Aster DM Healthcare Ltd. (Aster) is one of the largest private healthcare service providers which operate in multiple GCC states based on the number of hospitals and clinics and an emerging healthcare player in India. GCC states that comprise the United Arab Emirates, Oman, Saudi Arabia, Qatar, Kuwait and Bahrain. It also operates in Jordan and Philippines. Aster is having operations in different verticals and geographies. It has already started work for 10 new hospitals, 5 in GCC states and 5 in India. Although it has a larger portion of revenues coming from GCC states, due to India based company, it has registered office in the southern region and is mulling listing in India. Asters hospitals in India are located in Kochi, Kolhapur, Kottakkal, Bengaluru, Vijaywada, Guntur, Wayanad and Hyderabad. These are operated under “Aster”, “MIMS”, “Ramesh” or “Prime”, “Aster Aaadhar” and “Aster CMI” brands. Its clinics are located at Kozhikode, Eluru and Bengaluru. As of 30.09.17 the company had 17408 employees including 1417 full-time doctors, 5797 nurses, 1752 paramedics and 8442 other employees. In addition, it had 891 “fee for service” doctors. Aster has a diversified portfolio of healthcare facilities, consisting of 9 hospitals, 90 clinics and 206 retail pharmacies in the GCC states, 10 multi-specialty hospitals and 7 clinics in India, and 1 clinic in the Philippines as of September 30, 2017. Overall currently it has total 323 operating facilities.

Majority of Aster hospitals and clinics provide secondary and tertiary healthcare services to patients. In addition to providing core medical, surgical and emergency services, some of its hospitals provide complex and advanced quaternary healthcare in various specialties, including cardiology, oncology, radiology, ophthalmology, neurosciences, pediatrics, gastroenterology, orthopedics and critical care services. Aster had plans on the table for more large hospitals in metros of India before the budget, but now it mulls affordable hospitals in tier –II and tier- III cities and in rural areas. No plans have been firmed up so far in this regard.

Continue Reading →

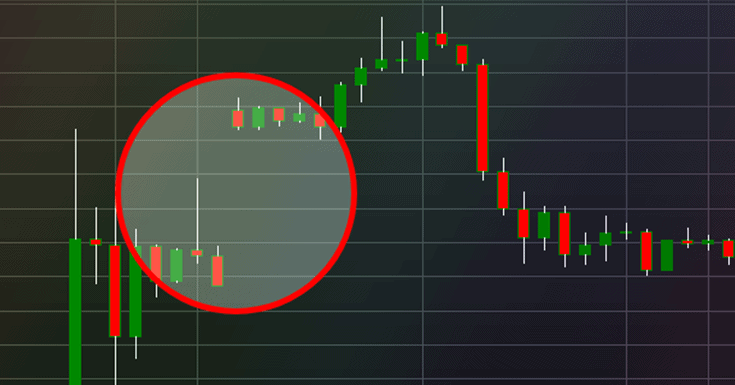

I think we can all agree that habits are what determine our success or failure in any endeavor, trading included. So, how do we go about developing the type of habits that will lead us to profitable trading?

I think we can all agree that habits are what determine our success or failure in any endeavor, trading included. So, how do we go about developing the type of habits that will lead us to profitable trading?