Sensex gains 307 points as financials, metals rally; Nifty PSU Bank jumps 7%

After a one day blip, equity market once again edged higher on Friday, led by buying in financial, metal and auto stocks. PSU bank stocks advanced the most in trade after state-owned lender, State Bank of India, posted a net profit of Rs 3,581 crore for the March quarter of FY20 (Q4FY20). The profit grew 326.93 per cent from Rs 838 crore clocked in the year-ago quarter (Q4FY19). Sequentially, the profit declined by 35.85 per cent.

The S&P BSE Sensex gained 307 points or 0.9 per cent to settle at 34,287.24 while NSE’s Nifty ended at 10,142.15, up 113 points or 1.13 per cent. Volatility index, India VIX, slipped dropped nearly 4 per cent to 28.51 levels.

On a weekly basis, Sensex rallied 5.7 per cent and Nifty added 5.86 per cent.

On the sectoral front, the Nifty PSU Bank index gained around 7 per cent to 1,386.75 levels with all the 13 constituents advancing. Nifty Metal index rallied nearly 4 per cent to 2,049.70 levels. On the other hand, Nifty FMCG was the only index that ended in the red. The index settled 0.27 per cent lower at 29,542 levels.

In the broader market, both the mid and smallcap indices outperformed the benchmarks. The S&P BSE MidCap index climbed 1.8 per cent to 12,554.16 while the S&P BSE SmallCap index surged 2.51 per cent to 11,855 levels.

Shares of public sector banks (PSBs) rallied up to 10 per cent on Friday on the National Stock Exchange (NSE) after the State Bank of India (SBI) reported improvement in assets quality on year-on-year (YoY) as well as sequential basis. SBI, Jammu & Kashmir Bank, Punjab National Bank (PNB), Bank of Baroda, Canara Bank and Indian Bank among the PSBs were up in the range of 7 per cent to 10 per cent on the NSE.

State Bank of India (SBI) on Friday reported a standalone net profit of Rs 3,581 crore in the March quarter of FY20 (Q4FY20). The profit grew 326.93 per cent from Rs 838 crore clocked in the year-ago quarter (Q4FY19). Sequentially, the profit declined 35.85 per cent. The profit was supported by a one-time gain of Rs 2,731.34 crore from the stake sale in SBI Cards done during the quarter.

IDBI Bank was locked in the upper circuit for the fifth straight day and has zoomed 89 per cent in the current week as the bank turned profitable in March quarter after 13 straight quarters of loss. The lender posted a profit of Rs 135 crore for the March quarter (Q4FY20) on account of recoveries from bad loans. It had posted a net loss of Rs 4,918 crore in the corresponding period of last year.

Dalmia Bharat Sugar and Industries, Dhampur Sugar Mills and Balrampur Chini Mills surged between 15 per cent and 20 per cent in the intra-day trade, while Avadh Sugar & Energy and Dwarikesh Sugar Industries were locked in the upper circuit of 10 per cent on the BSE. With malls and restaurants being allowed to re-open from June 8, sugar demand is expected to rise. Therefore, along with the summer demand, it is expected that mills may be able to sell the entire June quota, said a Business Standard report.

Shares of Reliance Industries (RIL) hit a new high of Rs 1,618, up 2.4 per cent on the BSE on Friday after the company said that Abu Dhabi state fund Mubadala Investment Co will buy a 1.85 per cent stake in its digital unit, Jio Platforms, for Rs 9,093.6 crore. The stock surpassed its previous high of Rs 1,603 touched on December 20, 2019.

Realty major DLF on Thursday reported a consolidated net loss of Rs 1,857.76 crore in the fourth quarter of last fiscal year, mainly due to reversal of deferred tax assets (DTA) as it adopted a lower tax rate. It had posted a net profit of Rs 436.56 crore in the year-ago period, the company said in a regulatory filing.

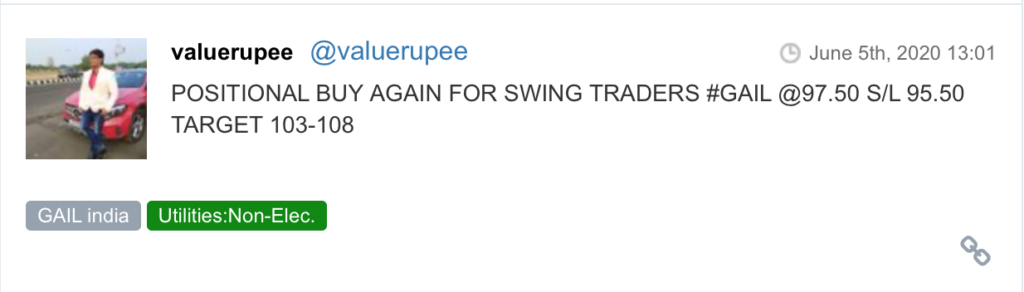

Here are some picks from the week gone by.