Rising bond yields, Covid-19 cases spoil D-St party; Sensex slides 487 points

An across-the-board sell-off dragged the benchmark indices around a per cent lower on Friday as sombre global mood hit markets during the second-half of the trading session. US 10-year Treasury yields rose again on Friday, back above 1.6 per cent, and were on track to rise for the seventh straight week. Add to it, the dollar index rose 0.4 per cent denting sentiment further.

Against this backdrop, gains in Asian stock markets proved tough to match for most of European peers, after they hit a 1-year high in the prior session. Nasdaq Futures, which tumbled over 1.5 per cent, or 200 points, also suggested a lower start for Wall Street later in the day.

Japan’s Nikkei added 1.7 per cent – but this faded out as Europe opened for business. Britain’s FTSE 100 and the STOXX Europe 600 slipped around 0.5 per cent each, weighing on the MSCI World Index, which was down 0.1 per cent.

Back home, the equity indices snapped their three-day winning streak and settled 0.9 per cent lower. The frontline S&P BSE Sensex dropped 487 points, or 0.95 per cent, to end the day at 50,792 levels. From the intra-day high of 51,822, the index plunged 1,284 points to hit an intra-day low of 50,538.

On the NSE, the Nifty index held the 15,000-mark to close at 15,031 levels, down 144 points, or 0.95 per cent. In the intra-day trade, the index hit a low of 14,954.

26 of the 30 constituents on the Sensex and 42 of the 50 constituents on the Nifty ended the day in the red. Hindalco, Bajaj Auto, HDFC Life, SBI Life, Maruti Suzuki, Adani Ports, IndusInd Bank, ICICI Bank, Hero MotoCorp, SBI, and Reliance Industries, all down between 2 per cent and 3 per cent, were the top laggards on the indices.

On the flipside, PowerGrid, Titan Company, Infosys, ONGC, Indian Oil Corp, BPCL, and JSW Steel remained the top gainers on the benchmark indices.

In the broader markets, the S&P BSE SmallCap index fended the fall and settled 0.14 per cent higher supported by gains in Apollo Pipes, Jindal Poly Firms, MTNL, BGR Energy Systems, Delta Corp, and Meghmani Organics.

The MidCap counterpart, however, fell 0.45 per cent.

Sectorally, all the NSE indices were painted red with the Nifty Auto and PSU Bank indices down around 2 per cent each. The Nifty Bank, Financial Services, FMCG, Metal, and Private Bank indices, on the other hand, slipped nearly 1 per cent.

Shares of Blue Dart Express hit a new high of Rs 5,526.25, up 3 per cent, on the BSE in intra-day trade on Friday after its parent company DHL group posted a record profit for the calendar year 2020 (CY20), primarily driven by the global e-commerce boom, which led to considerably higher shipment volumes in the parcel and express business. The company’s 2020 operating profit was at €4.8 billion, up 17.4 per cent on a year-on-year (YoY) basis.

Shares of India Glycols, on Friday, slipped 9 per cent to Rs 529; falling 13 per cent from day’s high, on the BSE in intra-day trade after its board approved the transfer of the company’s BioEO (speciality chemicals) business to IGL Green Chemicals Private Limited (IGCPL), a wholly owned subsidiary. BioEO accounted for 12.85 per cent of the total revenue and 26.20 per cent of the total net-worth of India Glycols, as on March 31, 2020.

Shares of Indian Energy Exchange (IEX), on Friday, advanced 13 per cent to hit a new high of Rs 347.80 on the BSE in intra-day trade after the company entered into strategic partnership with the National Stock Exchange (NSE) of India and Oil and Natural Gas Corporation (ONGC) to build gas markets. The stock surpassed its previous high of Rs 322.85, touched on February 11, 2021. In the past three months, it rallied 60 per cent, against 12 per cent rise in the S&P BSE Sensex.

Shares of Prestige Estates Projects jumped 4 per cent and hit an intra-day high of Rs 302.50 on the BSE on Friday after the company said it has completed phase I of its Rs 9,160-crore deal with Blackstone Group at Rs 7,467 crore. The stock of the real-estate company is trading close to its 52-week high level of Rs 314.95, touched on February 18, 2021.

Shares of Dixon Technologies hit a record high of Rs 20,564, up 2.4 per cent on the BSE in the intra-day trade on Friday, having gained 8 per cent in the past three trading days, after the company fixed March 19, 2021 as the record date for 1:5 stock split i.e. from Rs 10 to Rs 2. The stock of the consumer electronics company surpassed its previous high of Rs 20,440 on February 25, 2021.

Shares of IDBI Bank surged 17 per cent to Rs 44.80 on the BSE in intra-day trade on Friday after the Reserve Bank of India (RBI) removed the lender from the prompt corrective action (PCA) framework on improving finances and credit profile. This eases the rules for the lender to expand its business and also sets the stage for strategic divestment by the government which holds a 45.48 per cent stake in the firm.

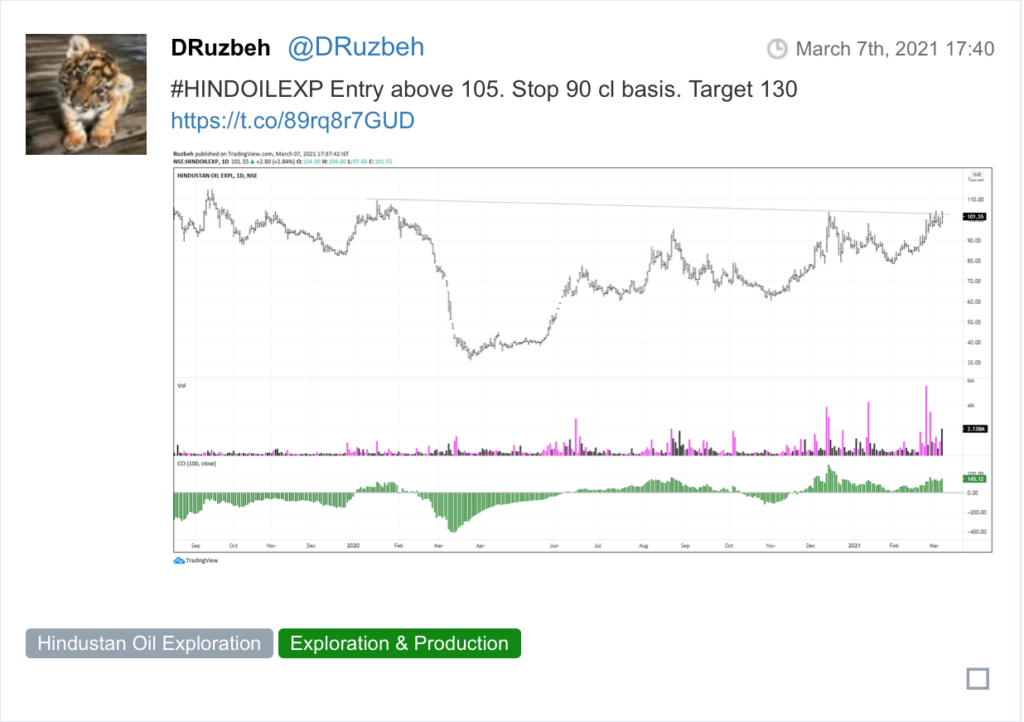

Here are some picks from the week gone by.