Sensex falls 111 points, Nifty holds 15,750; RIL sinks 7%, MRPL 10%

Benchmark indices swung wildly in trade on Friday after the government’s move to tax oil refiners’ windfall gain amid soaring crude oil prices hurt index heavyweight Reliance Industries’ stock. Other oil-linked stocks such as ONGC, OIL India, MRPL, and Chennai Petrochemicals, too, bled in the broader markets.

Overall, the BSE Sensex index gyrated 959 points intra-day before closing 111 points, or 0.21 per cent, lower at 52,908. The Nifty50, too, hit an intra-day low of 15,511 before settling at 15,752, down 28 points or 0.18 per cent.

In the broder markets, the BSE MidCap and SmallCap indices fell 0.07 per cent and 0.46 per cent, respectively. Among sectors, the BSE Oil and Gas Index dropped 3.5 per cent.

Shares of oil upstream companies, including Reliance Industries (RIL), ONGC, and Oil India, came under heavy selling pressure on Friday after the government imposed taxes on the export of petrol, diesel, and aviation turbine fuel (ATF), as it mandated exporters of these products to meet the requirements of the domestic market first.

Bajaj Auto slipped 3% on flat June sales numbers. It has shed 7% in the last three days. The company’s total two-wheeler sales grew 2 per cent year on year (YoY) to 315,948 units, mainly due to a 23 per cent YoY jump in exports at 190,865 units during the month.

Shares of Parag Milk Foods slipped 12% and the stock hit a 52-week low as the Q4 loss widened. For the financial year 2021-22, Parag Milk Foods reported a loss of Rs 532.50 crore, due to one-time write down of Rs 509.50 crore.

Shares of ITC gained 2% in a weak market as the stock neared its 52-week high. A stable tax environment for cigarettes in recent years has allowed ITC to calibrate price increases to avoid a disruption in demand.

Shares of Jamna Auto hit a record high as the price rallied 17% in one week on healthy outlook. The volumes of M&HCVs/ trucks, the key end-user segment for the Jamna Auto Group, grew by nearly 49% in FY2022.

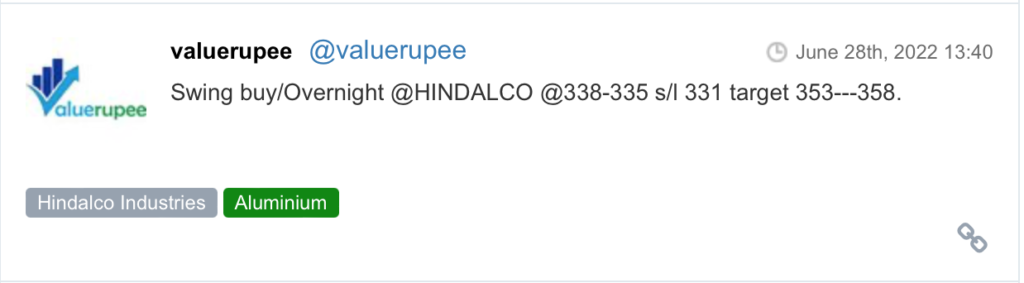

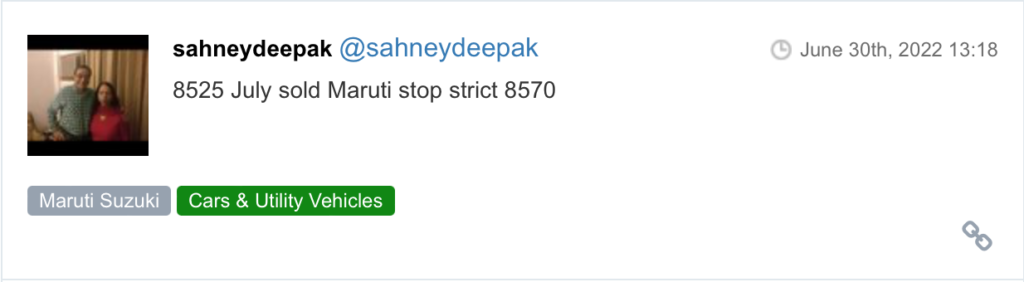

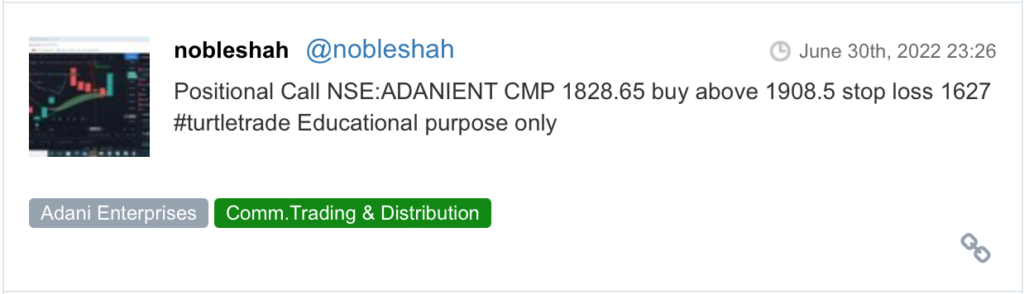

Here are some picks from the week gone by.