Sensex slips 143 points amid weak global cues; financials decline

The Indian stock market ended Friday’s volatile session in the negative territory amid weak global cues. The relentless rise in Covid-19 cases both in India as well as on the global front weighed on investor sentiment. The S&P BSE Sensex slipped 143 points or 0.39 per cent to settle at 36,594 levels while NSE’s Nifty ended at 10,768, down 45 points or 0.42 per cent.

HDFC, HDFC Bank, ICICI Bank, and Axis Bank contributed the most to the Sensex’s fall. Axis Bank ended as the top loser on the index while Reliance Industries (RIL) ended as the biggest gainer – up around 3 per cent. RIL hit a fresh lifetime high of Rs 1,884.40 during the day before settling at Rs 1,878.50 on the BSE.

On a weekly basis, Sensex gained 1.6 per cent while Nifty rose 1.5 per cent.

The sectoral trends on the NSE remained mixed. While financials, metals and auto stocks declined in the trade, pharma, FMCG, and realty counters rallied. The Nifty Pharma gained 0.85 per cent to 10,072.25 levels. On the other hand, Nifty Bank slipped over 2 per cent to 22,398.45 points.

In the broader market, the S&P BSE MidCap index fell 0.72 per cent while the S&P BSE SmallCap index declined 0.35 per cent.

Shares of IOL Chemicals & Pharmaceuticals (IOL) continued their northward journey and rallied 16 per cent to Rs 723 on the BSE on Friday, on the back of over two-fold jump in trading volumes. The stock of the pharmaceutical company hit a new lifetime high today and has appreciated by 105 per cent in the past 18 trading days. On June 16, IOL ended at Rs 352.05 on the BSE.

YES Bank slipped 9% after fixing FPO floor price at Rs 12 per share. A lengthy approval process and the risk of the issue getting undersubscribed if the secondary markets see volatility, are some of the reasons why firms have stayed clear of FPOs. The qualified institutional placement (QIP) has been the go-to instrument, given its fast-track nature.

Shares of PI Industries hit a fresh all-time high of Rs 1,789, up 3.5 per cent in the intra-day trade, on the BSE on Friday. The stock has surged 8 per cent in the past two days after the company successfully raised Rs 2,000 crore via qualified institutional placements (QIP). The agrochemical firm on Wednesday said the company has fixed issue price at Rs 1,470 per share, about 4 per cent lower than the floor rate, for sale of shares to institutional investors.

Shares of Vodafone Idea on Friday declined as much as 3.84 per cent to Rs 9.01 on the on report that the company has defaulted on rental and energy payments for June to telecom tower companies. According to a senior executive of a telecom tower firm, Vodafone Idea cited payment of adjusted gross revenue (AGR) to the government and the resultant cash flow problems for the default.

Shares of pharmaceutical companies rallied up to 6 per cent on Friday in an otherwise range-bound market amid expectations that growth is picking up in the sector after two consecutive months of decline. According to a report by ICICI Direct, the Indian Pharma market is back in the green posting 2.4 per cent YoY growth in June 2020.

Shares of insurance companies were in focus at the bourses on Friday, with SBI Life Insurance and HDFC Life Insurance Company gaining up to 4 per cent on the BSE as their new business premiums (NBP) contracted by lesser margin on a year-on-year (YoY) basis in June as compared to April and May. The NBP of life insurance companies contracted 10.46 per cent year-on-year (YoY) in June, it is, however, indicative of recovery signs after the government decided to gradually unlock. Life insurers had seen their NBP decline 32.6 per cent and 25.4 per cent in April and May, respectively.

Shares of state-owned Punjab National Bank slumped up to 6.7 per cent to Rs 34.6 on the BSE on Friday after the bank said it has reported loan extended to Dewan Housing Finance Ltd (DHFL), worth Rs 3,688.58 crore, as fraud. “The bank is reporting Borrowal Fraud of Rs 3,688.58 crore in NPA account of Dewan Housing Finance Ltd. (DHFL) at large corporate branch at Mumbai, Zonal Office,” the bank said in a regulatory filing.

Shares of Tata Consultancy Services (TCS) slipped around 1 per cent on the BSE on Friday after the company reported a weak set of numbers for the quarter ended June 2020, owing to the supply and demand disruptions caused by the Covid-19-induced lockdown. For the quarter under review, TCS reported a profit before tax (PBT) of Rs 9,504 crore, which was 9.6 per cent lower than in the previous quarter and 10.65 per cent lower than the same period of the previous financial year.

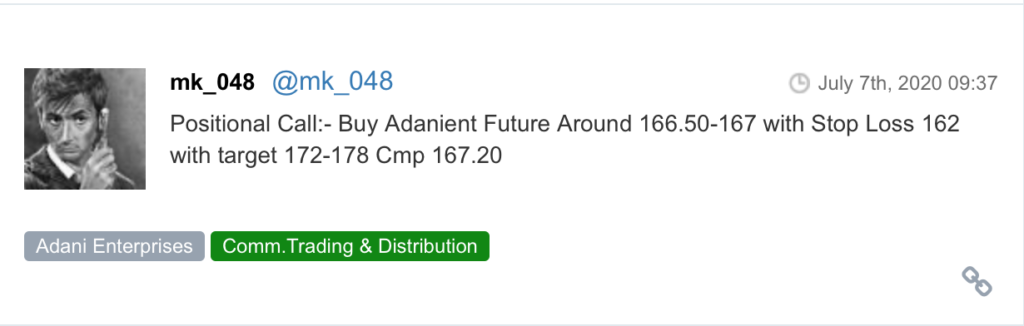

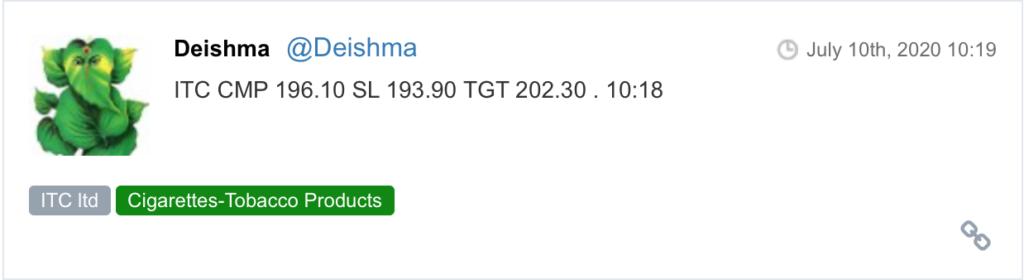

Here are some picks from the week gone by.