Bulls return to D-St after 6 days; Sensex up 642 points, Nifty tad below 14750

Images on investors’ trading screens turned around 180 degrees by the end of the session on Friday as bulls fought back to lift indices over a per cent higher. A drop in the US Treasury yield and a GDP growth upgrade by Moody’s for India helped the markets snap 5-day losing streak.

Tracking sluggishness in the global markets, the domestic equity markets opened in a sea of red with the frontline indices dropping over a per cent. The dip was, however, quickly bought-into, pushing markets in the positive territory in less than 120 minutes into the trade.

Mood in the global markets changed after the US Treasury yields slipped to 1.5 per cent from Thursday’s high of 1.74 pe cent. Back home, Moody’s Analytics said India’s economy is likely to grow by 12 per cent in CY2021 following a 7.1 per cent contraction last year as near-term prospects have turned more favourable.

Consequently, bulls reigned on Dalal Street for the first time in six days riding on the back of FMCG and metal counters. Both, the Nifty FMCG and Metal indices, ended over 2 per cent higher each, followed by gains in the Nifty Pharma and PSU Bank indices, up over 1 per cent. Other indices settled with less than a per cent gains, while the Nifty Realty index ended in the red, down 0.7 per cent.

Among the key headline indices, the 50-share barometer on the NSE closed above the 14,700-mark at 14,744 levels, up 186 points or 1.28 per cent. The 30-share benchmark Sensex, on the other hand, advanced 642 points, or 1.3 per cent, to end at 49,858 levels. In the intra-day deals, the Sensex and the Nifty touched 50,003 and 14,788, respectively jumping 1,416 and 350 points from day’s low.

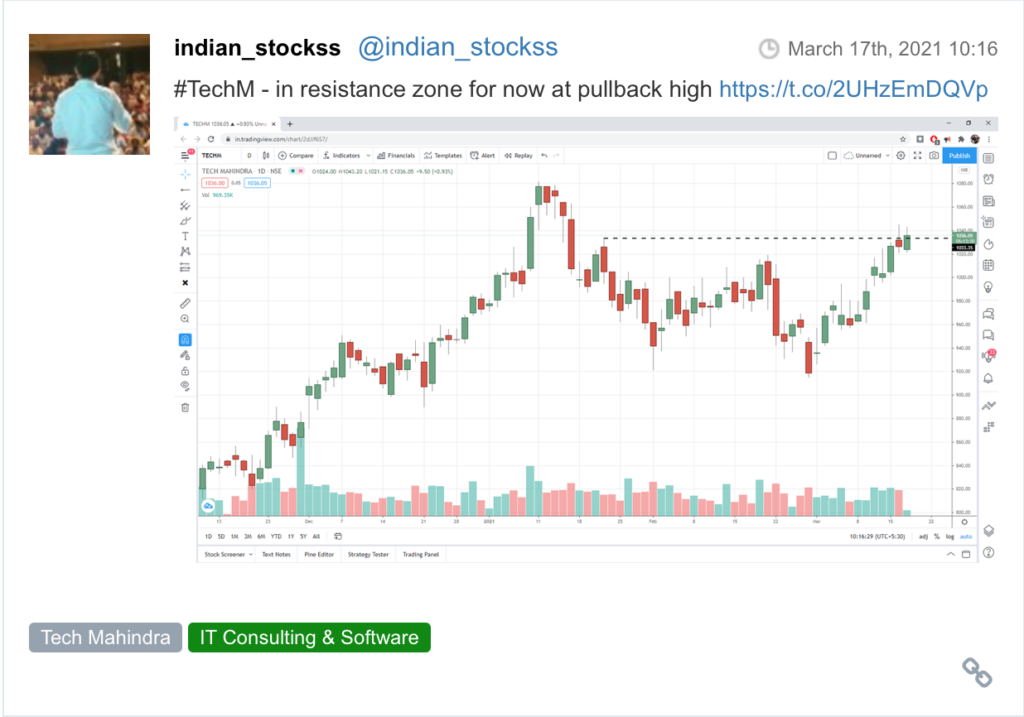

Individually, HUL, Power Grid, JSW Steel, Tata Steel, NTPC, UPL, Reliance Industries, Divis Labs, Gail, and UltraTech Cement were the top gainers on the Nifty, while L&T, Coal India, Tech M, Bajaj Auto, Titan, and ONGC ended as the top laggards.

In the broader markets, the S&P BSE MidCap and SmallCap indices closed 1.35 per cent and 0.4 per cent higher, respectively.

Shares of Aarti Drugs advanced 15% as the board approved buyback at Rs 1,000 per share. The stock of the pharmaceutical company bounced back 17 per cent from the day’s low of Rs 670. At 03:00 pm; it was trading 10.5 per cent higher at Rs 755, as compared to a 1.4 per cent rise in the S&P BSE Sensex. Trading volumes on the counter jumped an 10-fold with a combined 6.9 million equity shares changing hands on the NSE and BSE.

Shares of Godrej Properties (GPL) slipped 5 per cent to hit a seven-week low of Rs 1,273 on the BSE in Friday’s intra-day trade, extending its decline to 17 per cent thus far in the month of March. The stock of Mumbai-based real estate developer was quoting lower for the sixth straight trading day. It has corrected 19 per cent from its 52-week high level of Rs 1,573 touched on March 1 and was currently trading at its lowest level since February 1.

Shares of recently-listed household appliances company Stove Kraft were trading lower for the 10th straight day, down 6 per cent at Rs 407 on the BSE in intra-day trade on Friday on the back of heavy volumes. With today’s decline, the stock has slipped 26 per cent from its high of Rs 547 touched on March 3. It had hit a low of Rs 406.95 on February 8. Currently, the stock was trading 6 per cent higher over its initial public offer (IPO) issue price of Rs 385 per share.

Shares of Indo Count Industries advanced 12 per cent to Rs 128 on the BSE on Friday after the textile company announced expansion and modernisation projects of existing capacities with capital expenditure (capex) of Rs 200 crore. The total capex will be funded by a mix of internal accruals and debt and is expected to be operational in H2 (October-March) of FY2022.

Future group stocks slip as Delhi High Court puts RIL deal on hold. Future Retail (Rs 55.85), Future Lifestyle Fashions (Rs 64.85), Future Enterprises (Rs 8.60), and Future Consumer (Rs 6.42) were locked in 10 per cent lower circuit, while Future Supply Chain Solutions (Rs 79.80) and Future Market Networks (Rs 15.05) were frozen in 5 per cent lower circuit on the BSE. In comparison, the S&P BSE Sensex was down 0.26 per cent at 49,088 points, at 10:31 am. The stock of Future Retail hit a record low, falling below its previous low of Rs 60.80, touched on Thursday, March 18.

Shares of Easy Trip Planners made a decent debut at the bourses, getting listed at Rs 212.25, commanding a premium of 13.5 per cent against the issue price of Rs 187 per share on the National Stock Exchange (NSE) on Friday. On the BSE, the stock opened at Rs 206, up 10 per cent against its issue price. Post listing, the stock slipped 20 per cent from its intra-day high of Rs 233 and touched the issue price level on the BSE.

Shares of ICRA, on Friday, rallied 9 per cent intra-day to Rs 3,036.50 on the National Stock Exchange (NSE) after PPFAS Asset Management bought more than two per cent stake in the rating agency company via open market. The stock is trading close to its 52-week high level of Rs 3,137.90, touched on January 12, 2021.

Shares of Indian Energy Exchange (IEX) rose 3 per cent to hit a new high of Rs 366.40 on the BSE in intra-day trade on Friday in an otherwise weak market. The stock of electric utility company was trading higher for the seventh straight day, up 22 per cent during the period, after the company entered into a strategic partnership with the National Stock Exchange (NSE) and Oil and Natural Gas Corporation (ONGC) to build gas markets.

Here are some picks from the week gone by.