The benchmark indices on Friday settled higher thanks to early rollovers to January series and bargain hunting at lower levels after market witnessed seven straight sessions of losses. The S&P BSE Sensex finished at 26,040, up 61 points, while the broader Nifty50 closed at 7,985, up 6 points. The market breadth, indicating the overall health of the market, remained negative. On the BSE, 1,309 shares fell and 1,249 shares rose. A total of 174 shares were unchanged.

BSE Capital Goods and BSE Consumer durables were the top sectoral gainers and added nearly 1%.

Cipla was the top Sensex gainer and surged 4%, bouncing back 6.5% from intra-day low, after the pharmaceutical company said its flagship product Sereflo received final approval from UK health regulator.

The market hit fresh 7-month high intraday Friday with the Sensex reclaiming 27000 and Nifty 8250 levels. However, profit booking in the last couple of hours of trade dragged the benchmarks as well as broader markets to end flat despite positive global cues.

The 30-share BSE Sensex declined 0.11 points to 26843.03 while the 50-share NSE Nifty rose 1.85 points to 8220.80. The market breadth was also weak as about 1521 shares declined against 1092 advancing shares on Bombay Stock Exchange. The market volatility may continue for some more time after hitting multi-month highs, as investors are eagerly waiting for key events – RBI policy meeting on June 7, Fed meeting on June 14-15 and the referendum in Britain.

Here are some picks from the week gone by.

Continue Reading →

The original post is by Mastermind, Sana Securities, authored by Rajat Sharma and appears here.

I wasn’t really sure of the title to this post but the idea stemmed out of a question that I received from a subscriber.

Instead of repeating the exact question, I will break it up into 2:

- Can you earn fixed interest income on the spare cash lying in your trading account?

- Should you transfer spare cash into your bank account where you can earn up to 4% – 6% interest (savings account rate for Yes Bank and Kotak Mahindra Bank) or can you earn higher?

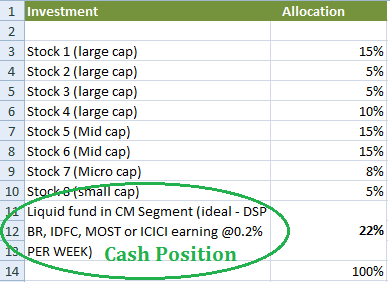

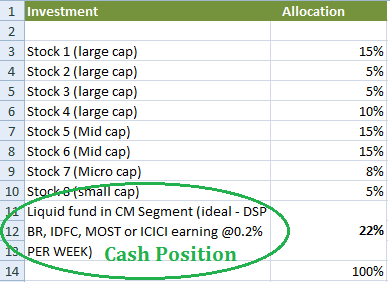

Cash Position: The best cash position is naturally the one that earns the highest possible ‘fixed income rate’ in the market. Fixed interest income can be earned on – money lying in savings/ current account, money market and liquid funds, ultra-short and short term funds and medium and long term funds.

As a trader or as a short term investor, you will require the money that you keep in your trading account at a short notice. For this reason, many short term investors believe that the best thing to do is to transfer funds from trading account to your savings bank account, perhaps at the end of the trading day (i.e. at 3.30 pm) and allocate them back to your trading account terminal when needed. It’s all in real time with internet banking these days. This is not the best thing to do.

How much are you going to earn by doing this?

Savings bank interest: In the most aggressive (bank) scenario you will earn ~ 0.06% on a weekly basis (i.e. ~ half of 6% divided by 52 weeks; considering that you transfer it exactly at 3.30 pm each day for until when the market opens on the next day).

Now consider a Liquid fund on the Mutual Fund Segment within your trading terminal.

Liquid and money market fund interest: Typically, these funds earn between 7.8% – 7.9% annual interest but that’s not all. You can actually stay invested in these funds unless you need to settle a trade (see example below). Here you will earn ~ 0.15% on a weekly basis (i.e. 5.8% divided by 52 weeks; see example below).

Example: You have Rs. 2,00,000 lying unutilised in your trading account and do not want to buy anything or make any position. You can either transfer this money to your bank account or buy a money market or liquid fund which typically earns 7.8 % return with very little volatility.

If you have stocks lying in your demat account, you will typically get 4 times their market price as margin to trade / invest (i.e. if you have stocks with current market value of Rs. 2,50,000 in your demat account, you will be allowed to buy/sell for up to Rs. 10,00,000/-). No interest will be charged on such buying and selling for up to 3 days**. Even on the 3 rd day, all you have to do is sell your liquid fund and your account is settled immediately. So practically, you may never have to sell your cash position. All you have to do is to define how much of your capital would you want to keep in cash at any point, based on market factors.

** These margins and limits may vary. The above is based on the limits we provide to all our clients.

Now consider this:

If you choose an ultra-short to short term fund where interest rates are 8.9% – 9.6%, and can stay invested for up to 15 days, then you earn ~0.18 % on a weekly basis (provided that instead of 2-3 days, as above, you can plan your buying and selling for up to 15 days).

Depending on market factors you do get opportunities to invest in even higher interest bearing instruments. For now, if you are still worried about losing out on basic interest income in trading account and are constantly transferring money back and forth between your accounts, STOP. There are easier solutions in life and better things to do after 3.30 pm.