Sensex ends 255 points higher; financial, metal stocks advance

The domestic stock market regained some lost ground on Friday, a day after benchmark indices tumbled around 2.5 per cent. The S&P BSE Sensex ended 255 points, or 0.64 per cent higher at 39,983 levels, thanks to healthy buying in the financial counters. NSE’s Nifty ended at 11,762 levels, up 82 points, or 0.7 per cent. India VIX declined nearly 2 per cent to 21.64 levels.

In the broader market, the S&P BSE MidCap index gained 1 per cent to 14,621 points while the S&P BSE SmallCap index settled nearly 1 per cent higher at 14,787 levels.

Shares of IDBI Bank surged 18% on government stake sale plan report. The government currently owns a 47.11 per cent stake in IDBI Bank. In January 2019, Life Insurance Corporation (LIC) completed the acquisition of 51 per cent controlling stake in the lender. The state-owned life insurer infused Rs. 21,624 crore into the bank.

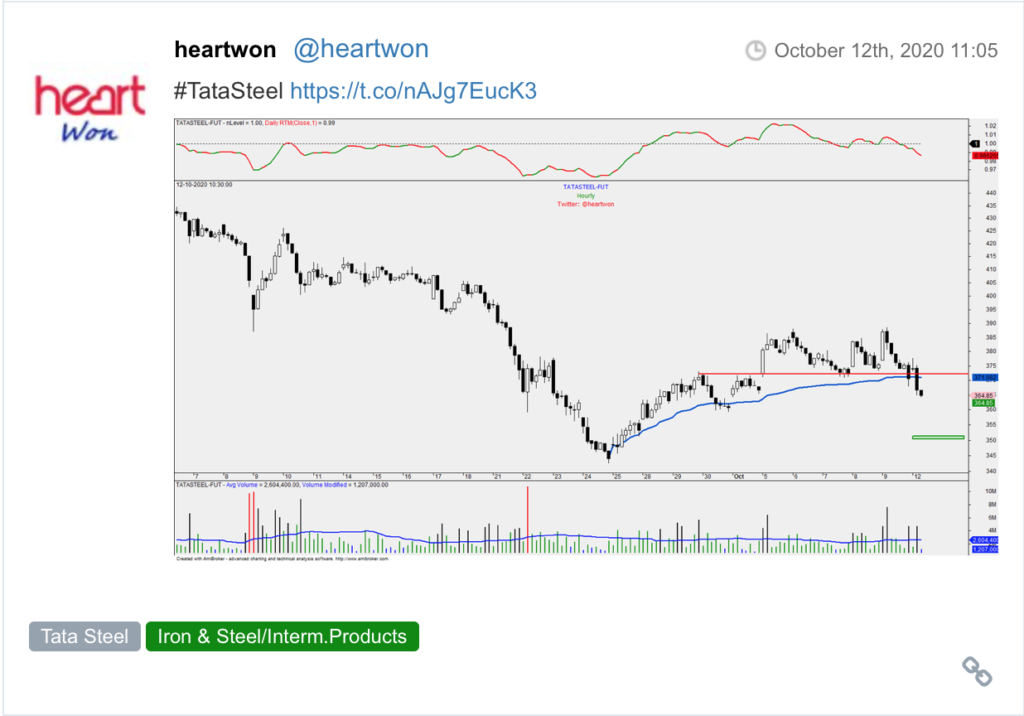

Shares of steel companies were in demand on Friday, rallying by up to 6 per cent on the BSE on the expectation of demand recovery. JSW Steel advanced 6 per cent to Rs 308, hitting a fresh 52-week high on the BSE. The stock surpassed its previous high of Rs 298 touched on October 9, 2020. Tata Steel, Jindal Steel and Power and Steel Authority of India (SAIL), on the other hand, were up 3 per cent to 6 per cent on the BSE.

Shares of Cyient were up 5 per cent to Rs 383 on the BSE on Friday after the company reported 586 basis points (bps) expansion in consolidated EBIT (earnings before interest tax) margin at 11.0 per cent in September quarter (Q2FY21) on a sequential basis. The improvement in margins was led by higher utilisation, lower subcontracting cost, and lower restructuring cost. Consolidated revenue grew 1.3 per cent quarter-on-quarter (QoQ) in constant currency terms.

Shares of consumer electronics companies rallied up to 15 per cent intra-day at the bourses on Friday after the government banned the import of air conditioners with refrigerants. Amber Enterprises India surged 15 per cent to hit a 52-week high of Rs 2,300 on the BSE. At 10:38 am, the stock was trading 5 per cent higher at Rs 2,102, as compared to 0.44 per cent rise in the S&P BSE Sensex.

Shares of Mindtree slumped as much as 11.43 per cent to Rs 1,264.25 apiece on the BSE on Friday as the company missed analysts’ estimates on the revenue front. Further, softening trends in top clients, too, weighed on the investor sentiment. At 10:42 AM, the stock of the company was trading nearly 8 per cent lower at Rs 1315.15 on the BSE against Thursday’s close of Rs 1427.55.

Shares of HCL Technologies on Friday slipped 4 per cent to Rs 821 on the BSE as investors booked profit after the company reported better-than-expected earnings for the quarter ended September 2020 (Q2FY21). The stock has fallen 8 per cent in the past two trading days and corrected 10 per cent from its record high level of Rs 911, touched on October 14, 2020.

Shares of UPL slipped 9 per cent to Rs 458.85 on the BSE in the early morning trade on Friday after KPMG resigned as the auditor with effect from October 8 for the company’s material arm in Mauritius – UPL Corporation, in order to re-organise the Audit Process to improve productivity, at the request of the company. “This is to inform you that the company has received the attached communication dated October 14, 2020 from UPL Corporation Limited, Mauritius, a material subsidiary of the Company,” UPL said in an exchange filing on Thursday after market hours.

Here are some picks from the week gone by.