Sensex gains for 2nd day, rises 632 points; Nifty holds 16,350; IT stocks lead

Equity markets rose for a second consecutive day on Friday, propelled by across-the-board buying. The S&P BSE Sensex hit a high of 54,937 intra-day, before ending at 54,885, up 632 points or 1.17 per cent.

The NSE Nifty, on the other hand, settled the day at 16,352, up 182 points or 1.13 per cent. The index hit a high of 16,371 earlier today. In the broader markets, the Nifty MidCap100 index and the Nifty SmallCap100 indices rose 1.4 per cent each.

Apollo Hospitals, Tech M, HDFC Life, Hero MotoCorp, IndusInd Bank, Bajaj Finance, Wipro, Infosys, L&T, HUL, and Bajaj Finserv zoomed over 2.5 per cent on the Nifty. Dr Lal Path Labs, Whirlpool of India, IndiaMART InterMESH, Page Industries, Route Mobile, Balrampur Chini, and Sonata Software, on the other hand, surged up to 9.5 per cent in the broader market.

Sectorally, the Nifty IT index was the lead gainer, up 2.54 per cent, on the National Stock Exchange (NSE). The only loser was the Nifty Metal index, down 0.06 per cent.

Edible oil major Ruchi Soya Industries Ltd reported a 25 per cent decline in its standalone net profit to Rs 234.33 crore for the March 2022 quarter.

India Cements posted a net loss of Rs 10.6 cr in Q4FY22 as revenue dipped 4%. Coal prices also increased from $60 per tonne to $300 per tonne during the last one year adding to the pressure on the company.

Allcargo Logistics Q4 consolidated net profit jumped to Rs 247 crore. The company had posted a net profit of Rs 53.71 crore for the year-ago period.

Shares of BPCL were weak after the Centre called off the privatisation process. The statement by DIPAM said “the privatisation of BPCL and the expressions of interest received from the bidders stand cancelled.”

ONGC tumbled 6% to hit a four-month low. The stock was down 27% from 52-week-high. The stock was also under pressure after UK imposes 25 per cent energy windfall tax on oil and gas producers.

Muthoot Finance sunk 9% on weak Q4 results as analysts turned bearish on the stock. India’s largest gold financing company on Thursday reported a 4 per cent decline in standalone profit at Rs 960 crore as compared to Rs 996 crore profit reported during the corresponding period last year. The company’s standalone income also dipped 5 per cent to Rs 2,678.37 crore.

Shares of Piramal Enterprises dipped 10% and hit a 52-week low post March quarter results. The stock has now fallen below its previous low of Rs 1,688, touched on May 27, 2021.

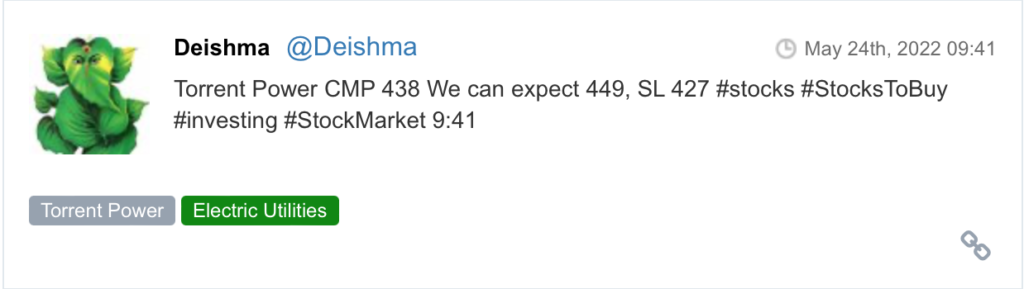

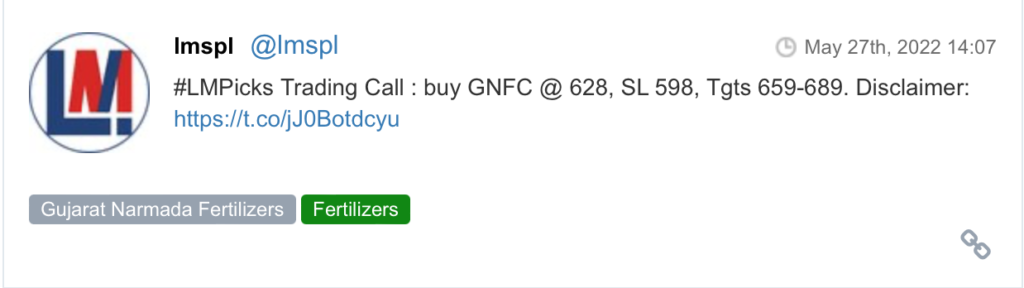

Here are some picks from the week gone by.