Derivatives or Futures and Options are leveraged instruments to trade in the stock market. There are broadly 3 groups of people who use derivatives-

- Short term traders for making quick buck– most of them want to make a quick buck. Leveraged trading means, you can potentially make 100% returns from a 10% movement in the stock. 100% returns from a 10% move looks lucrative! The only issue is you can lose bigger amount if stock moves in opposite direction

- Long term stock investors for hedging portfolio- these category of people may use derivatives for long term hedging of their portfolio or making some extra return on their stock holdings. They mainly use options. And, the idea is to hedge the portfolio, and not make great returns from short term trading

- Long term investors who buy special long term options with a long term view- These include big investors including Warren Buffett and many others buying warrants, convertible debentures, long term calls etc.

Majority of people who trade in derivatives come in the first category. More than 95% of traders lose money. Mostly these are young people who get job in corporate companies, open a new demat account and want to make some quick money. They are replaced by new traders (as new graduates complete college and get job). The cycle repeats.

Here is an interview of Nithin Kamath where he mentions –

Continue Reading →

We recently revamped the entire website, as you know by now. It is not just a cosmetic change but we have added new features for the benefit of our users. The whole purpose of the revamp was to add more value to the time invested by the users on the website.

One such feature is Online Trading.

How often have you read about something interesting like a view on a particular stock etc. but then you had to go log in to your Zerodha account to trade? In the midst of this, you receive a call and the next thing you know is that you missed it. Sounds familiar right? Not anymore.

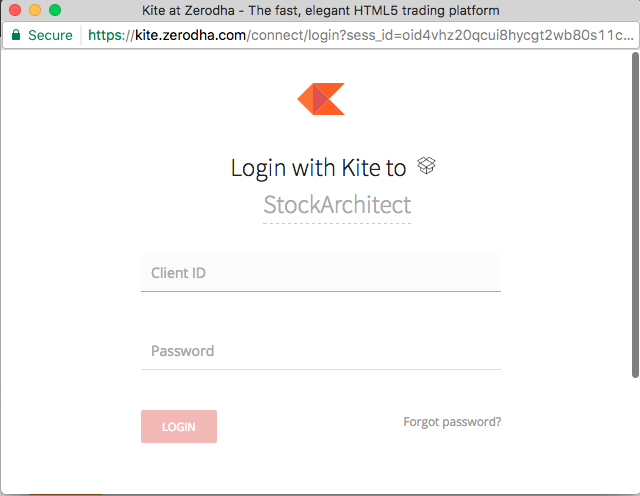

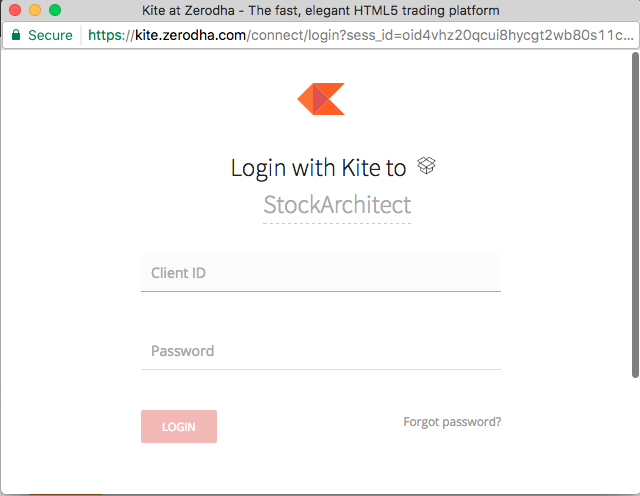

StockArchitect in partnership with Zerodha brings the convenience of trading right into the interface so that you never miss out that important trade even for a split second.

Using the feature is simple.

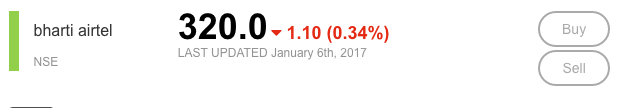

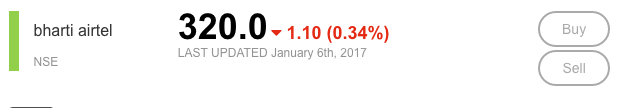

Let us take a stock say, Bharti Airtel.

In the top middle of the screen, you will the Buy and Sell buttons.

Click on Buy or Sell and you will be asked to login to your Zerodha account.

Voila – you are now on familiar territory. Trade as you would.

Don’t have a Zerodha Account? Help is at hand. You can sign up now.

Keep yourself tuned to this space as we announce new features for our users.

Happy Investing!

The original post appeared on the website of Economic Times and can be found here.

The Nifty50 rallied over 4 per cent in July and the trend may continue in August too. Technical charts and options data show a bullish picture as off now, which means if the market managed to sustain the momentum, Nifty may very well touch the 9,000 mark in August.

But here is the spoiler. Data for the past 10 years shows August has not been great for the bulls. On an average, the Nifty50 has given a negative return of nearly 1 percent in last 10 years. The index saw deep cuts of over 5 percent in August in three out of last 10 years.

In 2011, the Nifty50 saw a vicious cut of 8.8 percent in August, followed by a deep cut of 6.6 per cent in 2015. In 2015, the Nifty50 plunged 5.8 per cent.

Continue Reading →