Sensex ends 100 points up after a volatile day; Nifty below 11,000

Fresh trade war concerns between the United States and China weighed down investors’ sentiment on Friday leading to a sluggish trade through the day. The benchmark S&P BSE Sensex and the broader Nifty50 plummeted 411 points and 131 points respectively during the intra-day trade before staging a smart recovery during the last trading hour.

Indices inched higher on reports that the PMO took stock of the steep sell-off being witnessed in the market since the presentation of the Union Budget 2019-20. Reports suggested that PMO met officials from the Finance Ministry on Thursday to discuss concerns raised by the FPIs and even considered proposals submitted by them.

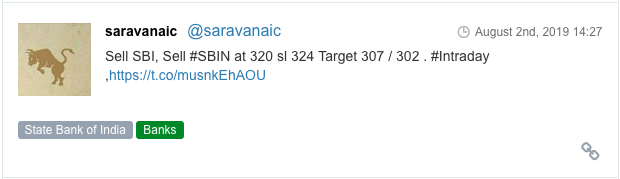

The Sensex closed at 37,118 level, up 100 points, or 0.27 per cent with Bharti Airtel, Asian Paints, Bajaj Auto, and Maruti being the top gainers. On the other hand, Tata Steel, SBI, Vedanta, and ONGC ended the day with steep losses. The broader Nifty50 failed to hold the psychological 11,000-mark to end at 10,997, up 17 points, or 0.16 per cent.

In the broader markets, S&P BSE Mid-cap closed at 13,547 level, up 20 points, or 0.15 per cent while the S&P BSE Small-cap settled 55 points, or 0.44 per cent, lower at 12,496 level.

Sectorally, metals slipped the most as risks to global economy increased after US President Donald Trump imposed fresh tariffs Chinese imports. The index dipped 2.16 per cent at close, followed by Nifty PSU Bank, down 1.12 per cent. Among the gainers, Nifty Auto index ended 1.26 per cent higher, followed by Nifty IT index, which gained 0.57 per cent on the back of weaker rupee.

Shares of Talwalkars Group companies – Talwalkars Healthclubs (THL) and Talwalkars Better Value Fitness (TBVFL) – were on Friday locked in their respective lower circuits for 12th trading session in a row after various rating agencies downgraded the companies’ long-term facilities and debenture issues. The market price of these stocks hit new lows at the bourses today.

Shares of Jet Airways (India) were locked in the upper circuit of 5 per cent for the second straight day, to quote at Rs 36.85 apiece, on the BSE on Friday after reports suggested that four bidders are likely to bid for the beleaguered airline. The airline gained 16 per cent from Thursday’s low of Rs 32 in an otherwise weak market.

Shares of Ashok Leyland hit an over 5-year low to trade at Rs 61 per share, slipping 12 per cent intra-day, on the BSE on Friday as analysts remained cautious on the company’s medium-term outlook for the domestic medium and heavy commercial vehicle (M&HCV) industry. The stock was trading at its lowest level since February 10, 2015, when it had touched Rs 56 per share in the intra-day trade.

Shares of Bharti Airtel climbed 5 per cent to Rs 339 apiece in Friday’s early morning trade on the National Stock Exchange (NSE) in an otherwise weak market after the telecom operator reported an improved margin and industry-best average revenue per user (ARPU) for the June quarter (Q1FY20). Consolidated EBITDA (earnings before interest, tax, depreciation and amortisation) margin improved to 41 per cent during the quarter as compared to 34.5 per cent in the corresponding quarter last year.

Shares of JK Tyre & Industries were trading near 5-year low of Rs 60 apiece, down 16 per cent in early morning deals, on the BSE on Friday, after the company reported a sharp 75 per cent drop in consolidated net profit at Rs 16 crore in the June quarter (Q1FY20) due to weak operational performance. The tyres manufacturing company’s profitability was hit due to overall slow-down in automotive sector, the management said. It had posted a profit of Rs 64 crore in the year-ago quarter.

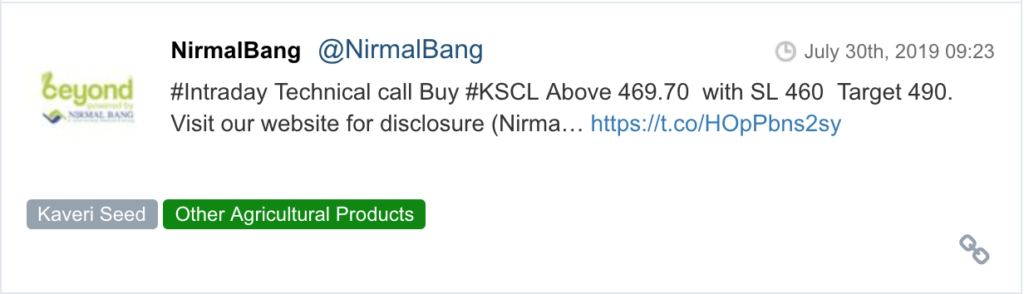

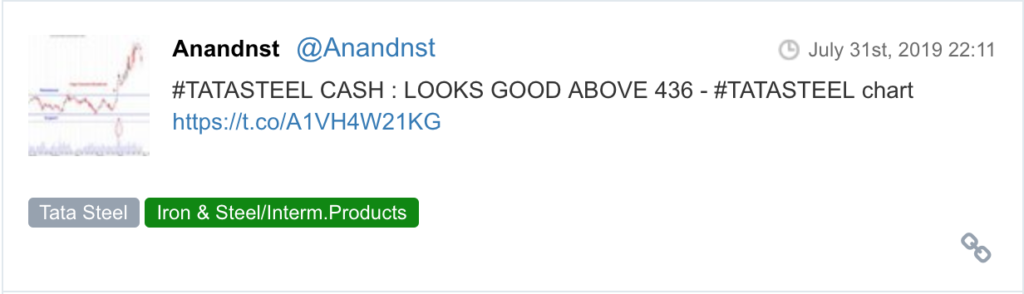

Here are some picks from the week gone by.