Sensex tanks 720 points from day’s high, ends 125 down; Nifty PSB drops 3%

In a volatile session on Dalal Street, the benchmark indices tumbled from record high levels to snap their three-day winning run amid losses in RIL, IT stocks and select banking counters. Despite a firm global market sentiment, the Indian indices settled in the red as profit taking ensued following a steep rally in the indices which saw them hitting significant landmarks.

After touching a record high of 59,737, the BSE barometer Sensex plunged 721 points from the high to end at 59,016, down 125 points. At the same time, its NSE counterpart Nifty50 settled the day 44 points down at 17,585. The 50-pack index had touched record peak of 17,793 in morning session. However, on the weekly basis, the benchmark indices gained, thus taking their winning run to the fourth straight week.

The fall was more pronounced in the broader markets. The BSE Midcap index sank 1.14 per cent and BSE Smallcap index 1.06 per cent, thus, underperforming benchmark Sensex. Overall, the advance-decline ratio on BSE stood at nearly 1:2, indicating that for every one share that rose, two declined.

Sectorally, PSU Bank index tanked the most among all sectors, reversing strong gains that were seen on Thursday amid expectations that FM Nirmala Sitharaman would announce National Asset Reconstruction Company Ltd (NARCL) that would acquire bad loans in an attempt to resolve them. While the announcement did come, investors preffered to take profits off the table, pushing the index 2.96 per cent lower.

It was closely trailed by Nifty Media & Realty that shed 2.38 per cent and 2.35 per cent, respectively. On the other hand, Nifty Media, Nifty Financial Services, Nifty Bank and Nifty Private Bank were the gainers. Nifty Auto setlled the day unchanged.

Shares of Surya Roshni edged higher by 11 per cent to Rs 731.20, also their new high on the BSE, in intra-day trade on Friday on the back of heavy volumes and amid a strong growth outlook. In the past seven trading days, the stock has zoomed 43 per cent, as compared to a 1.7 per cent rise in the S&P BSE Sensex.

Shares of CESC rallied 10 per cent to Rs 96.75 on the BSE in intra-day trade on Friday after the 1:10 stock split came into effect. The company’s board had fixed 17 September, 2021, as the record date for the stock split in the ratio of 1:10, i.e. a equity share with the face value of Rs 10 to be sub-divided into 10 equity shares with a face value of Re 1 each. The stock of electric utilities company surpassed its previous high of Rs 92.61 (adjusted to stock split) touched on 11 January, 2018.

Shares of aviation companies were in focus with InterGlobe Aviation, the parent firm of IndiGo airlines, recording a 52-week high at Rs 2,155. The stock has so far rallied 9 per cent on the BSE in intra-day trade on Friday, and in the process has surpassed its previous high of Rs 2,023.60 touched on 15 September, 2021. Shares of SpiceJet, India’s second-largest private airline, have also surged 8 per cent to Rs 81.95 amid heavy volume. The trading volume at the counter jumped over three-fold with a combined 15 million equity shares changing hands on the NSE and BSE. In comparison, the S&P BSE Sensex was up 0.95 per cent at 59,702 at 10:55 am.

Shares of Poonawalla Fincorp (formerly Magma Fincorp) were locked in the lower circuit for the second straight day, down 5 per cent at Rs 163.55 on the BSE on Friday, after resignation of Abhay Bhutada, managing director (MD) of the company. The stock of the non-banking finance company (NBFC) was down 10 per cent in the past two trading days. It had hit a 52-week high of Rs 199.65 on August 18, 2021.

Shares of Vodafone Idea continued their northward movement and were up 10 per cent at Rs 12.37 on the BSE in the intra-day trade on Friday. The stock has zoomed 39 per cent in the past two trading days after the government announced relief package for the telecom sector. On Wednesday, the Union Cabinet announced key telecom reforms, including moratorium of telecom dues both adjusted gross revenue (AGR) and Spectrum for 4 years, effective October 2021, which is a key cash flow relief measure for Vodafone Idea.

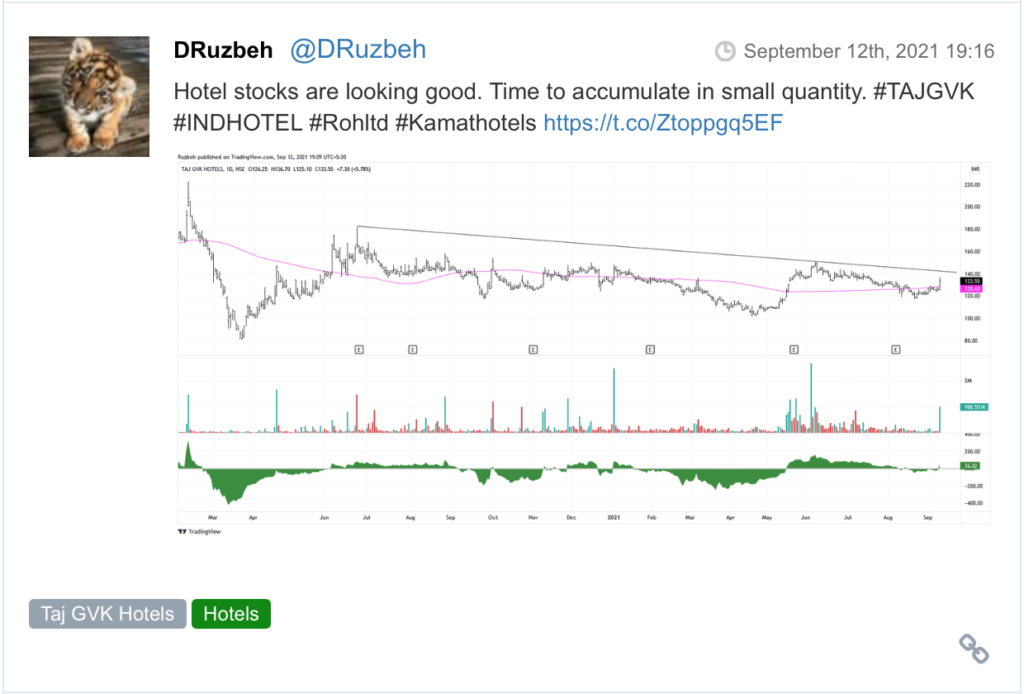

Here are some picks from the week gone by.