Reblog: A Real Life Example of the Philip Fisher Scuttlebutt Approach

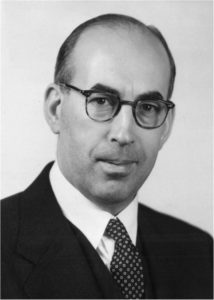

One of the greatest investors of all time, a man named Philip Fisher, developed a famous approach to investing research known as the “scuttlebutt”. He said that there was a lot of knowledge about a company that could give insight into its investment merits if the investor could merely find it out and synthesize it into a somewhat accurate and cohesive view of an entire corporation. Peter Lynch, arguably the greatest mutual fund manager in history, engaged in this when he was jumping on beds at La Quinta and driving around town checking out a new food chain known as Dunkin’ Donuts.

My husband and I drove quite a distance to check out some companies that had finally hit our “severely undervalued” targets after years and years of watching the stocks. One of the firms happened to be a confectioner. We spent the day speaking with a small business owner who had extensive experience with this particular company and bought more than $500 worth of products to take back to our office, have analyzed, and compare to the other manufacturers in the industry. We learned a great deal about the business that is common knowledge to those who work in the sector but you can’t necessarily glean from the regulatory filings such as the 10-Kand annual report.

For instance, there appears to be a struggle at headquarters between two factions: Those who want to dilute this particular brand and sell it through mass distributions outlets and those who want to keep it a premium product sold through a chain of heavily-controlled storefronts.