Nifty ends at new closing peak of 15,436; Sensex adds 308 points; RIL soars 6%

Bulls ruled on Dalal Street on Friday, the first day of the June F&O series, as a trinity of steady decline in Covid-19 cases, the announcement of unlock in the national capital, and $6 trillion fiscal stimulus in the US held up investor confidence.

The benchmark Nifty index scaled a fresh record peak of 15,469.6 on the National Stock Exchange (NSE) today, surpassing its previous record peak of 15,432 hit on February 16. The index traded higher for the sixth consecutive session as India recorded its lowest daily count of new Covid-19 cases in 44 days. The country, on Thursday, logged 186,364 fresh virus cases while death remained above 3,500-mark.

Add to it, Delhi Chief Minister Arvind Kejriwal announced earlier on Friday that the national capital will begin to unlock from Monday and said that construction activities and factories will be reopened from May 31.

Reading these developments as the first step towards a gradual uptick in economic activities, benchmark indices zoomed to day’s high of 51,529 on the S&P BSE Sensex and record peak on the Nifty. By the close, the Sensex index was quoting at 51,423 levels, up 308 points or 0.6 per cent while the Nifty50 was at 15,436-mark, up 98 points or 0.64 per cent.

Reliance Industries was the biggest contributor towards the indices’ rally today after the stock clocked its sharpest intra-day rally in two months and zoomed 6.4 per cent. The stock, which settled 5.8 per cent higher on the BSE, looks firm on both, fundamental and technical, grounds. Analysts at Jefferies maintained their ‘buy’ rating on the counter with a target of Rs 2,580 per share. READ MORE

That apart, Grasim, Adani Ports, M&M, Eicher Motors, Coal India, HDFC, Kotak Bank, and IndusInd Bank remained the top gainers of the day, up between 1 per cent and 3 per cent. On the downside, Sun Pharma, ICICI Bank, Bajaj Finserv, NTPC, PowerGrid, Shree Cement, and Nestle India were the top laggards, down up to 4.5 per cent.

Broader markets, however, settled the day in the red on the back of profit-booking. The BSE Midcap index fell 0.12 per cent and the BSE SmallCap index dropped 0.48 per cent.

In terms of sectoral participation, the Nifty PSU Bank index gained 0.7 per cent, followed by the Nifty Private Bank index, up 0.3 per cent. On the contrary, the Nifty Pharma index slipped 1.2 per cent on the NSE.

Mahindra & Mahindra, on Friday, reported a consolidated profit of Rs 163 crore for the March quarter of 2020-21 (Q4FY21), which was impacted by one-time loss of Rs 840 crore. In comparison, M&M had reported a loss of Rs 3,255 crore in the year-ago quarter. The company has also announced highest-ever dividend of Rs 8.75 per share for FY21, to commemorate the 75th year of the company.

Shares of Metropolis Healthcare rallied 14 per cent to Rs 2,613 on the BSE in intra-day trade on Friday after the company reported nearly four-fold jump in consolidated net profit at Rs 61.3 crore in the March quarter (Q4FY21), on the back of healthy operational performance. The company, a leading diagnostic service provider, had profit of Rs 15.5 crore in the year-ago quarter. The stock surpassed its previous high of Rs 2,605, touched on May 12, 2021.

Shares of Lux Industries hit a new high of Rs 3,323, soaring 19 per cent on the BSE in intra-day trade on Friday. With today’s rally, the stock one of India’s largest hosiery producers and exporters has zoomed 63 per cent in five sessions on the back of robust results for the March quarter (Q4FY21). In comparison, the S&P BSE Sensex was up 1.6 per cent during the period.

Shares of Reliance Industries (RIL) were trading higher for the third straight day, and recorded their sharpest intra-day gain of 5 per cent in nearly two months. The stock traded at Rs 2,072.95 on the BSE in intra-day deals on Friday on heavy volumes. Earlier, on March 3, 2021, RIL had rallied 5.4 per cent in intra-day trade and settled 4.5 per cent higher at Rs 2,201.35.

Shares of Hester Biosciences rallied 14 per cent to Rs 3,099 on the BSE in the intra-day trade on Friday, surging 22 per cent in two days, after the company said it is part of a MoU between vaccine maker Bharat Biotech and Gujarat Covid Vaccine Consortium (GCVC) for contract manufacturing the drug substance for Covaxin. The company said a memorandum of understanding (MoU) has been signed between Bharat Biotech (BB) International Limited and Gujarat Covid Vaccine Consortium (GCVC) towards contract manufacturing for the drug substance for COVAXIN, of which Hester is a part.

Sun Pharma dips 3% on profit booking post March quarter results. The company said it is evaluating developing a new pipeline of biosimilars as its R&D focus. It has also requested for an inspection of the Halol site in Gujarat. When compared to Rs 636 crore net profit in Q4 of FY19, the rise is around 40 per cent. The year 2019-20 was partially hit by the Covid-19 pandemic, thanks to a national lockdown beginning March. This impacted sales.

Suryoday Small Finance Bank (SFB) on Thursday reported an 89 per cent decline in its net profit to nearly Rs 12 crore for the financial year ended March 2021. The bank, which was listed on the bourses in late-March 2021, had reported a net profit of Rs 110.94 crore in the previous year, the bank said in a regulatory filing.

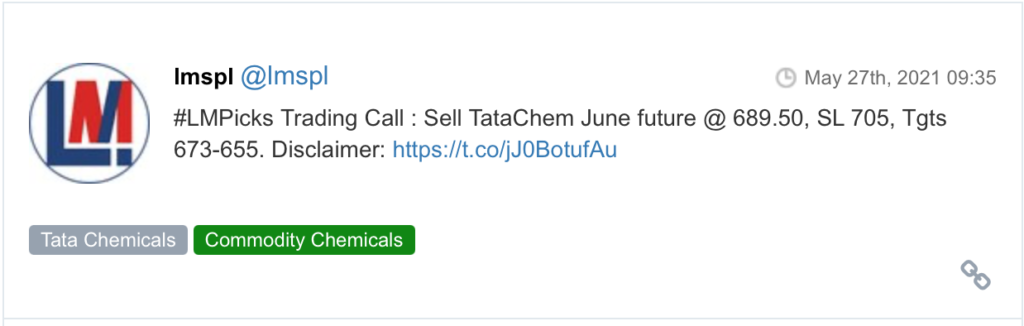

Here are some picks from the week gone by.