Reblog: The Concepts Of Earnings Power And Intrinsic Value.

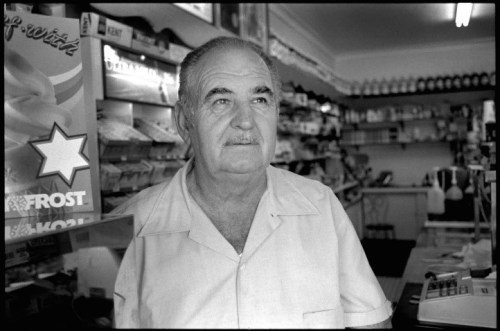

Growing up I would help out serving customers in my grandparent’s corner convenience store (Milk Bar) on weekday afternoons and weekends.

There was only one cash register on top of the counter, which received cash from the customer’s purchase, and my grandmother would take out money, from the cash register, to buy new stock for the shelves, pay the utility bills, and pay me.

My grandparents would then have to choose, either to, invest in growth, pay down debt, or pay their own living expenses, out of the remaining amount of money left in the cash register.