserv are some of the other high-value stocks whose prices have surged 3-4 times over the past three years.

Britannia Industries, Shree Cement and Bajaj Finserv are some of the other high-value stocks whose prices have surged 3-4 times over the past three years.

“Some growth stocks such as Eicher Motors have performed well because of their niche businesses with dominance play. So they come with higher valuations,” said Mustafa Nadeem, CEO, Epic Research.

Desai said the market usually looks for companies with visible earnings growth. “As soon as they are discovered, investors start chasing them until their valuations become expensive. One should remember that many a times, investors get trapped chasing higher valuations,” he said.

Jain said, “The stocks look expensive on the valuations front, “But the right way is to look at valuations vis-a-vis their growth profile, quality of franchise, earnings visibility and sustainability of margins. Hence, if one looks at these stocks on the parameters mentioned, I believe these are good investments with a long-term horizon.”

The return offered by the Nifty100 stocks was higher than a 12.88 per cent CAGR (or 43 per cent return) growth clocked by the NSE100 index during the same period. It even beat the 14.41 per cent CAGR (or 47 per cent) registered by NSE100’s equal weight index during the same period.

The original article is written by Mastermind, Deepak Shenoy and is available here.

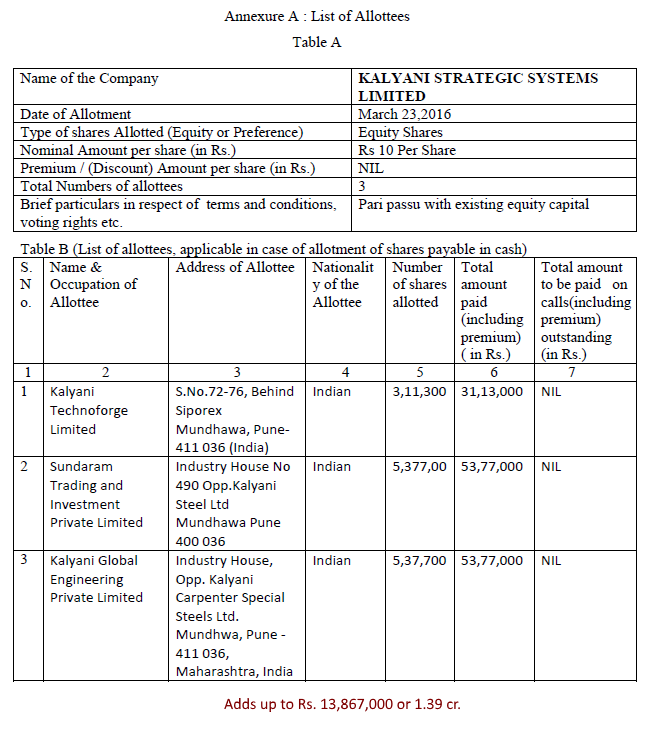

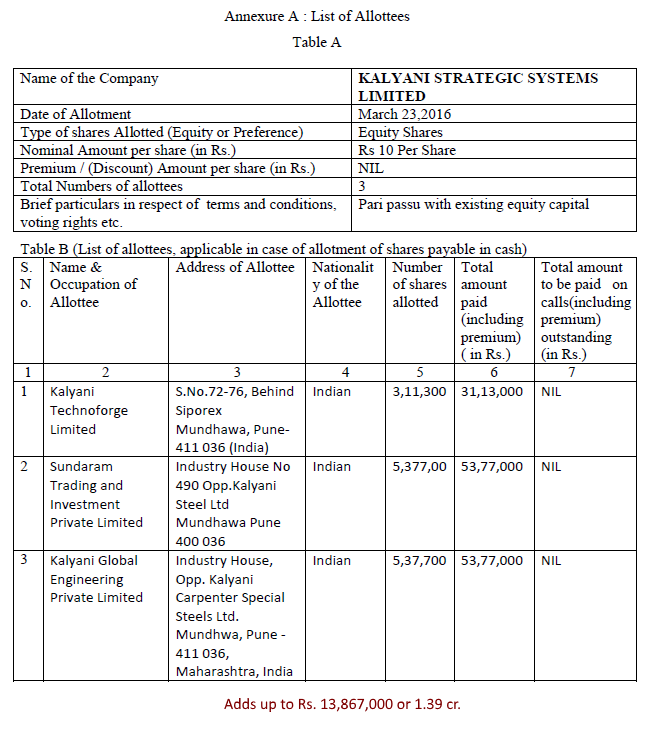

After Bharat Forge was caught having reduced its ownership in its key defence subsidiary, Kalyani Strategic Systems Limited (KSSL), from 100% to 51%, the question is: how did the stake reduce?

We’ve found the answer for you. Wading through MCA documents, we found that:

- KSSL had about Rs. 500,000 in capital (5 lakh)

- Bharat forge put in about 1.39 cr. in November 2015 at Rs. 10 per share (par). This took the total capital to about Rs. 1.44 cr.

- In March 2016, Three promoter companies put in about Rs. 1.38 cr. as capital into KSSL. This increased the total capital to about Rs. 2.83 cr. and gave the promoter companies 49% of KSSL.

Here are the three promoter group companies that bought into KSSL:

Sundaram Trading and Investment Private Limited is on the list of promoter companies of Bharat Forge. (BSE) Kalyani Global Engineering (see Tofler) has a common director with Kalyani Technoforge, a Shrinivas Kanade, who’s also on the board of other Bharat Forge promoter companies, such as Ajinkya Investment and Trading Company, KSL Holdings etc.

This is pretty simple to see – the promoters of Bharat Forge have been issued fresh shares of KSSL.

Why is this a problem?

The issue is: the shares have been issued at par, i.e. Rs. 10 per share. Why are promoter companies getting to buy shares at Rs. 10 per share, when Bharat Forge has done all the hard work of setting up Joint Ventures etc. through KSSL?

KSSL is their defence arm, and was owned 100% by Bharat Forge. It never was in the need of money – and if it needed Rs. 1.38 crores, this is so small an amount that Bharat Forge could sneeze and that much would be magically available. No, this is rotten because the amount was tiny and that the shares were sold at par.

Remember, the shares were issued to promoter companies in March 2016.

KSSL had a joint venture with SAAB in Feb 2016. Was that worth nothing? Even after that, no premium was paid by promoters.

In May 2016, the conf call transcript of Bharat Forge even says that they fielded a gun program (in response to a question about artillery) in KSSL, and they were looking to bag orders.

The fear is that promoters will try to take part of what should entirely be the property of Bharat Forge shareholders. In such instances, one does not get the confidence that the promoters will allow profits to continue to flow through the listed company. This should be addressed by Bharat Forge immediately, and in the longer term, SEBI should increase disclosure norms when subsidiaries issue shares and dilute parents.

Disclosure: No positions.

The original post is by our Vivek Bothra and the original post appears here.

In Jan’ 2015, almost a year back, diversified firm Max India spin-off plan were announced management indicated it is splitting listed entity into three companies with the existing firm becoming India’s first listed company with insurance as the sole business.

The Max India Group is a multi-business corporate, the listed entity has following primary business

- Life Insurance – As a 74: 26 Joint venture with Mitsui Sumitomo of Japan

- Max healthcare – Operating as equal JV with Life group of South Africa

- Health Insurance – As a 74: 26 Joint venture with BUPA of UK

- Antara – 100% owned retirement living real estate venture

- Max speciality Films – 100% owned

Continue Reading →

The post is reblogged from this link. It is authored by Mastermind, Deepak Mohoni

The market remains in an intermediate uptrend with the sensex, nifty and the Nifty Midcap 100 all in one. The uptrend began on June 24 when the sensex bottomed out at 25,911. As of now, the indices will have to go below their June 24 lows for a downtrend, but those levels will rise to the top of the minor decline that has set in. The levels are 27,900 for the sensex, 7,925 for the nifty, and 12,900 for the Midcap 100.

The US indices have now entered an intermediate uptrend. The FTSE-100, BOVESPA, Shanghai and our market were already in one. The other markets are still in intermediate downtrends.

The original post appeared in Business Standard and is available here.

L&T Infotech will not be enjoying the proceeds of the present issue as this being an offer for sale, the entire sale amount of around Rs 1,200 crore will go the parent L&T.

With an aim to unlock value of its subsidiary and realise the benefit of listing, engineering giant L&T is offering its holding in its subsidiary L&T Infotech for sale. This marks the listing of a sizeable IT company in India after a long time. The issue will be priced around Rs. 705-710 per share and will be hitting the market on July 11, 2016.

We take a closer look at the company, its operations and positioning among its peers. Here are 10 key points to note in L&T Infotech:

Continue Reading →

This post is written by Mastermind, Sana Securities. The original post appears here.

I have written about educated speculation in the stock markets (here) and about how to create an ideal streamlined portfolio of stocks for the long-term (here). A topic I have never touched is short-term trading in stocks. The irony is that this is what keeps me busy on a regular basis. If you follow the markets as much as I do, it is hard to resist buying and selling in the short-term. So here it is.

Continue Reading →