Sensex sheds 889 points, Nifty gives up 17k; RIL, financials weigh; Infy up 3%

Stocks across the board, barring the IT sector, witnessed significant selling pressure in trades on Friday as unwinding of global stimulus packages dented sentiment. That apart, unforseen threat from the Omicron virus and high inflation kept bulls at bay all through the day.

The BSE Sensex tanked to a low of 56,951, and evenutally settled with a heavy loss of 889 points at 57,012. In the process, the BSE benchmar ended the week with a significant loss of 3 per cent (1,775 points).

The NSE Nifty slumped to a low of 16,966, and finally ended with a loss of 263 points at 16,985.

Index heavyweight Reliance Industries plunged 2.6 per cent to Rs 2,341, and alone accounted for a loss of 176 points on the BSE benchmark. That apart, the HDFC twins were the other major dragggers (223 points loss).

IndusInd Bank was the biggest per centage loser among the Sensex 30, down 4.7 per cent. It was followed by Kotak Bank, Hindustan Unilever, Titan, Bajaj Finserv and HDFC – all down over 3 per cent each.

SBI, Axis Bank, Mahindra & Mahindra, Bharti Airtel, ITC, Maruti and Tata Steel were the other major losers. On the positive front, Infosys surged 3 per cent. HCL Technologies, PowerGrid and Sun Pharma were the only other gainers.

The broader indices also finsihed with deep cuts. The BSE Midcap and Smallcap indices were down 2.4 per cent and 2.1 per cent, respectively. The overall breadth too was extremely negative, with more than two declining stocks for every advancing share on the BSE.

In the broader markets, Kopran hit its second straight 5 per cent upper limit at Rs 318.95 in intraday trades today. The stock was was at its highest level since 1994, and in the past 21 months, the stock price of zoomed a whopping 1,874 per cent from levels of Rs 20.50. READ MORE

Among sectoral indices, the BSE Realty index nose-dived 4 per cent. The Energy, Bankex, Auto and Oil & Gas indices were down over 2.5 per cent each. The IT index also pared gains towards the close, still finsihed more than a per cent higher.

Surya Lifescience IPO was subscribed 4.4 times as of 03:20 PM on Day 2 of the offer period. The retail quota was subscribed 21.36 times and NIIs 1.91 times.

HP Adhesives which closes for subscribtion today, was subscribed 17.55 times, with demand for retail portion up to 74.59 times. The NIIs quota received bids up to 12.60 times, and the QIBs portion was subscribed 1.01 times.

The shares of RateGain Travel and Technologies debuted on a weak note on the bourses. Against the issue price of Rs 425, the shares listed at Rs 364.8 on the BSE, a 14 per cent discount. On the NSE, the shares debuted at Rs 360, down 15.2 per cent. The IPO was subscribed 17.41 times, while according to reports the grey market premium (GMP) indicated a likely 8-10 per cent listing gain.

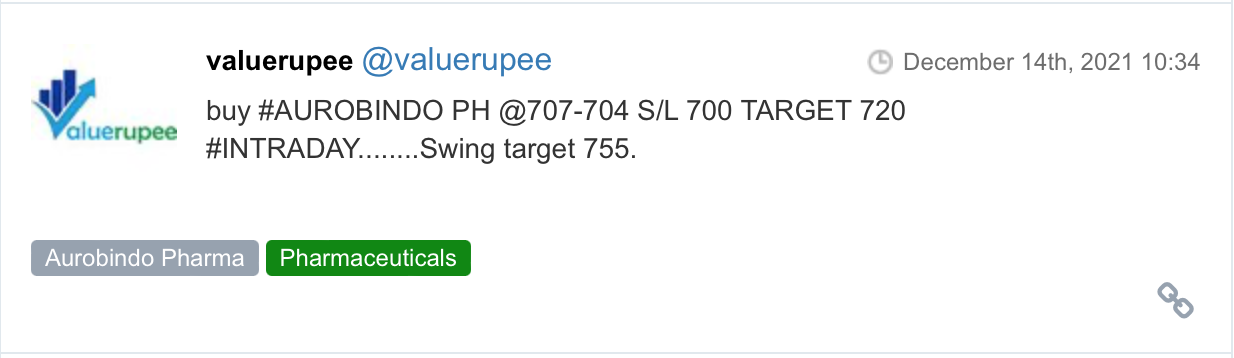

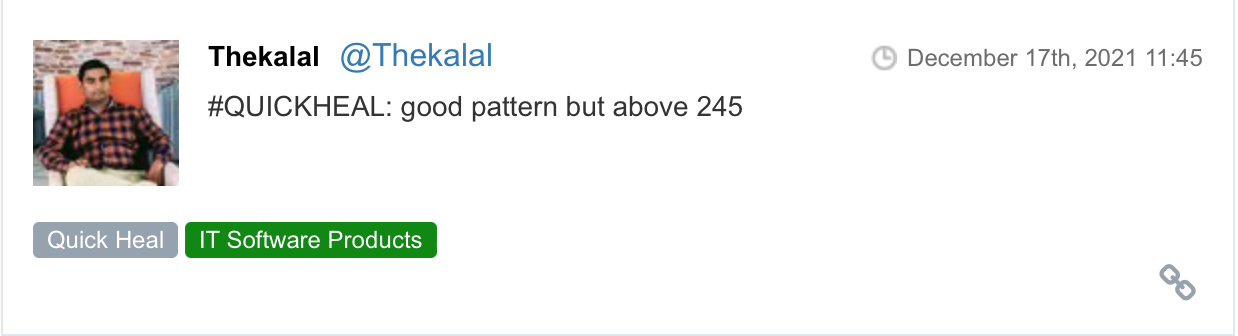

Here are some picks from the week gone by.