Since 2008, the global asset management industry has been reeling under a relentless tsunami. While the assets under management (AUM) of actively managed mutual funds (MFs) have increased from $9.0 trillion to $13.4 trillion, passively managed index funds have surged from $0.6 trillion to $2.2 trillion. These now account for 12% of the total MF industry. Vanguard, the international company most identified with passive investing, had less than $25 billion in AUM for over two decades since its inception in 1975. It crossed the $100-billion mark in 1995. The march of exchange-traded funds (ETFs) has been equally impressive. By various accounts, the total AUM of ETFs has crossed the $2.1-trillion mark. ETFs have made significant inroads into the fixed income asset class, while index funds have been focused on equity.

Continue Reading →

The original article appeared in LiveMint on August 26, 2016 and can be found here.

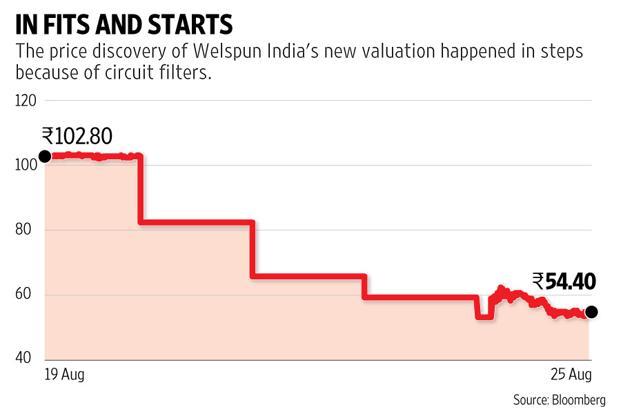

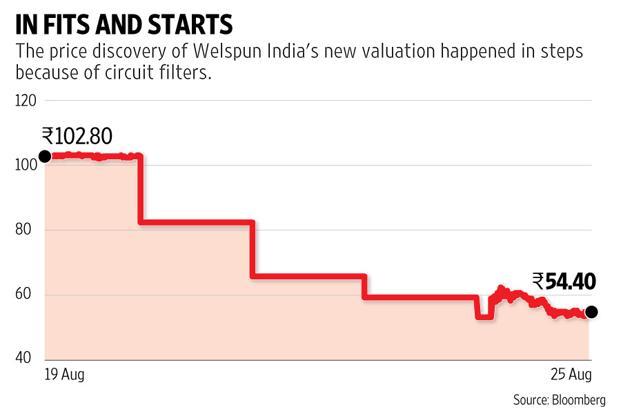

In four trading sessions, Welspun India’s market valuation came down to Rs. 5,700 cr. If there were no circuit filters, we would have known this within minutes on Monday.

Late last week, Target Corp. said it will end its business relationship with Welspun India Ltd, stating it had received bedsheets where Egyptian cotton was substituted with a cheaper variant.

When stock market trading resumed on Monday, it was clear Welspun India wasn’t worth the Rs.10,370 crore valuation it enjoyed until the prior week. But how much was it now worth?

Continue Reading →

At StockArchitect, our intention is to help investors take informed investment decisions. We have been mentioning about the Masterminds who share their knowledge and their ideas for investors. We have also mentioned how news anchors share their views for the investors.

So is it all about the Masterminds and news anchors? There is more.

We strongly believe that it is of paramount importance that investors should be aware of the events that occur both locally and globally. After all investment decisions are impacted by these events. We therefore also cover a host of Business channels and publications just to ensure that the investors have all the news as they happen right in one place.

Continue Reading →