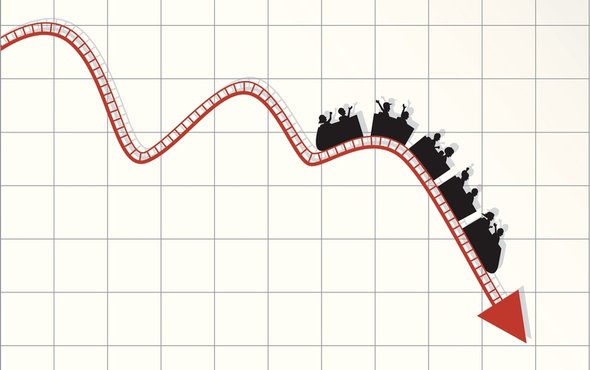

The U.S. stock market plunged Monday, with the Dow Jones falling nearly 1,600 points at one point, the biggest single-day drop in its history. It then turned around and regained 567 points on Tuesday. What the remainder of the week holds in store is anyone’s guess.

Many experts had been forecasting a decline for months after a prolonged upswing resulted in a series of record highs. Several factors are likely to have been involved. The Bureau of Labor Statistics January jobs report, released on Friday, was almost certainly one of them. It generated worries about inflation and bond yields, together with concern The Federal Reserve may raise interest rates faster than expected—events that may have “spooked” the markets.

Markets translate the decisions of millions of people into a price for a stock or bond. Like a spooked crowd in a public place, investors tend at times to run in the same direction—let’s all play the lottery or let’s escape the burning movie theater.

The work of visionaries such as Nobel laureates Richard Thaler and Daniel Kahneman has demonstrated humans do not operate as rational agents, as assumed by classical economics. From this realization have emerged disciplines such as behavioral economics, neuroeconomics and the like.