Reblog: The Evolution Of A Value Manager

The original article appears on valuewalk.com and is available here.

Over the years reading plenty of books on investing and studying many of the world’s greatest investors I’ve come to recognise how truly insightful the combination of Warren Buffett and Charlie Munger really are.

While Warren Buffett cites the book “The Intelligent Investor” as “by far the best book on investing ever written” his style evolved over the years in a large part influenced by Charlie Munger.

“Charlie shoved me in the direction of not just buying bargains, as Ben Graham had taught me. This was the real impact Charlie had on me. It took a powerful force to move me on from Graham’s limiting views. It was the power of Charlie’s mind. He expanded my horizons” Warren Buffett

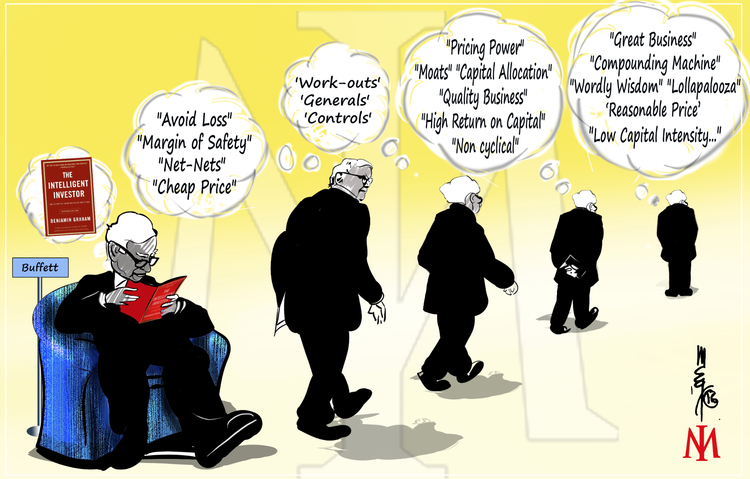

I think a lot of value investors evolve in a similar fashion. They start out on the hunt for cheap stocks and gradually they move towards the great businesses, the compounding machines, that can generate attractive returns over long periods of time. They move from paying low multiples for what are often poor businesses, to seeking truly great businesses at fair multiples.

Here’s a look at the evolution of Warren Buffett, as I see it.

Warren Buffett

The Buffett Partnership Years..

Warren ran the Buffett Partnership prior to undertaking his investment activities in Berkshire Hathaway where he employed a combination of value, event and activist investing styles. The portfolio was constructed to outperform in down markets and perform well [but likely under-perform] in very strong markets.

Warren sought protection from weak markets by investing in uncorrelated strategies and focussing on bargain purchases. While the portfolio was unconventional compared to the investment funds of then and now, Warren deemed it more conservative given its ability to protect capital in weak markets.

Many of the events Warren invested in are typical of the hedge fund strategies of today. These were split into three broad categories and their respective weightings were determined based on each categories level of attractiveness. They were the ‘Generals’, the ‘Work-Outs’, and the ‘Controls’.

The ‘Generals’ consisted of generally undervalued securities where there was nothing to say about corporate policies and no timetable as to when the undervaluation would correct itself. They were bought primarily on quantitative factors [but with considerable attention to qualitative factors] with a margin of safety, a diversity of holdings and a ‘bargain price’ substantially below what careful analysis indicated value to a private owner to be. These would be sold at some level between what they were purchased at and what was regarded as fair value to a private owner. Warren sought good management, a decent industry and ‘ferment’ in a previously dormant management or stockholder group. While being most correlated with the stock market this portion of the portfolio was expected to achieve a satisfactory margin over the Dow over the years. It was likely to be the star performer in a strongly advancing market.

The second category consisted of ‘Work-Outs’. These strategies are typical of ‘event’ hedge funds today and include spin-offs, mergers, liquidations, sell-outs and re-organisation trades. These securities were purchased after company announcements. As the share prices depended on corporate action the timing of the return could be predicted. The attraction of this category was downside protection [most of the time] from falling markets, a big edge. The category was expected to be a drag on performance during bull markets. Despite the gross profits in each ‘work-out’ being quite small, the predictability coupled with a short holding period, produced quite decent annual rates of return with more steady absolute profits from year to year than the ‘generals’. Like modern hedge funds Warren used borrowed money to offset a portion of the ‘work-out’ portfolio. On a long term basis, Warren expected the ‘work-outs’ to achieve the same sort of margin over the Dow as attained by the ‘generals’.

The final category was ‘Control’ situations where Warren either controlled the company or took a very large position and attempted to influence policies of the company. This is akin to today’s activist/private equity investors. Positions tended to develop from the ‘generals’ purchases unless a sizeable block of stock was purchased. Warren preferred to be passive unless an active role was considered necessary to optimise the employment of capital. This may have involved strengthening management, re-directing the utilisation of capital or effecting a sale or merger. When building stakes in ‘control’ situations the prices tended to be correlated with the stock market but once a position was built they tended to act more like the ‘work-out’ portfolio. Once control was achieved the value of the investment was determined by the value of the enterprise, not the market. The value was therefore far less volatile than the stock market and provided downside protection in weak markets.

In the early days, Warren remained focussed on avoiding the permanent loss of capital, having a portfolio that would protect capital and sticking with businesses he knew and that could be bought at a significant discount to what a private owner may pay for the whole business. The ‘Control’ situations and ‘Work-out’ positions provided the means to insulate the portfolio against market sell-offs.

In 1969 Buffett announced his retirement from the partnership and returned funds and proportional interests in Berkshire Hathaway to the investment partners. The partnership had delivered an astonishing annual compounded return of 31.6%pa between 1957 and 1968 versus +9.1%pa for the Dow.

onto Berkshire Hathaway…

Berkshire Hathaway then became Warren’s investment vehicle. Buffett met Munger in 1959 and they swapped investment ideas before Munger officially joined Berkshire as Chairman in 1968. While Buffett still engaged in activities such as merger arbitrage at Berkshire there was an increasing focus on ‘Controls’ and quality companies.

It was the acquisition of See’s Candy that helped both Munger and Buffett realise they had under-estimated the value of quality.

“If we’d stayed with the classic Graham, the way Ben Graham did it, we would never have had the record we have,” Munger said. “And that’s because Graham wasn’t trying to do what we did.”

At See’s Candy, Munger and Buffett worked out the value of pricing power. Munger convinced Buffett it was better to pay a higher price for a great business than a cheap price for an average or poor business.

At Berkshire, Munger and Buffett honed their investment skills. Peter Kaufman, in his excellent book ‘Poor Charlie’s Almanac’ notes “Charlie’s approach to investing is quite different from the more rudimentary systems used by most investors. Instead of making a superficial stand alone assessment of a company’s financial information, Charlie conducts a comprehensive analysis of both the internal workings of the investment candidate as well as the larger, integrated “ecosystem” in which it operates. He calls the tools he uses to conduct this review ‘Multiple Mental Models’. They borrow from and neatly stitch together the analytical tools, methods, and formulas from such traditional disciplines as history, psychology, physiology, mathematics, engineering, biology, physics, chemistry, statistics, economics and so on”.

Munger and Buffett sought businesses where a combination of factors could lead to extraordinary results or as Munger called them “The Lollapalooza Effect”.

The investment in Coke is a great example. Buffet paid c25X for the last piece of Coke he bought. But Buffett and Munger saw the enormous potential in the business. They started to focus more on a company’s moat to protect the businesses economics, a company’s ability to raises prices without hurting sales, the ability to re-invest incremental capital at very high rates of return, the huge operating leverage in the business, the large runway for global sales, the economies of scale from a massive distribution business and customer footprint [ie advertising] and the psychological factors that influence a company’s customers decision to purchase and how they can be strengthened and reinforced. They also focussed on the skill of management in deploying capital. This was the ultimate type of business.

As Berkshire grew, it’s range of investment opportunities like Coke became more limited. As Munger said at the AGM in 2016, they had to revert to Plan B.

More recently Berkshire has acquired far more capital intensive business like the railway business, Burlington Northern Santa Fe. While still a monopoly type of asset, the asset is far more capital intensive than a typical Buffett investment. Buffett has also invested in more mature businesses like Heinz with Brazillian investor 3G who has a reputation for streamlining businesses and getting them re-focussed on growth.

It’s no doubt Munger and Buffett would love to be able to outlay large licks of capital in attractive businesses like Coke was at the time of acquisition. Given their distaste for technology they have avoided the likes of Google, Ebay and Facebook. Outside of the technology angle these latter businesses would have ticked off a lot of the mental models that Munger loves .. winner takes all, network effects, strong and growing moat, high return on incremental capital and economies of scale.

The greatest investing duo of the last century have evolved through the decades. They still focus on value yet their analysis of that value has improved significantly. They have evolved to better capture the power of compounding.

For further reading I highly recommend reading Buffett’s Partnership letters, The Berkshire Hathaway annual letters and Poor Charlie’s Almanac. The recent lecture at UCA by Mohnish Pabrai on Berkshire’s See’s Candy/Coke investment is also excellent.