Bulls beat bears after 2 days; Sensex gains 568 points, Nifty tops 14,500

Breaking away from two-straight sessions of bear hammering, bulls were back in action on Dalal Street. Parked near day’s high, the benchmark indices ended Friday’s session with over one per cent gains amid healthy buying in metal, financial, and auto stocks.

The Nifty Metal index ended nearly 4 per cent higher, while the Nifty Financial Services, FMCG, and Auto indices ended with around 2 per cent gains. Realty, bank, pharma and IT indices, meanwhile, advanced up to 1.5 per cent.

Among the benchmark indices, the frontline S&P BSE Sensex closed with gains of 568 points, or 1.17 per cent, at 49,008 level. The broader Nifty, on the other hand, reclaimed the 14,500-mark on a closing basis and settled at 14,507 level, up 182.4 points or 1.27 per cent.

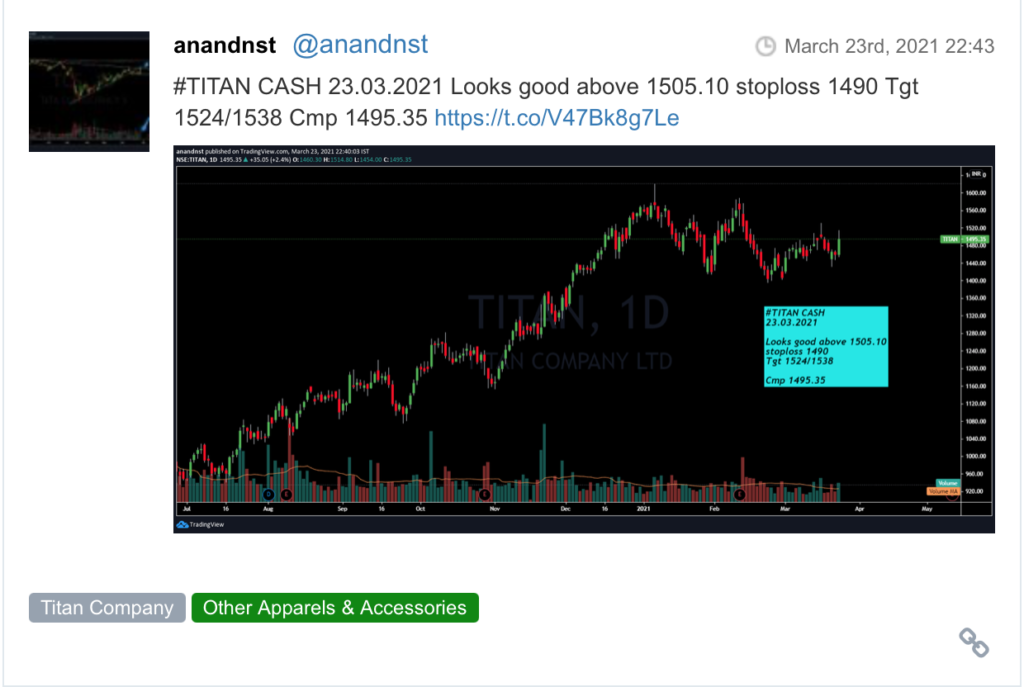

Bajaj Finserv, Asian Paints, HUL, Titan Company, Bajaj Auto, and HDFC were leading the list of gainers on the Sensex, up between 2.7 per cent and 4.4 per cent. Tata Steel, Tata Motors, Bharti Airtel, and Adani Ports were the additional gainers on the Nifty with up to 6 per cent returns today.

On the downside, PowerGrid, IndusInd Bank, ITC, Maruti Suzuki, UPL, and TCS declined the most on the benchmark indices, down up to 2 per cent.

Overall, the S&P BSE MidCap index ended 1.66 per cent higher, while the SmallCap counterpart closed with a per cent gain.

Shares of Welspun India (WIL) advanced 10 per cent to Rs 84.65 on the BSE in intra-day trade on Friday after rating agency India Ratings & Research, a Fitch Group firm, upgraded the long-term credit rating of the company from IND AA- to IND AA with a stable outlook. The stock of the textiles company was trading close to its 52-week high of Rs 87.60 touched on March 15.

Shares of Tata Group companies, on Friday, rallied up to 6 per cent in intra-day trade on the BSE after the Supreme Court pronounced its verdict in favour of the Tata Group in the high-profile Tata vs Mistry fued. The judgment on the five-year long protracted legal battle sets a precedent on various important matters in the courtroom battles.

Debuting at the bourses, shares of Kalyan Jewellers listed at at Rs 73.90, 15 per cent below its issue price of Rs 87 per share on the BSE today. The stock, however, reversed losses and hit a high of Rs 81 in the intra-day trade before closing at Rs 74.4.

Those of Suryoday Small Finance Bank listed at a 4 discount, at Rs 292 on the BSE, as against an issue price of Rs 305. The stock hit an intra-day low of Rs 271 but ended at Rs 272.

Recently listed Laxmi Organic, however, jumped 18 per cent to Rs 194 in intra-day trade after foreign portfolio investors bought over three million equity shares worth about Rs 50 crore of the company via the open market. On Thursday, Goldman Sachs India Fund Limited and Plutus Wealth Management LLP purchased a combined 3.17 million equity shares of Laxmi Organic Industries for Rs 49 crore. The FPIs purchased these shares at an average price of Rs 155.60 per share on the NSE.

Shares of Wabco India were locked in upper circuit of 20 per cent at Rs 6,777.60 on the BSE in Friday’s session after the promoter received a strong response for its offer-for-sale (OFS). The company informed the stock exchanges that it will exercise oversubscription option to the extent of 686,955 shares in addition to the base offer size.

Shares of Hathway Cable and Den Networks both slumped on news of stake sale by promoters, Reliance Jio via OFS. The OFS opens for non-retail investors today and for retail investors on March 30.

Here are some picks from the week gone by.