Benchmark indices gained on Friday, as the Modi government is expected to win the no-confidence vote, to be held at 6 pm today. In the 545-member (including the Speaker) Lok Sabha, the BJP-led NDA can bank on around 311 members.

The S&P BSE Sensex ended the day at 36,496, up 145 points while the broader Nifty50 index settled at 11,010, up 53 points.

IT and pharma stocks gained as the rupee hit an all-time low. The Nifty IT index was trading up by 1.5 per cent with Infosys, Tech Mahindra and HCL Tech up between 1.6 per cent to 2.6 per cent. Meanwhile, in the pharma sector, Sun Pharma and Cipla gained over 2.5 per cent each.

Among individual stocks, Bajaj Finserv hit a record high, after the Bajaj Group-owned asset & wealth management firm posted a 41 per cent surge in its first-quarter profit on Thursday.

Bajaj Auto, on the other hand, dipped 9 per cent after the company reported a lower than expected 21% year on year (YoY) growth in standalone net profit Rs 11.15 billion in June quarter (Q1FY19). Analysts on an average had expected a profit of around Rs 13 billion for the quarter

Continue Reading →

Benchmark indices fell on Thursday, snapping a six-day record-setting rally, as profit-taking hit IT stocks while large state-run lenders slid as they stood to receive less money than expected from a government recapitalisation plan.

The S&P BSE Sensex ended at 36,050, up 111 points while the broader Nifty50 index settled at 11,069, up 16 points.

The government’s Rs 881.39 billion capital infusion in struggling public sector banks should help in part to mitigate risks but resolution of bad assets and continued high credit costs hinder the sector’s near-term performance, Fitch Ratings said on Thursday. While the capital infusion plan was less than half of its estimate of $65 billion needed for the sector, Fitch said yesterday’s announcement will encourage banks to resolve their non-performing loan (NPL) stock faster as improved capital buffers bolster their ability to absorb potential large haircuts.

Jindal Saw dipped 8% to Rs 154, extending Wednesday’s 4% decline on BSE after the company reported 19% growth in net profit at Rs 963 million for the quarter ended December 2017 (Q3FY18). It had a profit of Rs 807 million in the same quarter last fiscal. Total income increased 49% to Rs 21,807 million from Rs 14,666 million in the corresponding quarter of previous year.

Dr. Reddy’s Laboratories Ltd posted a 38.5 percent slump in quarterly net profit as sales declined due to pricing pressure in the United States, its biggest market. Net profit was Rs 3.03 billion ($47.7 million) in the third quarter ended December 31, compared with Rs 4.92 billion a year earlier, the company said.

Continue Reading →

Benchmark indices settled the day flat and posted small weekly gains as investors stayed cautious ahead of assembly election results. Exit polls declared yesterday showed BJP ahead of other rival parties in all the five states.

Victory for BJP in Uttar Pradesh will boost PM Narendra Modi’s chances of winning the 2019 general election. It would also give the party more number of legislators in the Rajya Sabha where it doesn’t have a majority, improving the government’s chances of passing key reform bills.

The 30-share Sensex ended 17 points higher at 28,946, while the 50-share Nifty settled the day at 8,934, up 7 points.

In the broader market, the BSE Midcap was down 0.2%, while BSE Smallcap fell 0.1%.

The S&P BSE Sensex settled 77 points down at 26,105 and the Nifty50 eased 6 points to close at 8,074. In the broader market, BSE Midcap rose 0.61% while Small cap closed 0.25% higher.

Even though the indices were largely range-bound during the day, Sensex rose 120 points as well as fell more than 100 points during the day. Nifty50 also breached its crucial 8,050 level during the day.

Weaker rupee boosted export-oriented sectors like pharma even when the overall market sentiment was not very positive.

Continue Reading →

Benchmark indices slumped by almost 3% tracking weak global cues after US bond yields soared on expectations US President-elect Donald Trump’s policies would stoke inflation. Further, demonetisation move by the government dampened investor sentiment especially with fast moving consumer goods and consumer discretionary sectors to have an impact in the short term. In an effort to curb black money and counterfeiting the government in a surprising move announced the demonetisation of Rs 500 and 1,000 currency notes with effect from midnight Tuesday.

Continue Reading →

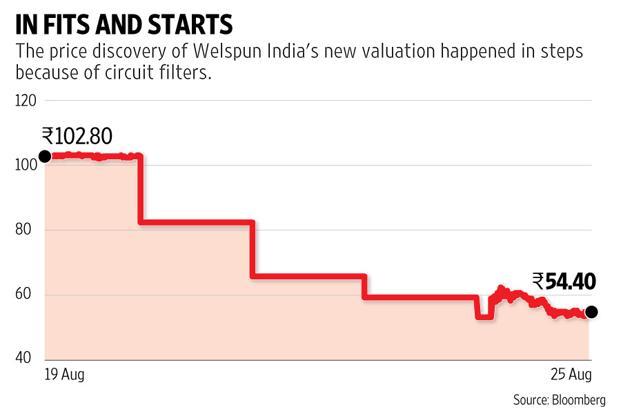

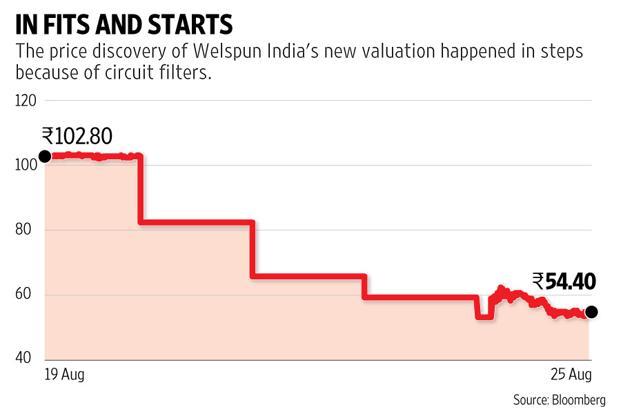

The original article appeared in LiveMint on August 26, 2016 and can be found here.

In four trading sessions, Welspun India’s market valuation came down to Rs. 5,700 cr. If there were no circuit filters, we would have known this within minutes on Monday.

Late last week, Target Corp. said it will end its business relationship with Welspun India Ltd, stating it had received bedsheets where Egyptian cotton was substituted with a cheaper variant.

When stock market trading resumed on Monday, it was clear Welspun India wasn’t worth the Rs.10,370 crore valuation it enjoyed until the prior week. But how much was it now worth?

Continue Reading →