Sensex surges 548 points amid broad-based buying; Nifty ends above 10,900

The Indian stock market ended 1.5 per cent higher on Friday, led by buying in Reliance Industries (RIL), HDFC Bank, ICICI Bank, and HUL.

The S&P BSE Sensex settled 548 points or 1.5 per cent higher at 37,020 levels. Of 30 constituents, 25 advanced and the rest five declined. ONGC (up 5.5 per cent) ended as the biggest gainer on the index while TCS (down around 1.5 per cent) was the biggest loser. NSE’s Nifty advanced 162 points or 1.5 per cent to end at 10,902. Meanwhile, the volatility index, India VIX, slipped 5.4 per cent to 23.99 levels.

On a weekly basis, Sensex gained 1.16 per cent while Nifty added 1.24 per cent.

Sectorally, barring Nifty IT index, all the other indices ended in the positive territory. Nifty PSU Bank index rose 1.83 per cent to 1,431.60 levels while the Nifty Bank ended 1.7 per cent higher at 21,967 points. Nifty IT, on the other hand, slipped 0.62 per cent to 16,821 levels.

In the broader market, the S&P BSE MidCap gained 1.55 per cent while the S&P BSE SmallCap rose 1.11 per cent.

Shares of Mahindra & Mahindra (M&M) hit an over five-month high of Rs 588, up 3 per cent on the BSE on Friday; extending its previous days’ 4 per cent rally on the expectation of good June quarter earnings. In the past three months, the stock has outperformed the market by surging 61 per cent, as compared to 16 per cent rise in the S&P BSE Sensex.

Reliance Industries’ announcement related to its retail business, Reliance Retail, which includes its online grocery business JioMart, impacted sentiment towards Avenue Supermarts. In an otherwise bullish market when Sensex was up 1.2 per cent, the stock of Avenue Supermarts, which operates the popular chain of DMart hypermarkets, shed 6.5 per cent on Thursday.

Britannia Industries on Friday posted a strong set of numbers for the first quarter of the fiscal year 2020-21 (Q1FY21). The company’s consolidated net profit jumped 118 per cent year-on-year (YoY) to Rs 542.68 crore as against Rs 248.64 crore in the year-ago period. Sequentially, the numbers grew 45.74 per cent. The company’s revenue came in at Rs 3,384.46 crore, up 26.4 per cent against Rs 2,677.32 crore in the corresponding quarter of the previous fiscal. Total income came in at Rs 3,514.35 crore against Rs 2,767.80 crore in June 2019 quarter.

Shares of Granules India jumped 8 per cent to Rs 265, also it’s a new high, on the BSE on Friday after the company reported a strong set of numbers with Ebitda (earnings before interest, taxes, depreciation and amortization) margin improvement of 503 basis points to 25 per cent in June quarter (Q1FY21). The company’s revenue from operations in Q1FY21 grew by 23.6 per cent year on year (YoY) to Rs 735.6 crore. Ebitda for the quarter grew at 54.8 per cent at Rs 183.60 crore. Profit after tax rose 33.9 per cent YoY at Rs 111.4 crore.

Shares of Bharat Petroleum Corporation (BPCL) rose 7 per cent to Rs 421 on the BSE on Friday. The stock has surged 14 per cent in the past two trading days, on reports that global oil giants are showing interest in the state-owned oil marketing company. The counter has seen more-than-doubled trading volumes with a combined around 16 million equity shares changing hands on the BSE and NSE till 11:36 am.

Shares of L&T Technology Services (LTTS) slipped 8 per cent to Rs 1,325 in the intra-day trade on the BSE on Friday on profit booking after the company reported a disappointing set of June quarter (Q1FY21) numbers. In the past three weeks, the stock of L&T group company had rallied 14 per cent, as compared to a 4.7 per cent rise in the S&P BSE Sensex.

Cyient zoomed 9% on better-than-expected Q1 performance, positive outlook. On a year-on-year (YoY) basis though, the Hyderabad-based company’s net profit declined 10 per cent from Rs 90.5 crore reported in the year-ago period while revenue decreased 8.9 per cent from Rs 1,089 crore in Q1FY20. Sequentially, revenues slipped 7.6 per cent to Rs 991.7 crore.

SBI Cards trades higher for the second straight day, nears record high. The stock hit a four-month high today, on the back of a 27 per cent in the past one month. In comparison, the S&P BSE Sensex was up 9 per cent during the period.

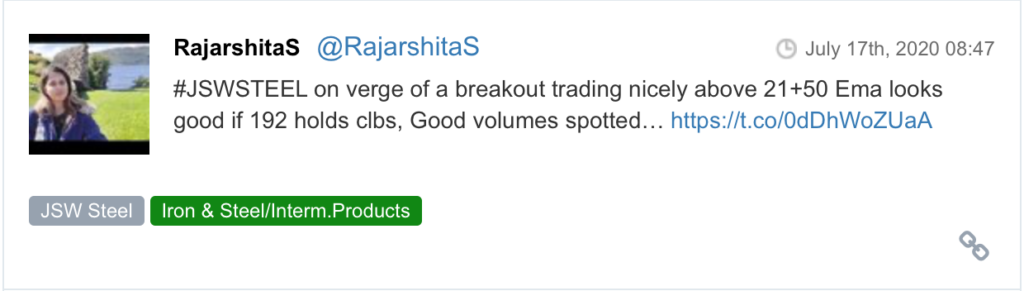

Here are some picks from the week gone by.