Reblog: The Best Gann Fan Trading Strategy

How to use the gann fan indicator, How to draw gann fan, these are the most common questions about this indicator. For good reason though!

How to use the gann fan indicator, How to draw gann fan, these are the most common questions about this indicator. For good reason though!

This trading strategy is a complex support and resistance trading strategy that uses diagonal support and resistance levels. Unlike the traditional horizontal support and resistance levels, the Gann fan angles are mathematically calculated based on the price, time and the price range of the market. If you want to learn how to correctly trade horizontal support and resistance level we’ve got your back, just read Support and Resistance Zones – Road to Successful Trading.

Our team at Trading Strategy Guides has developed the best Gann fan trading strategy which can be applied to all markets because according to the Gann theory, financial markets move as a result of human behaviour which makes them cyclical in nature. In other words, history is a good predictor of future price action.

One of the main reasons why Gann fan angles are superior to the horizontal support and resistance levels is that financial markets are geometric in their movements. This means that if you can spot a pattern or or any other geometric shape in a chart, then there is a high probability you can spot them at the Gann fan angles.

Now…

Before we get started, let’s look at what indicator you need for the job for the Best Gann Fan Trading Strategy:

The First and ONLY indicator you need is the:

Gann Fan Indicator: This indicator is notable unique because it draws diagonal support and resistance levels at different angles. At first sight you might recognise the indicator because it’s a colourful indicator much like the Fibonacci Channel indicator which has been introduced to our audience in previous months, read more here: Fibonacci Retracement Channel Trading Strategy.

Gann Theory Explained

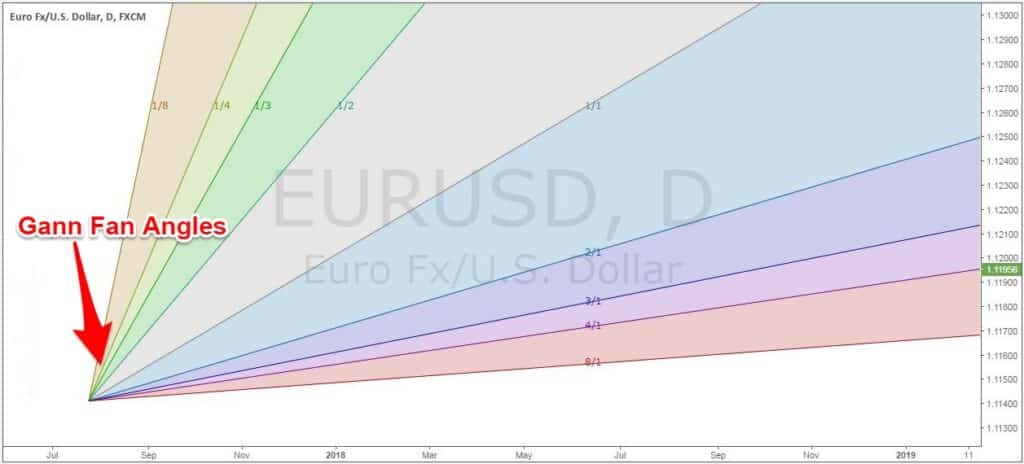

We have special Gann fan angles and more specifically Gann came up with 9 different angles (see Figure Above).

The most important angle is the 45-degree angle or the 1/1 line. For every Gann angle, there is a line that is derived from that angle. We can distinguish 4 different Gann angles above the 45-degree angle and 4 other Gann angles below, as follows:

- 1/8

- 1/4

- 1/3

- 1/2

- 1/1 – 45 degree

- 2/1

- 3/1

- 4/1

- 8/1

How to Use the Gann Fan Indicator

According to Gann theory, there are special angles that you can draw on a chart that will give you a good indicator of what price is going to do in the future. All of Gann’s techniques require equal time and price intervals, in other words, a rise of a 1/1 would imply a 45-degree angle.

This statement may sound obscure, but after we’ll go through some example, shortly and you’ll get a better understanding of how to use the Gann fan indicator and more importantly how to draw Gann fan angles.

Gann believed that when price and time move in sync, then that’s the ideal balance of the market. The biggest part of the Gann theory revolves around the fact that prices above the 1/1 line, the 45-degree line will determine a bull market and prices below the 1/1 line determine a bear market (see Figure above).

How to Draw Gann Fan Angle

In this section, I’m going to teach you how to draw gann angles, how to draw gann angles correctly, and a great gann angles formula for trading this strategy. Many traders are used to draw Gann fan angles the wrong way which is why you need to pay closer attention to this section.

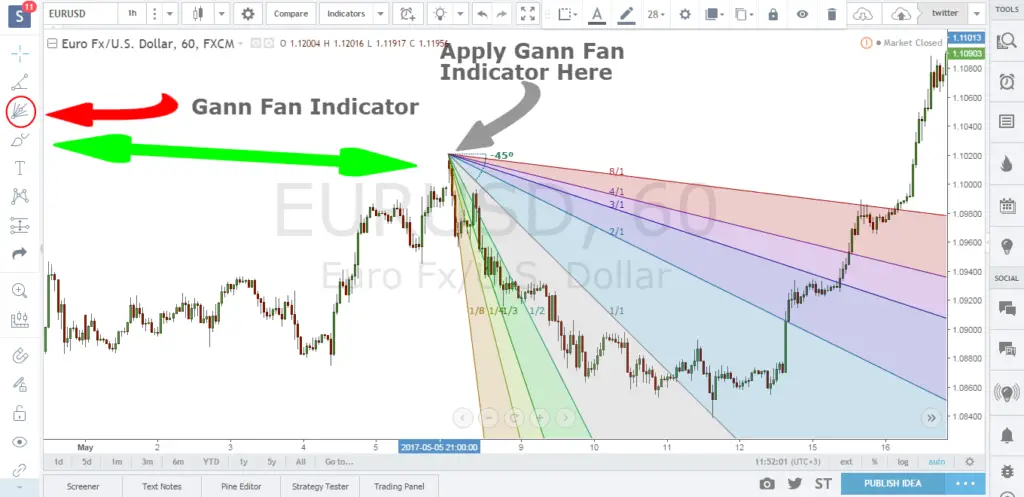

You first need to draw a perfect 45-degree angle and most sophisticated trading platformsshould have incorporated such tools. On the Tradingview platform, you can locate the Trend Angle tool on the left-hand side panel (see Figure below).

Next step is to select any major swing high or swing low on the chart from where you want to draw the Gann fan angles. Once you’ve chosen your swing low point simply utilize the trend Angle tool and draw a perfect 45 degree angle.

Once you’re done, you need now to learn how to draw the Gann fan angles. On this step you need to use the Gann Fan indicator which again is located on the left hand side panel (see Figure below).

Now, all you have to do is to simply place the Gann fan indicator on the chart and make sure it overlays on top of the 45-degree line you previously have drawn. This is the correct way to draw the Gann fan angles and if you have been following all these steps all the other Gann fan angles should comply with the Gann rules.

Now, let’s move forward to the most important part of this article, the trading rules of the best Gann fan trading strategy.

Before we go any further, we always recommend writing down the trading rules on a piece of paper. This exercise will step up your learning curve and you’ll become a Gann expert in no time.Here is another strategy called The PPG Forex Trading Strategy.

Let’s get started…

The Best Gann Fan Trading Strategy

(Rules for BUY Trade)

Step #1: Pick a significant High, Draw Gann Fan Angles and Wait For the 1/1 Line to Break to the Upside

The best Gann fan trading strategy works the same on every time frame, but we recommend not going lower than the 1h chart as you want to be able to pick significant swing high points which can’t be seen on the lower time frames.

To draw Gann fan angles please refer to the previous “How to draw Gann fan Angle” section.

Next, let’s address our entry point:

Step #2: Wait for a Break Above 2/1 Gann angle Before Buying at the market

This step is significantly important because a reversal of the previous trend is only confirmed once the 2/1 Gann angle is broken to the upside. You want to buy at the market as soon as we break above 1/1 line.

Now, after we have our position opened, we need to do one more important thing:

Step #3: Apply again the Gann Fan Indicator on the Swing low Prior to the Breakout above 2/1 Gann Fan Angle

How to use the Gann fan indicator? Simply follow the instruction presented in the above sections. At this point, you can also get rid of the previous Gann fan angles drawn from the swing high. This will make sure your chart will not get cluttered and the price is still visible.

One of the reasons why this is the best Gann fan strategy is because we use the Gann fan indicator to track every swing in the market.

At this point, your trade is opened, but we still need to determine where to place our protective stop loss and take profit orders, which brings us to the next step of best Gann fan trading strategy.

Step #4: Place Your Protective Stop Loss below the Most Recent Swing Low Which Should Align With the Point from Where You Draw the Second Set of Gann Fan Angles.

The best Gann fan strategy has a very clear level where we should place our protective stop loss order which is right below the swing low located prior to the 1/2 Gann angle breakout.

Next, will learn where to take profits:

Step #5: Take Profit One we Break and Close Below the 1/1 line. We Need the Close Below 1/1 line to be by at Least 20 Pips to Consider it a Valid Breakout

We want to ride the new trend for as long as possible and with the help of the Gann fan indicator, we can pinpoint the ideal time to take profits. We take profit at the earliest symptom of market weakness which is a break below the 1/1 line that signals a possible start of a bearish move.

We also want to add a buffer of 20 pips to the 1/1 Gann angle breakout just to annihilate possible false breakouts.

Note** The above was an example of a buy trade using the best Gann fan strategy. Use the same rules – but in reverse – for a sell trade. In the figure below you can see an actual SELL trade example using this strategy.

Simply follow the how to use the Gann fan indicator section to draw the Gann fan angles. We’ve applied the same Step #1 and Step#2 to help us identify the SELL trade and followed Step #3 through Step#5 to manage the trade (see next figure).

Conclusion

Conclusion

This is the best Gann fan strategy because unlike the traditional support and resistance lines the Gann angles can pinpoint significant changes in the market swing trends. We at Trading Strategy Guides have a clear understanding of what is really going on at these critical levels because we always make sure we backtesting our strategies so they have a positive expectancy.

If you want to gain a much clearer understanding of how support and resistance level really work we recommend having a look at our work here: Support and Resistance: What Is Going On At These Critical Areas.

Thank you for reading!

The original article appeared on tradingstrategyguides.com and is available here.