Banks lift indices to 10-wk high; Sensex ends 976 points up, Nifty at 15,175

Benchmark indices built on gains clocked through the day and ended nearly 2 per cent higher on Friday after India’s largest public sector bank, State Bank of India, reported a healthy quarterly show. The lender’s net profit zoomed over 80 per cent to Rs 6,451 crore in Q4FY21 as it set aside lower provisions and expected asset quality to improve going forward.

Supported by rally in other financial stocks, the BSE barometer of 30-shares ended at 50,540 levels, up 976 points or 1.9 per cent. On NSE, the Nifty50 index advanced 269 points to settle above the crucial level of 15,150-level at 15,175. Both the indices hit their respective highs of 50,591 and 15,190.

SBI was the second best gainer on the Sensex, up 4 per cent, while IndusInd Bank, HDFC Bank, ICICI Bank, Axis Bank, HDFC, and Kotak Mahindra Bank were the other top gainers, up between 3 per cent and 4.5 per cent. All these stocks contributed nearly 680 points towards the Sensex’s total gains.

On the downside, Dr Reddy’s Labs and Power Grid on the Sensex, and Eicher Motors, Indian Oil Corporation, Grasim, and SBI Life on the Nifty were the only only laggards on the indices, down up to 0.3 per cent.

Financial indices — Nifty Bank, Private Bank, PSU Bank, and Financial Services — outperformed on the NSE today, and gained between 3-3.5 per cent. Meanwhile, all other sectoral indices settled up to 1 per cent higher.

In the broader markets, the S&P BSE MidCap and SmallCap indices underperformed the benchmarks today and ended 0.8 per cent and 0.65 per cent higher, respectively.

Shares of State Bank of India (SBI) bounced 6 per cent from its intra-day low and hit a high of Rs 399.70 on the BSE on Friday after the lender announced its March quarter result. The stock had initially fallen 3 per cent to Rs 378.10, from its opening level of Rs 390.45, post the announcement of the results. At 02:36 pm, SBI was trading 3.5 per cent higher at Rs 397.85 on the BSE supported by heavy volumes.

Sugar stocks traded weak in a firm market on reduction in export subsidy. Dalmia Bharat Sugar and Industries, Bajaj Hindustan Sugar, Dhampur Sugar Mills, Dwarikesh Sugar Industries, Balarampur Chini Mills, Uttam Sugar Mills and Avadh Sugar Mills were down 3 per cent to 5 per cent on the BSE.

JK Lakshmi Cement surges 7%, nears record high on healthy Q4 results. Despite hike in the prices of inputs like petcoke, diesel, fly ash, gypsum, the company said it has improved its profitability on account of substantial higher volumes, higher realisations, improved efficiency, improved product mix etc.

Shares of Hindustan Petroleum Corporation (HPCL) rallied 8 per cent and hit a 52-week high of Rs 288.15 on the BSE in intra-day trade on Friday after reporting many-fold jump in its March quarter (Q4FY21) net profit to Rs 3,018 crore on the back of inventory gains and rise in refining margins. The state-owned oil marketing company had a net profit of Rs 27 crore in January-March 2020 (Q4FY20).

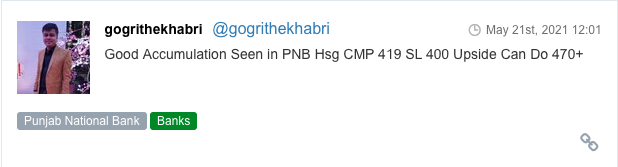

Here are some picks from the week gone by.