Sensex dips 162 points on US-Iran tensions; PSBs, Autos top drags

Following the global sell-off, Indian equity markets, too, settled lower on Friday after US military killed Iran Revolutionary Guards’ commander Qasem Soleimani in a surprise air-strike. The middle-east tensions sent Brent Crude Futures soaring, while market sentiment turned sour at D-Street.

Brent crude futures jumped nearly $3 on Friday after a US air strike in Baghdad killed top Iranian and Iraqi military commanders, sparking concerns of disruption to Middle East oil supplies. At 3:10 pm, Brent Crude Futures were at $68.62 per barrel-mark, up 3.5 per cent.

The S&P BSE Sensex, which hit an intra-day low of 41,348.68, recovered slightly in the fag-end of the session and settled 162.03 points, or 0.39 per cent, lower at 41,464.61 level. 20 of the 30 constituents ending the day in the red. Oil-linked stocks, such as paints, aviation, oil-marketing companies (OMCs), and financial counters remained under pressure.

In the intra-day trade, Hindustan Petroleum (HPCL) and Bharat Petroleum (BPCL), for instance, declined 2.9 per cent each on the BSE. Reliance Industries, Indraprastha Gas Ltd (IGL), and Indian Oil Corporation (IOC), too, slumped up to 0.7 per cent.

On the NSE, the Nifty50 lost 55.50 points, or 0.45 per cent, to settle at 12,226.65-mark. Sectorally, Nifty PSU Bank index slipped the most, down 2 per cent at close. Besides, Nifty Bank, Auto, Private Bank indices slipped over 1 per cent. On the upside, Nifty IT index advanced 1.3 per cent on the back of a weaker rupee.

In the broader market, small-caps traded in the green territory, while mid-caps followed benchmarks. The S&P BSE mid-cap index was down 0.44 per cent, while the S&P BSE small-cap index was up 0.01 per cent at close.

The General Insurance Corporation of India (GIC) stock surged 8 per cent to close at Rs 245.25 on Thursday. However, it has still shed 7.5 per cent in one month and is trading much below its listing price of Rs 400. A weak performance during H1FY20, with the combined ratio worsening to over 111 per cent, had made investors jittery.

A day after Tata Sons moved the Supreme Court, Tata group patriarch, Ratan Tata also joined issue and filed a petition in the top court appealing it to set aside the National Company Law Appellate Tribunal (NCLAT) order which had restored former Tata group chairman, Cyrus Mistry as Executive Chairman and termed conversion of Tata Sons from public to private company as ‘illegal’.

Shares of Marico were down 2 per cent at Rs 331 on the BSE on Friday. The stock has fallen 4 per cent in the past two days, on concerns over weak volume growth in the October-December quarter (Q3FY20). The personal products company’s stock was trading close to its 52-week low price of Rs 325, touched on February 18, 2019.

Shares of IIFL Securities were locked in 5 per cent upper circuit for the third straight day at Rs 47.15 on the BSE on Friday after ace investor Rakesh Jhunjhunwala bought nearly one percentage point stake in the financial services firm via open market. On Thursday, January 2, 2020, Rakesh Jhunjhunwala’s RARE Enterprises purchased 2.78 million equity shares representing 0.87 per cent stake for Rs 11.92 crore in a bulk deal on BSE. The shares were bought at a price of Rs 42.83 per share.

Shares of FDC hit a 52-week high of Rs 222 on the BSE after rallying 5 per cent in intra-day trade on Friday in an otherwise range-bound market after the drug company received good manufacturing practice (GMP) certificate from UK drug regulator for its Goa plant. The stock surpassed its previous high of Rs 220, recorded on May 27, 2019.

Shares of information technology (I-T) companies surged on Friday, buoyed by a fall in Indian Rupee against the US dollar after a key Iranian and Iraqi military personnel were killed by a US airstrike that sent the oil prices soaring. Iranian Major-General Qassem Soleimani, head of the elite Quds Force, and Iraqi militia commander Abu Mahdi al-Muhandis were killed early on Friday in an air strike on their convoy at Baghdad airport, Reuters reported.

Shares of Dishman Carbogen Amcis tanked 9 per cent to hit a new low of Rs 64.75 on the BSE on Friday. The pharmaceutical company’s stock has tanked 23 per cent in the past three days despite the company’s clarification on a report that the income tax (I-T) department found unaccounted cash during a search-and-survey operation last month.

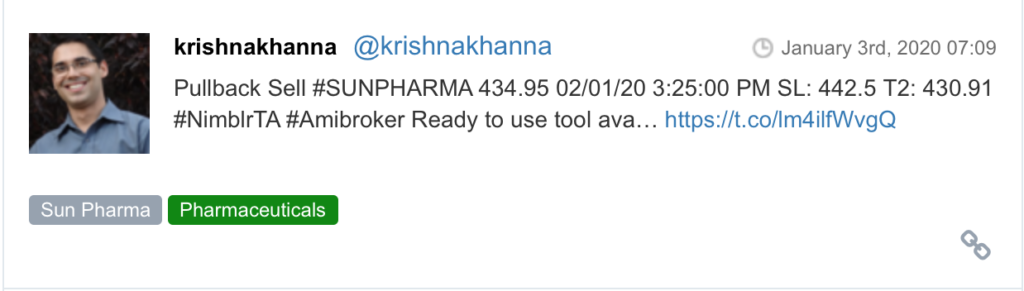

Here are some picks from the week gone by.