Investing isn’t, and can’t be, about soothsaying market levels or about technical `timing’ of the markets. It also is not about finding that next new `wave’, `mega theme’ or `grand’ strategy; nor is it about dwelling on national or global economic macros.Investing remains a simple, rather dull and boring, uncluttered practice of bottom-up stock picking, with painstaking efforts and arduous discipline.

Investing isn’t, and can’t be, about soothsaying market levels or about technical `timing’ of the markets. It also is not about finding that next new `wave’, `mega theme’ or `grand’ strategy; nor is it about dwelling on national or global economic macros.Investing remains a simple, rather dull and boring, uncluttered practice of bottom-up stock picking, with painstaking efforts and arduous discipline.

The rest are popular sports, meant for amusement, occasional applause but not for adoption. If the investing skills were to degenerate to mere predicting of market levels and, hoisting the investing boat just at the right point of time such that rising tide lifts the boat, it would have been an embarrassing branch of knowledge. But fortunately , it is not.

Capital preservation and capital appreciation remain the pillars and cornerstone objectives of a good investing philosophy. While both are almost equally important, preservation precedes appreciation. That precedence has a telling effect on investing philosophy and strategy conceptualisation.

Continue Reading →

This is an oldie but goodie – Peter Lynch on how to pick stocks. By chance, we were also doing the Lynch book list and ran into some confusion if anyone knows please let us know

Here are the obvious three

The Davis Dynasty: Fifty Years of Successful Investing on Wall Street says its by John; Peters S. Lynch (foreword) Rothchild, I would assume the foreword for a book about Shelby Davis would be the investor Peter Lynch but we were unlear if he had a middle S initial (or if he did not, is that a typo? – obviously can read the book itself but hard to find some of these out of print books and we only have so much time and rsources) in the end we were not sure so would want to exclude it. We will have our list for better or worse soon. We also transcribed the following video – it is not verbatim and is for information purposes only

Enjoy

Continue Reading →

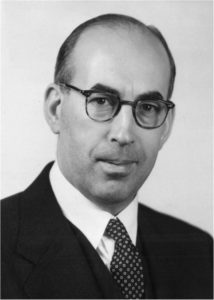

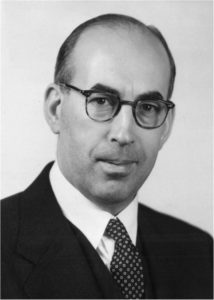

We recently came across Philip Fisher’s checklist for investing in stocks in Common Stocks and Uncommon Profits and Other Writings and thought it was worth reproducing here. Fisher was one of the most famous investors in his story. As his son, Kenneth (renowned as an investor in his right) wrote in his obituary: “Among the pioneer, formative thinkers in the growth stock school of investing, [Philip] may have been the last professional witnessing the 1929 crash to go on to become a big name. His career spanned 74 years, but was more diverse than growth stock picking. For decades, big names in investing claimed Dad as a mentor, role model and inspiration.”

15 Points to Look for in a Common Stock

Continue Reading →

Investing isn’t, and can’t be, about soothsaying market levels or about technical `timing’ of the markets. It also is not about finding that next new `wave’, `mega theme’ or `grand’ strategy; nor is it about dwelling on national or global economic macros.Investing remains a simple, rather dull and boring, uncluttered practice of bottom-up stock picking, with painstaking efforts and arduous discipline.

Investing isn’t, and can’t be, about soothsaying market levels or about technical `timing’ of the markets. It also is not about finding that next new `wave’, `mega theme’ or `grand’ strategy; nor is it about dwelling on national or global economic macros.Investing remains a simple, rather dull and boring, uncluttered practice of bottom-up stock picking, with painstaking efforts and arduous discipline.