Sensex up 38 points as banks rally, gains 11.6% in Samvat 2075

Benchmark indices ended little changed on Friday; however banking stocks had a field day with the State Bank of India (SBI) jumping over 7 per cent (Rs 282) on 3-fold jump in its net profit at Rs 3,012 crore for the September quarter.

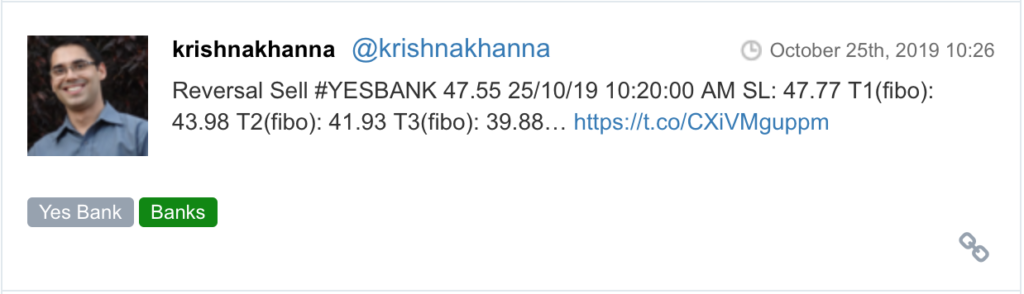

YES Bank, too, rallied around 8 per cent to Rs 52 apiece on the BSE.

The S&P BSE Sensex added 38 points or 0.10 per cent to end the Samvat 2075 at 39,058 levels. The NSE’s Nifty50 index ended at 11,584, up just 1 point or 0.01 per cent.

In the broader market, the S&P BSE MidCap index ended at 14,342, up around 3 points or 0.02 per cent while the S&P BSE SmallCap index lost 51 points or 0.39 per cent to close at 13,153.

Among other buzzing stocks, ICICI Bank hit a new high of Rs 470.70 apiece on the BSE during the session with the market capitalisation (m-cap) surpassing Rs 3 trillion-mark.

On the other hand, Piramal Enterprises tanked 17 in the afternoon deals on the BSE after the company announced capital-raising plan. The stock eventually settled at Rs 1,590 apiece, down around 8 per cent.

Volatiity index India VIX slipped around 6 per cent to 15.30 levels.

Among the sectoral indices on the NSE, PSU bank stocks advanced the most, followed by IT counters. The Nifty PSU Bank index gained 3.38 per cent to end at 2,300 levels. Nifty Bank rallied 1 per cent to 29,396-mark.

Public lender State Bank of India (SBI) on Friday reported a standalone net profit of Rs 3,012 crore for the September quarter of FY20 (Q2FY20), up 218 per cent YoY, from a profit of Rs 944.87 crore reported in Q2FY19. The bank logged a consolidated PAT at Rs 3,375.4 crore . The profit beat Street estimates. Prabhudas Lilladher, for instance, pegged the profit at Rs 2,633.3 crore.

Piramal Enterprises tanked 17.3 per cent to Rs 1,425.2 per share in the afternoon deals on the BSE on Friday after the company, at its board meeting, approved preferential Compulsory Convertible Debentures (CCD) allotment to Canadian institutional investor Caisse de dépôt et placement du Québec (CDPQ) for a price consideration of Rs 1,750 crore.

InterGlobe Aviation-run IndiGo airlines nosedived 8 per cent to Rs 1527.85 in intra-day deals on the BSE on Friday, after the airline reported its biggest quarterly loss of Rs 1,062 crore in the September quarter of financial year 2019-20 (Q2FY20). Moreover, it cut its capacity expansion targets for 2019-20 by 5 percentage points.

Shares of Bharti Infratel hit an over five-year low of Rs 219, down 8 per cent on Friday, extending its Thursday’s 8 per cent decline on the BSE after the company extended the deadline for its merger with Indus Towers by two months while considering regulatory uncertainty looming over the deal. The stock of the tower and related infrastructure sharing services provider was trading at its lowest level since May 2014.

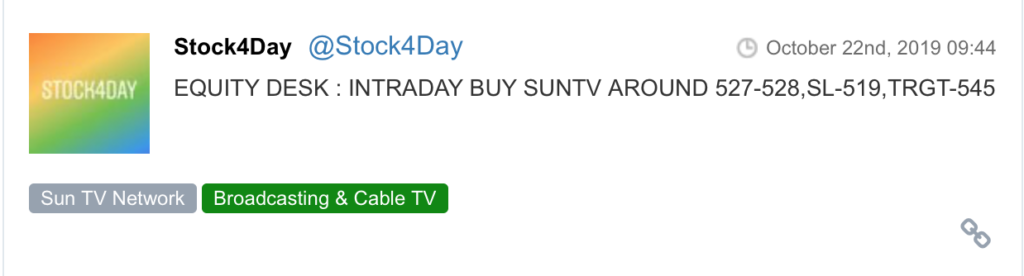

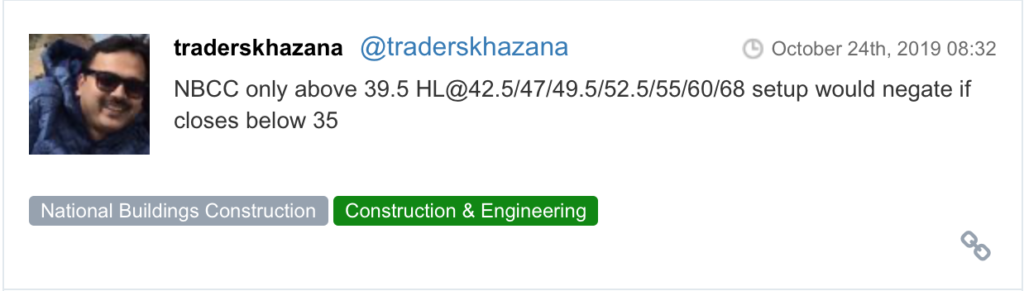

Here are some picks from the week gone by.