Sensex plunges 560 points; sees third biggest fall in 2019

Markets saw the third-worst fall of 2019 on Friday as benchmark indices S&P BSE Sensex and Nifty50, both, fell to two-month low. The indices touched intra-day lows of 38,271 level at Sensex and 11,399 mark at Nifty. ‘Super-rich tax’ concerns on FPI, trade war tenions and weak corporate earnings contributed to the fall.

The Sensex tanked 560 points, or 1.44 per cent, to close at 38,337 levels with 26 of the 30 stocks listed at the index ending in the red. IndusInd Bank, Bajaj Finance, M&M, and YES Bank were the top laggards while only NTPC, TCS, PowerGrid and ONGC ended in the green. The Nifty50, too, lost 178 points, or 1.53 per cent, to settle at 11,419 mark. Of the 50 stocks listed at the index, only 7 stocks advanced while the remaining 43 declined.

In the broader market, S&P BSE MidCap closed 285 points, or 2 per cent, lower at 14,078 level while the S&P BSE SmallCap slipped 248 points, or 1.83 per cent, at 13,310 levels.

Sectorally, all the indices ended in the red. Nifty Auto index, too, tanked to two-month low to end 3.31 per cent lower. This was followed by losses in Nifty Private Bank index and Nifty Pharma index, down 2.45 per cent and 2.23 per cent respectively.

The Nifty Auto index hitting a three-year low on Friday. Thus far in the calendar year 2019, auto index slipped 21 per cent, against 5 per cent rise in the benchmark index. M&M, Motherson Sumi Systems, TVS Motor Company, Exide Industries, Escorts, MSIL, Eicher Motors, Hero MotoCorp, Bosch and Ashok Leyland have seen market value erosion of more than 22 per cent during the period.

Shares of RBL Bank tanked as much as 13.75 per cent in the afternoon session on Friday after releasing June quarter results for the financial year 2019-20 (FY20). The lender reported healthy set of numbers for the period under review but said it expects to face some challenges on some of its exposures in the near term. Reacting to it, investor sentiment took a hit, thus dragging the stock nearly 14 per cent lower during the trade.

Shares of HDFC Asset Management Company (AMC) were trading higher for the fourth straight day, rallying 9 per cent to Rs 2,369 apiece on the BSE on Friday in an otherwise weak market, after it reported strong numbers for June quarter of financial year 2019-20 (Q1FY20). The stock was trading at the highest level since its listing on August 6, 2018.

Shares of Cyient tanked 11 per cent intra-day to hit its 52-week low of Rs 482 per share on the BSE on Friday after the company reported disappointing set of numbers for the quarter ended June 2019 (Q1FY20). Cyient’s Q1FY20 revenue of USD 157 million de-grew by 5.2 per cent quarter on quarter (QoQ) and 3 per cent year on year (YoY) and was around 5 per cent below against analyst estimates. This is Cyient’s worst QoQ performance in the past 10 years.

Shares of Maruti Suzuki India (MSIL) hit an over two-year low of Rs 5,790, down 2 per cent, in intra-day trade on Friday. The passenger vehicle company’s stock has slipped 6 per cent in the past three trading days on the BSE, on concerns of weak earnings amid a low volume in the April-June quarter (Q2FY19), and is trading at its lowest level since January 25, 2017, when it touched Rs 5,718 in intra-day deal.

ACC shares rose 5 per cent to Rs 1,647 on the BSE in Friday’s early morning deal after the company reported a better-than-expected 39 per cent year-on-year (YoY) growth in consolidated net profit at Rs 456 crore in June quarter (Q2CY19) on the back of higher realisation. The cement company had a profit of Rs 329 crore in the same quarter last year.

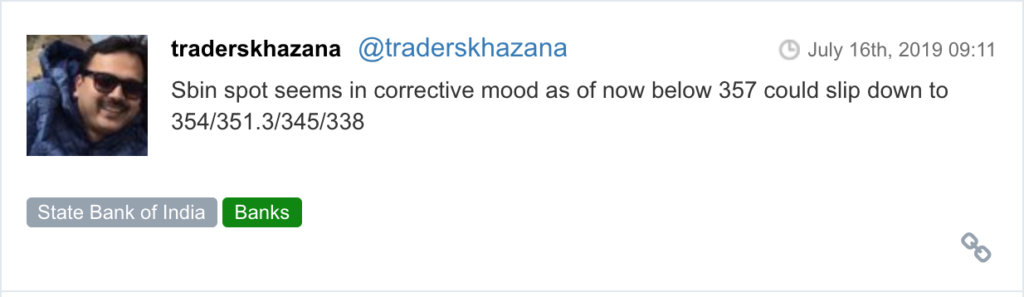

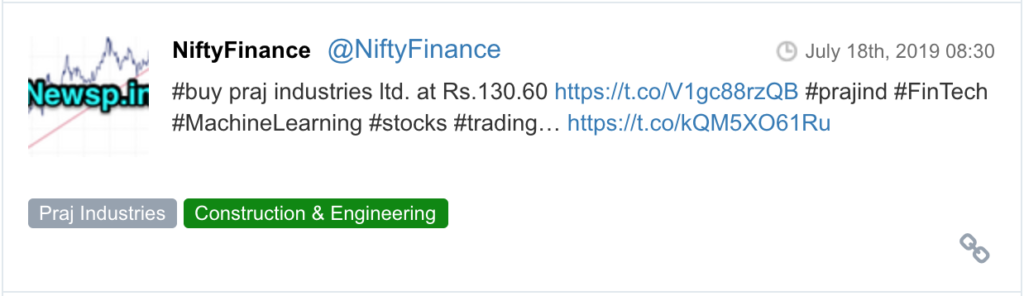

Here are some picks from the week gone by.