Sensex slumps 765pts, Nifty ends below 17,200; Reliance, FMCG, banks weigh

The key benchmark indices reversed their two-day winning streak with losses in excess of a per cent. Index heavweight Reliance Industries, banking and FMCG shares were responsible for a significant amount of the losses.

The BSE benchmark index, the Sensex, had started trade on a positive note and soon rallied to a high of 57,757 (up almost 300 points from the previous close). Selling emerged towards the end of the first-hour of trades, and thereafter it accentuated in noon deals. The BSE 30 index slumped to a low 56,641 in late trade – down 1,116 points from the day’s high. The Sensex finally ended with a loss of 765 points at 57,696.

The NSE Nifty tumbled 309 points from the day’s high of 17,490 to a low of 17,181, and eventually settled 205 points lower at 17,197.

The broader indices, however, outperformed the key benchmark indices. The BSE Midcap index ended almost flat, while the Smallcap index added 0.3 per cent. The overall market breadth was also positive, with 1,778 advancing shares versus 1,475 declining stocks on the BSE.

Among the Sensex 30 stocks, PowerGrid Corporation was the major loser, down 4 per cent at Rs 206. Reliance Industries shed 2.8 per cent at Rs 2,414.

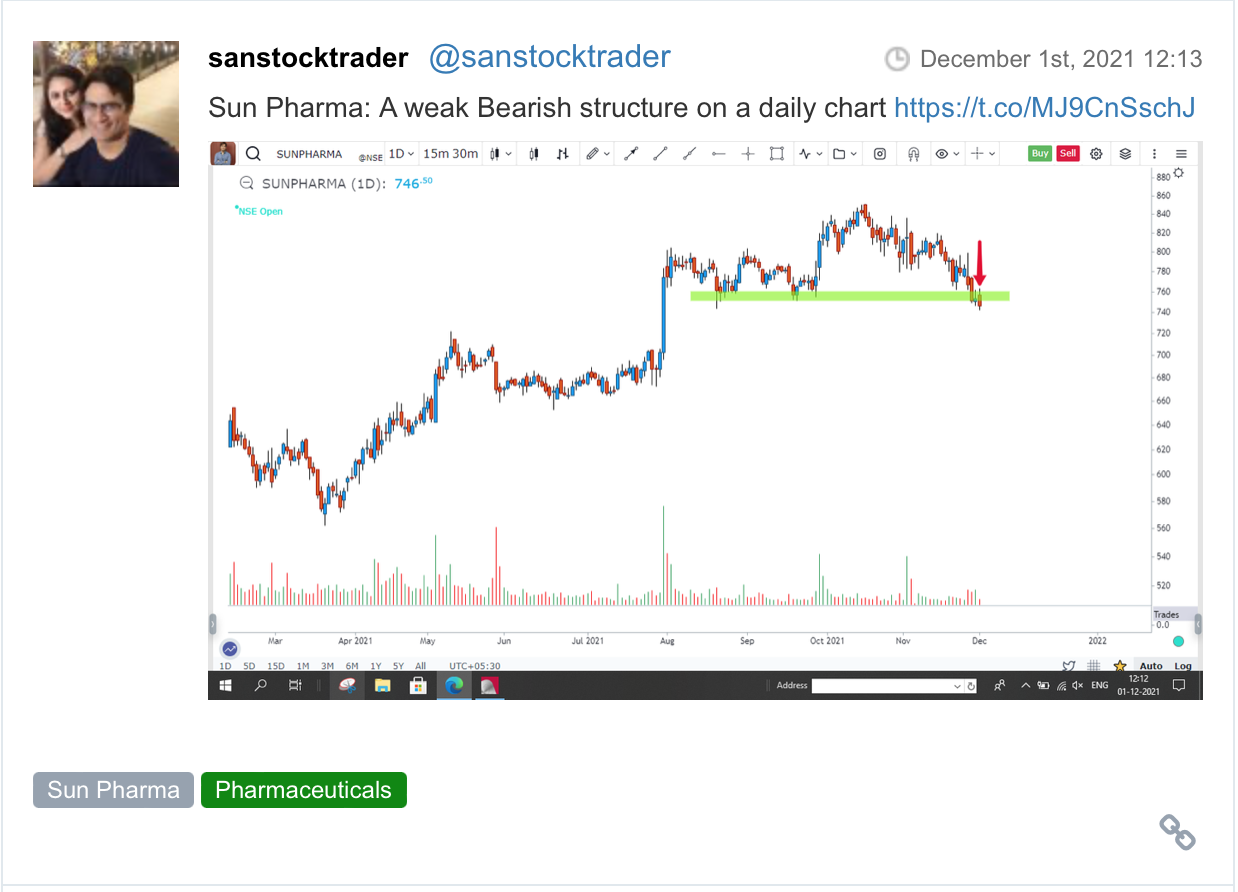

Asian Paints, Kotak Bank, Tech Mahindra, Maruti, Bharti Airtel, ITC, Sun Pharma, Dr.Reddy’s and Mahindra & Mahindra were the other prominent losers, down 1.5 per cent to 2 per cent, each. Larsen & Toubro and IndusInd Bank were two out of the five notbale gainers.

In the broader markets, Vodafone Idea zoomed another 12 per cent and hit a 52-week high in trades today. The stock has rallied as much as 32 per cent this week. The stock has been in demand post tariff hike.

Shares of Tata Teleservices Maharashtra (TTML) were locked at the 5 upper circuit for the 14th straight trading session, up 5 per cent at Rs 129.45, also its new high on the BSE on Friday. The Tata Group telecom services stock has nearly doubled or up 97 per cent from level of Rs 65.70 on November 12, 2021.

In the primary market, Tega Industries IPO was subscribed a whopping 204.7 times as of 3:20 PM on the final day of the offer today, with strong demand from wealthy investors (NIIs) and Qualified Institutioanl Buyers (QIBs), the quota was subscribed 612.7 times and 207.6 times, respectively. The retail quota was subscribed 28.2 times.

Anand Rathi Wealth IPO was subscribed 2.6 times so far on the second day of the issue. The retail portion was subscribed 4.1 times and wealthy investors 2.6 times.

Here are some picks from the week gone by.