Sensex ends 174 points up, Nifty near 15,800; IT, pharma indices hit new peaks

Market bulls rode the global momentum on Dalal Street on Friday, hitting new lifetime highs on the way. Bond yields in the US and Euro zone fell, with German 10-year yields set for their biggest fall this year, as investors bet on ultra-lose monetary policy to stay in place.

Backed by firm global cues, the frontline S&P BSE Sensex hit an all-time-high of 52,641.5 while the broader Nifty50 index claimed 15,835.5-mark in morning deals. In the broader markets, the BSE MidCap and SmallCap indices, too, touched new peaks of 23,045 and 25,249 levels, respectively.

That said, a fag-end weakness in banking, realty, and FMCG counters dragged the markets off highs. By close, the BSE barometer was at 52,475 levels, up 174 points or 0.33 per cent while the 50-share Nifty index ended at 15,799 levels, up 62 points or 0.39 per cent.

The BSE MidCap index, on the other hand, closed 0.14 per cent up while the BSE SmallCap index ended 0.4 per cent higher.

Sectorally, the Nifty Metal index zoomed nearly 3 per cent on the NSE, followed by the Nifty IT and Pharma indices, up over 1 per cent higher each. On the downside, the Nifty Realty and PSU Bank indices slipped up to 1 per cent.

Shares of pharmaceutical companies continued their upward journey at the bourses, with the Nifty Pharma index hitting a new high for the third straight day on Friday, amid strong gain in Aurobindo Pharma, Dr Reddy’s Laboratories and Cadila Healthcare, which rallied up to 5 per cent, each, on the National Stock Exchange (NSE).

Shares of Gayatri Projects slipped 18 per cent to Rs 31 on the BSE in intra-day trade on Friday, amid heavy volumes, after the National Highways Authority of India (NHAI) declared the company a non-performer and prohibited from participating in the ongoing and future bids for the road projects till defects and deficiencies in one of the company’s projects were rectified.

Investors lapped up Bajaj Finance despite NPA warning as the stock went up 10% in 2 days. The stock had corrected 6 per cent in the four days prior to Thursday as it slipped from its previous high of Rs 6,009 on June 4, 2021, to Rs 5,674 on June 9, after the consumer financier voiced concerns over asset quality issues due to localised lockdowns following the second wave of Covid-19.

Shares of Tide Water Oil (India) locked in upper circuit of 5 per cent at Rs 11,458 on the BSE on Friday after the company announced 1:1 bonus issue, a dividend of Rs 200 per share, and stock split from Rs 5 to Rs 2. The stock had hit a record high of Rs 12,991, on June 7, 2021, after the company announced stock split and bonus issue plan on May 26. Despite the correction from all-time level, the stock has rallied 144 per cent in the past month, as compared to 7 per cent rise in the S&P BSE Sensex.

Shares of Coal India hit a 52-week high of Rs 164.45 as they rallied 5 per cent on the BSE in intra-day trade on Friday amid expectations of improvement in earnings going forward. The stock of the state-owned company surpassed its previous high of Rs 162.95, touched on February 26, 2021. In the past two weeks, the stock has outperformed the market by gaining 12 per cent as compared to a 2.2 per cent rise in the S&P BSE Sensex.

Shares of eClerx Services zoomed 20% and neared a record high on healthy Q4 results. In Q4FY21, the company’s profit after tax grew 39 per cent QoQ at Rs 98.8 crore. EBIT (earnings before interest and tax) margins improved 295 basis points (bps) to 27.6 per cent mainly led by lower sales & development expenses and higher gross margins. The company said the total delivery headcount as of March 31, 2021 stands at 11,831 – an increase of 40 per cent year on year.

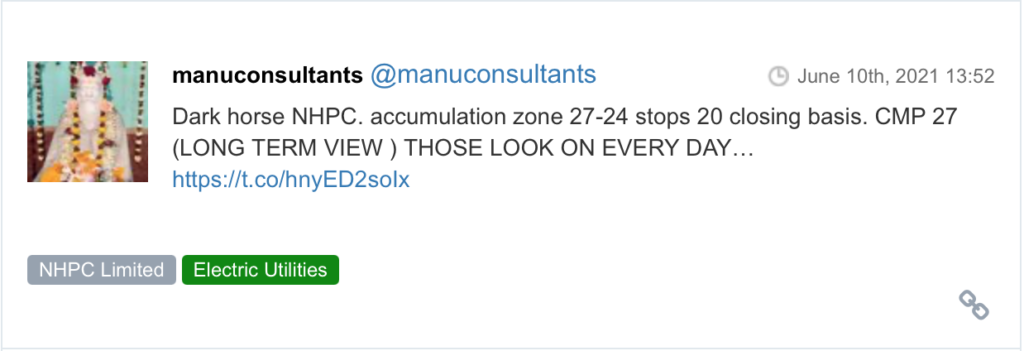

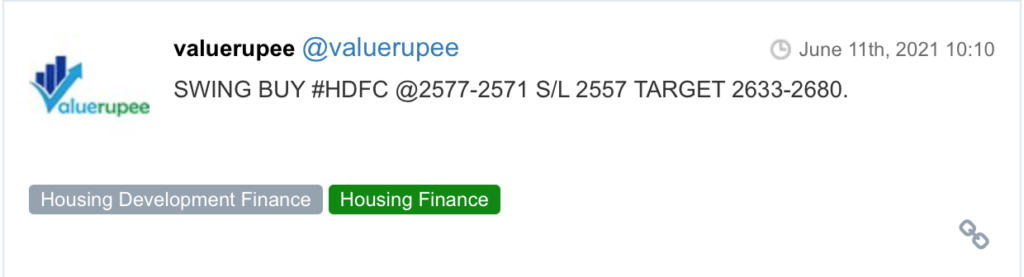

Here are some picks from the week gone by.