Some excerpts from my annual review to subscribers. Hope you will find it useful

Sources of outperformance

Superior performance versus the indices can usually be broken down into three buckets

- Informational edge – An investor can outperform the market by having access to superior information such ground level data, ongoing inputs from management etc.

- Analytical edge – This edge comes from having the same information, but analyzing it in a superior fashion via multiple mental models

- Behavioral edge – This edge comes from being rational and long term oriented.

I personally think our edge can come mainly from the behavioral and analytical factors. The Indian markets had some level of informational edge, but this edge is slowly reducing with wider availability of information and increasing levels of transparency.

Continue Reading →

Over the past few months I have received many requests for portfolio rebalancing. Since August, I have been of the view that this is not the best time to deploy fresh capital in the market.

Those already invested should try to rebalance their portfolios and so I have done in many client folios.

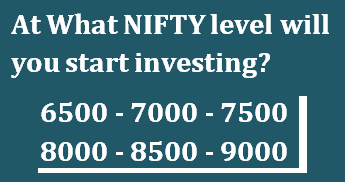

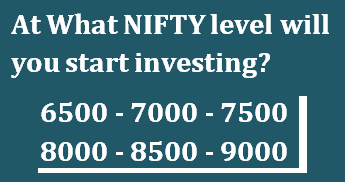

Common question: with NIFTY having fallen ~ 10% from its highs made earlier this year, is it time to start buying stocks? Here’s how valuations will look at different levels on the Nifty with current EPS base.

At what NIFTY level will you start investing?

To calculate current EPS, I will be taking current Nifty P/E (15 November, 2016) which is 21.00.

P/E = Price (Nifty level)

Earnings per Share (EPS)

Current EPS = 379

[1] Nifty at 7,000 levels

P/E = 7,000/379

=18.47

[2] Nifty at 7,500 levels

P/E = 7,500/379

=19.79

[3] Nifty at 8,000 levels

P/E = 8,000/379

=21.11

[4] Nifty at 8,500 levels

P/E = 8,500/379

=22.45

[5] Nifty at 9,000 levels

P/E = 9,000/379

=23.75

CURRENT NIFTY PE AS OF 15 NOVEMBER 2016 = 21.37

VIEW

Typically, in a bull market (which I believe we certainly are in right now); valuations tend to run ahead of the earnings. It would be difficult to buy these markets at valuations of sub 19 level anytime soon. Further, some of the buying and selling that happened over the past 2-3 days has no explanation.

There sure is some amount of panic and herd selling. This could go on for some time as investors sell their liquid investments to arrange cash in the short term. Certainly with this new reality (of demonetization) one thing every investor should do is to pay some attention to his portfolio and rebalance it in light of the new realities.

As for buying stocks, sure . . . . . the tide could turn anytime from these levels.

The original post is written by Rajat Sharma of Mastermind, Sana Securities and is available here.