Reblog: The Most Important Math in Trading

The original article is written by Steve of Trading Method, Trading Plan and can be found here.

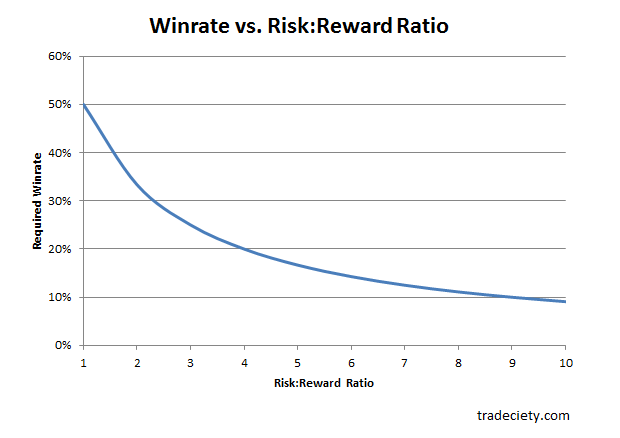

Most new traders think their win rate is the most important math in their trading. It is not, your risk / reward ratio will determine your profitability more than a win rate.

Chart Courtesy of Tradeciety.com

- Most new traders think their win rate is the most important math in their trading. It is not, your risk / reward ratio will determine your profitability more than a win rate. The reason for stop losses is to limit your losses when you are wrong so you cap your risk. Capping your risk makes it easier to have a reward that is multiples of your potential risk. If you risk $100 to make $300 it is a 1:3 risk / reward. If you open yourself to big losses it will be difficult to maintain a good risk / reward ratio. You can have a random 50 / 50 win rate and still be profitable through letting winners run and cutting losers short.

- “The trend is your friend until the end when it bends.” – Ed Seykota

- An uptrend is measured through higher highs and higher lows in your time frame.

- A downtrend is measured through lower highs and lower lows in your time frame.

- The 10 day EMA can measure the short trend by which side the price is staying on.

- The 200 day SMA can measure the long-term trend by which side the price stays on.

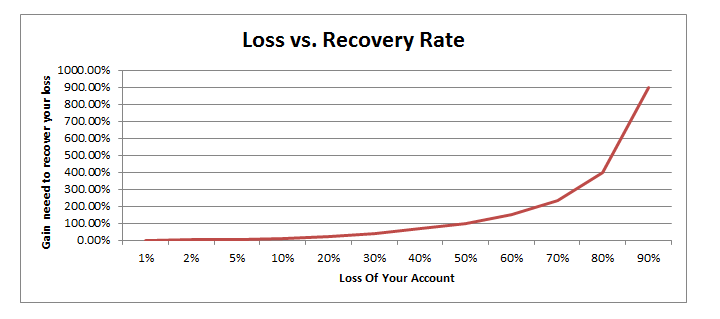

- How many losing trades in a row can you survive and not blow up your trading account?

- Risking a small percentage of your trading capital will help you avoid your risk of ruin If you risk 1% of your capital trading with position sizing and a stop loss you will be down 10% after 10 losing trades. How much would you be down at your current rate of risk? Ten losing trades in a row will happen eventually it is just a matter of when and will you survive the losing streak mentally and financially.