Financial, IT shares drag Sensex 453 points, ends below 60K; Nifty near 17,850

Weakness gripped Dalal Street on Friday as equity markets declined for a third straight session registering their first weekly loss of 2023. Investors remained on the sidelines as they awaited a key jobs report in the US due for release later today.

The jobs data will likely dictate the market trend in the US as strong job additions could mean continued monetary tightening by the Federal Reserve.

The BSE Sensex sank 683 points to the day’s low of 59,670 before closing 453 points lower at 59,900. The NSE Nifty touched a low of 17,796 and eventually pulled back to end 133 points lower at 17,859.

The top laggards that weighed on the benchmark indices were financial and IT shares. TCS, IndusInd Bank, Bajaj twins, Tech M, Kotak Bank, Infosys, Airtel, Tata Motors, Titan and Wipro led losses on Sensex, shedding 1-3 per cent, while JSW Steel was the top Nifty loser.

Handful of index winners included M&M, Reliance, Nestle, ITC, L&T, Britannia, BPCL and ONGC, which closed up to 1 per cent higher.

Besides, broader markets also could not escape the selloff and declined in line with benchmarks. The BSE Midcap and Smallcap indices slipped 0.7 per cent each.

Losses were equally spread across sectors. Nifty IT fell 2 per cent followed by 0.7-1 per cent cuts each in Bank, Financial, Metal, Realty and Pharma indices. FMCG and Consumer Durables outperformed with fractional gains.

Among buzzing stocks, IDBI Bank ended the day with a 8 per cent gain after SEBI allowed the government’s stake in the lender to be reclassified as public after divestment.

Shares of Sigachi Industries soared 20 per cent after the pharmaceutical company announced that its board will meet on January 10, 2023 to mull fund raising via preferential issue.

Bajaj Finance reported its strongest-ever loan book growth in the recently concluded December quarter. Despite this, its share price took a hit and extended losses into Friday’s trade as the assets under management (AUM) growth came below expectations. The broader trend in Bajaj Finance and Bajaj Finserv stocks has turned weak and if both these stocks fail to rebound and overcome key levels, the sell-off could intensify.

Share of Landmark Cars hit a new high after a weak debut as they surged 17% in two days. With the last two days’ gains, Landmark Cars is now trading 15% higher against its issue price of Rs 506 per share. It has bounced 34% from its low of Rs 433.20 touched on December 26.

Speciality Restaurants soars 20% in 2 days; hits record high in weak market. In past six months, the stock has rallied 122 per cent, as against 12 per cent rise in the S&P BSE Sensex.

Mukand rallies 6%; completes sale of 46 acre property for Rs 796 crore. The company has completed the transfer of 45.94 acres of property at its Kalwe/ Dighe facility in Thane District to AGP DC Infra Two for Rs 796.46 crore.

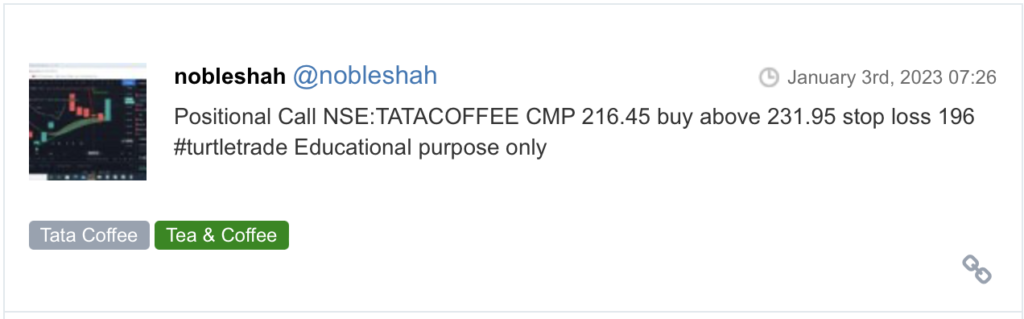

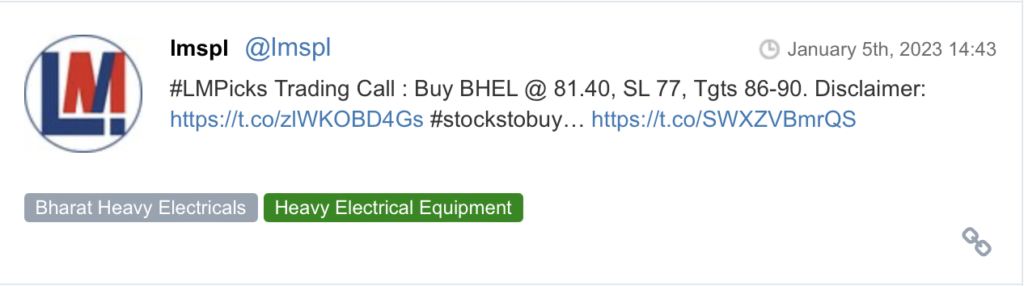

Here are some picks from the week gone by.