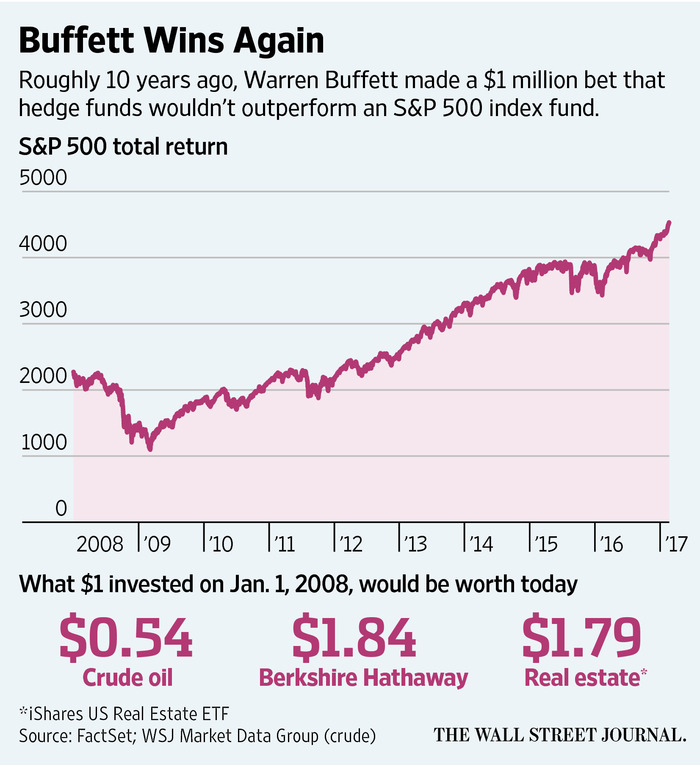

Reblog: Only a Market Crash Can Stop Warren Buffett From Winning This $1 Million Bet

It was a $1 million bet: Could hedge funds outperform index funds over a decade?

Warren Buffett said no in 2007. Now it looks like the billionaire investor was right.

His chosen index fund, the Vanguard 500 Index Fund Admiral Shares, climbed 66% from the start of the bet through the end of 2015, compared with a gain of 22% for a basket of hedge funds selected by asset manager Protégé Partners, including fees.

The $1 million bet with Protégé Partners ends Dec. 31. At this point, it would take a massive stock-market drop for Mr. Buffett to lose. An extended bull market and sub par performance by many hedge funds since the 2008 financial crisis have helped his case.

The proceeds will go to the winner’s chosen charity—Girls Inc. of Omaha, Neb., if Mr. Buffett wins or Absolute Return for Kids if Protégé Partners wins. The Long Now Foundation, a San Francisco nonprofit that encourages people to think longer term, is holding the stakes of the bet and will determine the winner.

The irony of the wager is that Mr. Buffett isn’t always a champion of passive investing. As Berkshire Hathaway Inc.’s chairman and chief executive, Mr. Buffett became one of the world’s richest people by investing in undervalued stocks and buying companies.

In fact, the stakes of Mr. Buffett’s current bet are likely to exceed $1 million because they are invested in Berkshire shares, which have climbed rapidly in recent months.

The rising value of the purse shows that Mr. Buffett’s faith in passive investing doesn’t trump confidence in his own investing abilities, said Mohnish Pabrai, managing partner of Pabrai Investment Funds and a follower of Mr. Buffett.

“If you ask Warren to place a bet between the S&P and Berkshire…he would pick Berkshire,” Mr. Pabrai said. “Otherwise, he would say they should dissolve Berkshire and put everything into the S&P.”

A former Protégé Partners executive named Ted Seides proposed the contest in 2007 following Mr. Buffett’s repeated criticism of hedge funds, which typically charge management fees and then keep a cut of any investment gains. So-called funds of funds usually charge an additional layer of management fees.

All of those fees, Mr. Buffett argued, were eating away at investors’ returns. Cheaper funds that cloned the market were a better choice, he said.

“I wholeheartedly agree with your contention that the aggregate returns to investors in hedge funds will get eaten alive by the high fees earned by managers,” Mr. Seides said in a letter to Mr. Buffett proposing the bet. A copy of the letter was included in a 2016 book Mr. Seides authored.

But “I am sufficiently comfortable that unusually well-managed hedge fund portfolios are superior to market indexes over time.”

Mr. Seides chose five funds of hedge funds that focused on equities and long-term value investing. Protégé Partners hasn’t named the funds chosen for its side of the wager, but Mr. Buffett said at Berkshire’s 2016 annual meeting that they represent “maybe 100 or 200 hedge funds.”

In a February 2015 essay, Mr. Seides blamed his side of the bet’s underperformance on “a number of cyclical headwinds,” including low interest rates.

Mr. Buffett, Mr. Seides and Protégé Partners all declined to comment.

When the bet launched, Protégé Partners told Fortune Magazine that it had an 85% chance of winning. Mr. Buffett gave himself a 60% chance. The ensuing decade was particularly unusual, encompassing the 2008 financial crisis, unprecedented activity from central banks around the world and negative interest rates in some countries.

Fortune, which reports the annual results of the bet, hadn’t released as of Wednesday how the two sides compared in 2016. But the S&P 500 rose 12% last year including dividends, while all hedge funds as a group rose 5.5%, according to researcher HFR Inc.

Mr. Buffett and Protégé Partners originally put about $320,000 each into bonds that would appreciate to $1 million over the course of their wager. But the bonds appreciated much faster than expected as interest rates fell so the two sides agreed to go for a bigger prize. In late 2012, they agreed to buy 11,200 shares of Berkshire B shares, which cost $89.70 at the end of 2012.

That bet within a bet—that Berkshire shares would rise between late 2012 and the end of 2017—has paid off.

Berkshire B shares have risen about 90% since the end of 2012 to $169.61 Wednesday, putting the value of those 11,200 shares at almost $1.9 million. During the same period, the S&P 500 is up 81%, including dividends.

Mr. Buffett’s annual letter to Berkshire shareholders, which will be released Saturday, will discuss his views on active and passive investing and fund fees, he has said in recent months.

When Mr. Buffett ran his investment partnerships in the 1960s, he charged no management fees and only took 25% of investment gains after the first 6%. Berkshire Vice Chairman Charles Munger praised that fee model earlier this month at the annual meeting of Daily Journal Corp., where Mr. Munger is chairman.

“I think it is fair and I wish it was more common,” he said of Mr. Buffett’s fee formula. “If it’s a bad stretch, why should you scrape money off the top?”

At Berkshire’s annual meeting last year, Mr. Munger pointed out that some money managers, including Mr. Buffett, do outperform the market. Mr. Buffett retorted: “There’s been far, far, far more money made by people in Wall Street through salesmanship abilities than through investment abilities.”

The original article appears in Wall Street Journal and is available here.

Follow us on Twitter, Facebook, Instagram, Pinterest, Google+