Let me tell you the story of two investors, neither of whom knew each other, but whose paths crossed in an interesting way.

Grace Groner was orphaned at age 12. She never married. She never had kids. She never drove a car. She lived most of her life alone in a one-bedroom house and worked her whole career as a secretary. She was, by all accounts, a lovely lady. But she lived a humble and quiet life. That made the $7 million she left to charity after her death in 2010 at age 100 all the more confusing. People who knew her asked: Where did Grace get all that money?

But there was no secret. There was no inheritance. Grace took humble savings from a meagre salary and enjoyed eighty years of hands-off compounding in the stock market. That was it.

Weeks after Grace died, an unrelated investing story hit the news.

Richard Fuscone, former vice chairman of Merrill Lynch’s Latin America division, declared personal bankruptcy, fighting off foreclosure on two homes, one of which was nearly 20,000 square feet and had a $66,000 a month mortgage. Fuscone was the opposite of Grace Groner; educated at Harvard and University of Chicago, he became so successful in the investment industry that he retired in his 40s to “pursue personal and charitable interests.” But heavy borrowing and illiquid investments did him in. The same year Grace Goner left a veritable fortune to charity, Richard stood before a bankruptcy judge and declared: “I have been devastated by the financial crisis … The only source of liquidity is whatever my wife is able to sell in terms of personal furnishings.”

Continue Reading →

Because financial matters are rarely covered during high school, many people don’t understand the stock market or how to invest their money properly.

This means that they are more vulnerable to investment scams. With the growth of the internet, and the current frothy state of global markets, these investment scams are unfortunately all too common.

So here are a list of 20 common traps that all traders and investors need to be aware of:

1) Ponzi Schemes

Ponzi schemes involve a cycle of using new investors money to fund the returns of existing investors.

Continue Reading →

William J. O’Neil is one of the greatest stock traders of our time, achieving a return of 5000% over a 25 year period.

He uses a trading strategy called CANSLIM, which combines fundamental analysis, technical analysis, risk management and timing.

You can learn this exact trading strategy in his best selling book, How To Make Money In Stocks: A Winning System in Good Times and Bad.

His financial successes led him to:

Continue Reading →

All greed starts with an innocent idea: that you are right, deserve to be right, or are owed something for your efforts. It’s a reasonable feeling.

But economies have three superpowers: competition, adaptation, and social comparison.

Competition means life is hard. Business is hard. Investing is hard. Not everyone gets a prize, even if they think they’re right and deserving.

Adaptation means even those who get prizes get used to them quickly. So the bar of adequate rewards move perpetually higher.

Comparison means every prize is measured only relative to those earned by other people who appear to be trying as hard as you.

And economies crave productivity. Getting more for doing less. It’s a universal and relentless force.

The feeling that you deserve a prize, even when success is hard, content is fleeting, and rewards are measured relative to others, combined with an economy that constantly wants more prizes for doing less, is the early seed of greed. It fuels both the push for more (great) and the lack of satisfaction when you get more (potentially dangerous).

Once people get a taste of reward – especially an above-average one – delusion can creep in. Sometimes it’s luck misidentified as skill. Or an inflated sense of the value you produce. Or overconfidence in your ability to find another reward.

Continue Reading →

When it comes to bad ideas, finance certainly offers up an embarrassment of riches – CAPM, Efficient Market Hypothesis, Beta, VaR, portfolio insurance, tail risk hedging, smart beta, leverage, structured finance products, benchmarks, hedge funds, risk premia, and risk parity to name but a few. Whilst I have expressed my ire at these concepts and poured scorn upon many of these ideas over the years, they aren’t the topic of this paper.

Rather in this essay I want to explore the problems that surround the concept of shareholder value and its maximization. I’m aware that expressing skepticism over this topic is a little like criticizing motherhood and apple pie. I grew up in the U.K. watching a wonderful comedian named Kenny Everett. Amongst his many comic creations was a U.S. Army general whose solution to those who “didn’t like Apple Pie on Sundays, and didn’t love their mothers” was “to round them up, put them in a field, and bomb the bastards,” so it is with no small amount of trepidation that I embark on this critique.

Before you dismiss me as a raving “red under the bed,” you might be surprised to know that I am not alone in questioning the mantra of shareholder value maximization. Indeed the title of this essay is taken from a direct quotation from none other than that stalwart of the capitalist system, Jack Welch. In an interview in the Financial Times from March 2009, Welch said “Shareholder value is the dumbest idea in the world.”

James Montier: A Brief History of a Bad Idea

Before we turn to exploring the evidence that shareholder value maximization (SVM) has been an unmitigated failure and contributed to some very undesirable economic outcomes, let’s spend a few minutes tracing the intellectual heritage of this bad idea.

Continue Reading →

Jesse Stine is not the regular stock guru you see on the Internet selling services. Nope.

And he’s not a hedge fund manager trading other people’s money either. Nope. Jesse Stine is an independent stock trader, just like you and me, trading his own hard-earned money.

And Jesse Stine produced a mind-boggling (and fully audited) 14,972% returns in the markets, turning $46K into $6.8M… in 28 months.

Yes, you read it right.

On top of becoming a self-made millionaire through his trading, Jesse also realized another dream of his a couple of years, which completely changed my life forever.

He wrote the book “Insider Buy Superstocks: The Super Laws of How I Turned $46K into $6.8 Million (14,972%) in 28 Months” in which he not only shares his life story, but also the trading strategy he used, as well as many invaluable lessons he learned through his 16 years of experience (at the time the book was publish, in 2013) as an independent trader.

I’d like to now share with you 13 lessons I gathered from his book.

Continue Reading →

Jesse Stine is not the regular stock guru you see on the Internet selling services. Nope.

And he’s not a hedge fund manager trading other people’s money either. Nope. Jesse Stine is an independent stock trader, just like you and me, trading his own hard-earned money.

And Jesse Stine produced a mind-boggling (and fully audited) 14,972% returns in the markets, turning $46K into $6.8M… in 28 months.

Yes, you read it right.

On top of becoming a self-made millionaire through his trading, Jesse also realized another dream of his a couple of years, which completely changed my life forever.

He wrote the book “Insider Buy Superstocks: The Super Laws of How I Turned $46K into $6.8 Million (14,972%) in 28 Months” in which he not only shares his life story, but also the trading strategy he used, as well as many invaluable lessons he learned through his 16 years of experience (at the time the book was publish, in 2013) as an independent trader.

I’d like to now share with you 13 lessons I gathered from his book.

Continue Reading →

Back during my schooling years, I studied the same problem again and again so as not to make the same mistake come exam time.

Problem was, I was horrible at application.

If the exact question came out in the exam, I killed it.

But that rarely happened. The question was always worded differently and confused the heck out of me.

I screwed up similar questions time after time simply because I couldn’t adapt what I had studied to the current version of the question.

Isn’t the market like this?

You make investment mistakes and in order to make sure you get it right next time, you focus and tell yourself you won’t make the same mistake again.

But how often does the market offer the exact same situation?

Rarely.

Continue Reading →

Over the past ten years, I’ve participated in both the public and private markets, investing in over 50 late-stage private companies, early-stage startups, and pieces of real estate. This is how I’ve learned to evaluate investments.

Successful investing boils down to buying assets at a discount to intrinsic value. The greater the discount, the more likely the investment will perform. Benjamin Graham, the father of value investing, called this “margin of safety.” The concept is simple in theory and extremely challenging in practice, with the valuation process anything but straightforward.

Two highly-educated, emotionally stable, and reasonable people can view the same information and come to very different conclusions. People weight information differently based on their preferences, values, and experiences. Some are comfortable tolerating certain types of risk. Predictions differ and forecasts can be wildly divergent. Those differences create the market. As just one participant in the market, here’s how I evaluate a company’s intrinsic value.

I always start by understanding what I call owner earnings, which I define as:

Owner Earnings = Net Income + Non-Cash Expenses (Depreciation, Amortization, Depletion) + One-Time Charges – (Maintenance Capital Expenditures + Working Capital Needs)

Continue Reading →

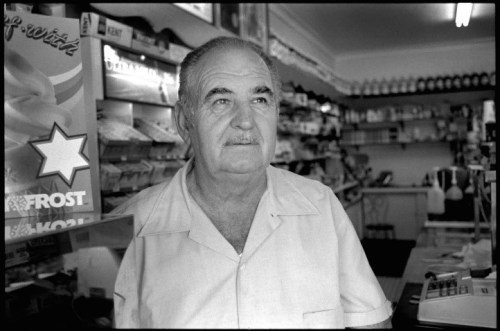

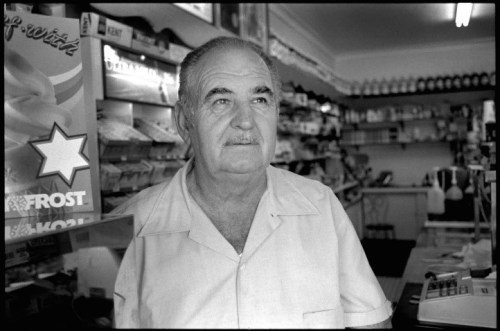

Growing up I would help out serving customers in my grandparent’s corner convenience store (Milk Bar) on weekday afternoons and weekends.

My late Grandfather in his convenience store, better known as Parris’ Milkbar.

There was only one cash register on top of the counter, which received cash from the customer’s purchase, and my grandmother would take out money, from the cash register, to buy new stock for the shelves, pay the utility bills, and pay me.

My grandparents would then have to choose, either to, invest in growth, pay down debt, or pay their own living expenses, out of the remaining amount of money left in the cash register.

Continue Reading →