Reblog: How To Use The Reward Risk Ratio Like A Professional

The reward to risk ratio (RRR, or reward:risk ratio) is maybe the most important metric in trading and a trader who understands the RRR can improve his chances of becoming profitable.

A trader who uses the RRR incorrectly will never become profitable on the other hand. In this article, I will show you what you need to know about the RRR.

Busting myths around the reward:risk ratio

Let’s first tackle some of the common misconceptions about the RRR to help you understand what most people get wrong before then diving into the specifics of the RRR.

Myth 1: The reward:risk ratio is useless

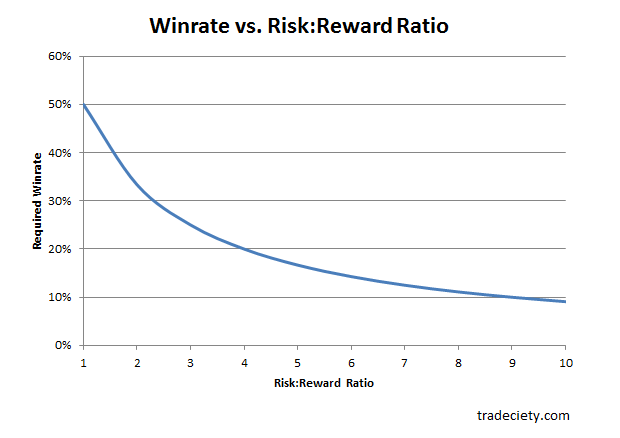

You often read that traders say the reward-risk ratio is useless which couldn’t be further from the truth. When you use the RRR in combination with other trading metrics (such as winrate), it quickly becomes one of the most powerful trading tools.

Without knowing the reward:risk ratio of a single trade, it is literally impossible to trade profitably and you’ll soon learn why.