IPO review: Ujjivan Small Finance Bank

- USFB is the second-largest SFB in India.

- It has shown growth in its business for the last three fiscals.

- Issue pricing appears reasonable against listed peers.

- Pre-IPO placement worth Rs. 299.19 cr. done at Rs. 35 per share in Nov. 19.

- UFSL shareholder quota offered at a discount of Rs. 2 per share against IPO pricing of Rs. 37 (upper band).

ABOUT COMPANY:

Ujjivan Small Finance Bank (USFB) is a mass-market focused SFB in India, catering to unserved and underserved segments and committed to building financial inclusion in the country. Its Promoter, UFSL (Ujjivan Financial Services Ltd.) commenced operations as an NBFC in 2005 with the mission to provide a full range of financial services to the ‘economically active poor’ who were not adequately served by financial institutions. UFSL’s erstwhile business was primarily based on the joint liability group-lending model for providing collateral-free, small ticket-size loans to economically active poor women. UFSL also offered individual loans to Micro and Small Enterprises (“MSEs”) and adopted an integrated approach to lending, which combined a customer touchpoint similar to microfinance, with the technology infrastructure and related back-end support functions similar to that of a retail bank. On October 7, 2015, UFSL received RBI In-Principle Approval to establish an SFB (Small Finance Bank), following which it incorporated Ujjivan Small Finance Bank Limited as a wholly-owned subsidiary. UFSL, after obtaining RBI Final Approval on November 11, 2016, to establish and carry on business as an SFB, transferred its business undertaking comprising of its lending and financing business to USFB, which commenced its operations from February 1, 2017. The bank is included in the second schedule to the Reserve Bank of India Act, 1934 as a scheduled bank on July 3, 2017. In the short period that it has been operational as an SFB, it is among the leading SFBs in India in terms of deposits, advances, branch count and geographical spread, as of March 31, 2019.

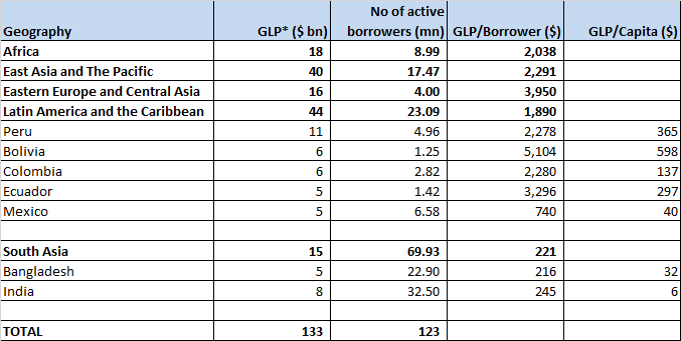

*GLP: Gross Loan Portfolio

*GLP: Gross Loan Portfolio