RBI liquidity measures cheer markets; Sensex up 327 points, Nifty tops 11,900

Continuing their gaining streak for the seventh session in a row, the benchmark indices ended nearly a per cent higher on Friday after the monetary policy committee (MPC) of the RBI left the repo rate unchanged at 4 per cent but announced a slew of liquidity measures to support the economy.

Further, RBI Governor Shaktikanta Das said the stance of the policy would remain “accommodative,” for “as long as necessary – at least during the current financial year and into the next year – to revive growth. READ MORE

The S&P BSE Sensex today ended 327 points, or 0.81 per cent higher at 40,509 levels while the Nifty50 index settled above the 11,900-mark at 11,914, up 80 points, or 0.67 per cent. On a weekly basis, Sensex rallied 4.6 per cent and Nifty gained 4.3 per cent.

ICICI Bank and Axis Bank (both up 3.64 per cent) were the top Sensex gainers, followed by SBI, and HDFC Bank (both up 3.5 per cent).

The Nifty sectoral indices were mixed. While Nifty Bank gained nearly 3 per cent to 23,847 levels, Nifty Pharma ended as the biggest loser – down over 1.3 per cent.

In the broader market, the S&P BSE MidCap index slipped 0.42 per cent while the S&P BSE SmallCap ended 0.29 per cent lower at 14,966 levels.

Shares of Majesco hit a fresh record high of Rs 889, up 5 per cent on the BSE in intra-day trade on Friday. The shares were trading above the proposed buyback price of Rs 845 per share. The stock surpassed its previous high of Rs 884.85, touched on Wednesday, October 7. At 02:34 pm, the stock was trading 4 per cent higher at Rs 880, against a 0.75 per cent rise in the S&P BSE Sensex.

Shares of Larsen & Toubro were up 4% after sinking 11% in 7 weeks. Analysts at Jefferies said an early recovery in macro investment cycle should see a sharp pick-up in the company’s order flow and valuations. The Middle East (ME) margin contraction factored-in does not come through in case of better margin order flow.

Shares of InterGlobe Aviation (IndiGo) moved higher by 5 per cent, hitting an over seven-month high of Rs 1,393 on the BSE in intra-day trade on Friday. The stock of the airline company was trading at its highest level since February 26, 2020. In the medium-to-long term, once the Covid-related crisis is over, the demand outlook for aviation remains very strong in India, largely driven by under-penetration, rise in the working population, and expansion of the middle class, the company said in its annual report.

Shares of Lakshmi Vilas Bank (LVB) surged 16 per cent to Rs 20.60 on the BSE on Friday after the private sector lender said that it had received an indicative non-binding offer from the Clix Group. The offer suggests the private equity firm comprising Clix Capital Services Private Limited, Clix Finance India Private Limited and Clix Housing Finance Private Limited would be amalgamated with LVB.

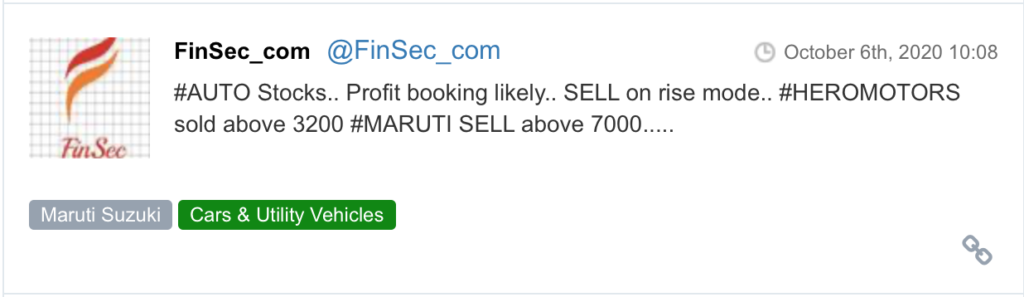

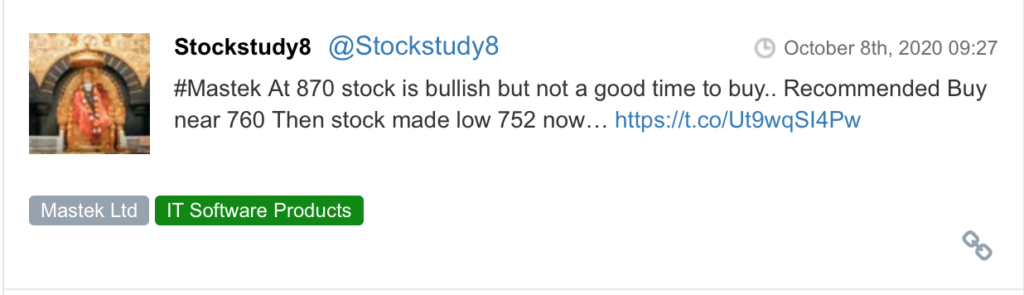

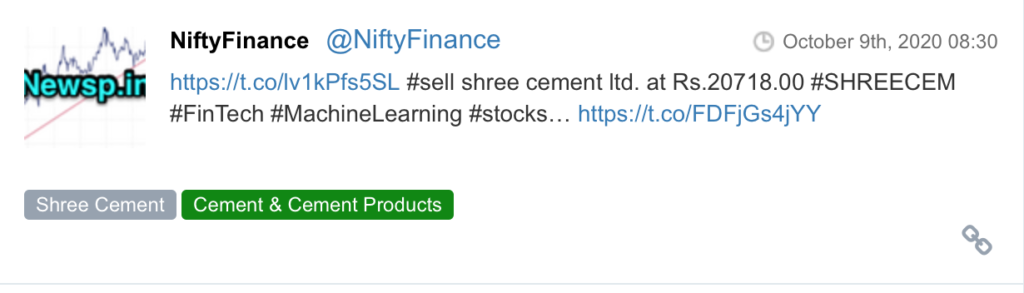

Here are some picks from the week gone by.