Sensex ends above 60,000; Nifty at 17,853; Metal stocks slide, IT shines

The Indian benchmark indices erased early gains partially but were still trading positively in the afternoon. The S&P BSE Sensex held the 60,000-mark, up 220 points at 60,106 while the Nifty was below the 17,900-level at 17,865.

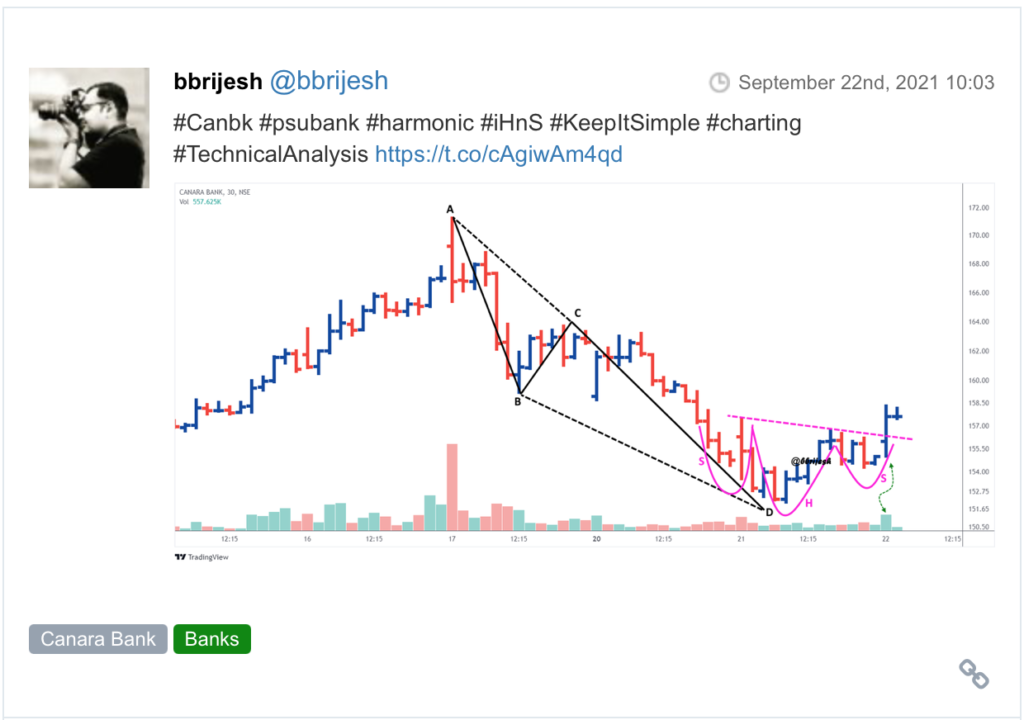

The top gaining sectors were Nifty Realty and Nifty IT, up 1 per cent each, while the laggards were the metals, public sector banks, FMCG and media stocks. The broader indices were trading mixed. The Nifty Midcap 50 fell over a per cent, while the Smallcap 50 rose 0.2 per cent.

Shares of information technology (IT) companies were on roll with most of the frontline stocks trading at fresh all-time highs on the bourses on strong revenue guidance by global IT firm Accenture for the financial year 2021-22 (FY22). Accenture forecasted 12-15 per cent revenue growth for FY22, on top of the $50.5 billion revenue it achieved in the current fiscal.

Shares of Airtel hit fresh high in intra-day deals, ending 2% higher. The stock traded higher ahead of ex-date for rights issue on Monday, September 27, 2021. The company’s Rs 21,000-crore rights issue will remain open for subscription between October 5 and October 21.

Shares of real estate companies extended their gains into fourth straight day with the S&P BSE Realty index surging 25 per cent during the period on strong demand ahead of festive season. Among individual stocks, DLF, Godrej Properties and Oberoi Realty have rallied between 30 and 41 per cent during the period under study.

Shares of Indus Towers hit an over two-year high of Rs 305.65 as they rallied 10 per cent on the BSE in Friday’s intra-day trade. The stock of the tower infrastructure services provider was trading at its highest level since April 2019. In the past seven trading days, it has surged 25 per cent after the government announced reforms in the telecom sector, which have increased Vodafone Idea’s going concern visibility.

Auto component maker Sansera Engineering made a decent stock market debut as its shares got listed at Rs 811.50, a premium of 9 per cent over its issue price of Rs 744 per share on the National Stock Exchange (NSE) on Friday. On the BSE, the stock opened at Rs 811.35, the exchange data shows. It moved higher to Rs 828, up 11 per cent on the BSE.

Here are some picks from the week gone by.